Jeff Yan Accuses CEXs of Underreporting Mass Liquidations

- CEXs can underestimate settlements by up to 100x

- Binance reports one liquidation per second

- Hyperliquid offers transparent on-chain settlement

Jeff Yan, co-founder of the Hyperliquid platform, has stated that some centralized exchanges (CEXs) are deliberately hiding the true volume of liquidations during times of high volatility. Yan believes this type of practice can mask the real risk in the cryptocurrency market.

In a post on X, he highlighted that certain CEXs—including Binance—report only one liquidation order per second, even when hundreds or thousands occur in that interval. “Since liquidations happen in bursts, this can easily be a 100x underreporting under some conditions,” Yan said, citing Binance's public documentation.

Hyperliquid's fully onchain liquidations cannot be compared with underreported CEX liquidations

Hyperliquid is a blockchain where every order, trade, and settlement happens onchain. Anyone can permissionlessly verify the chain's execution, including all liquidations and their… pic.twitter.com/K5sv74LJgO

— jeff.hl (@chameleon_jeff) October 13, 2025

The accusation came shortly after a record wave of market liquidations, triggered by sharp price fluctuations. According to aggregated data, more than 1,6 million traders were liquidated, totaling $19,1 billion in losses in a single day. However, derivatives data platform Coinglass noted that the actual amount could be even higher—"probably much higher"—since "Binance reports only one liquidation order per second."

The largest liquidation event in crypto history.

In the past 24 hours, 1,618,240 traders were liquidated, with a total liquidation amount of $19.13 billion.

The actual total is likely much higher — #Binance only reports one liquidation order per second.… pic.twitter.com/tvMCILVgU0

— CoinGlass (@coinglass_com) October 10, 2025

Yan contrasted this model with that of Hyperliquid, which operates with fully on-chain records. For him, "Hyperliquid's fully on-chain liquidations cannot be compared with underreported CEX liquidations." According to the executive, in the on-chain network, every order, trade, and settlement can be verified by anyone in real time, reinforcing operational transparency.

With this criticism, Yan suggests that the true size of liquidation events on CEXs may be underestimated—a fact that reduces the visibility of systemic risk and limits the true understanding of the impact on the cryptocurrency market.

Jeff Yan's post also mentions that such practices reflect a disconnect between what exchanges disclose and what actually occurs during times of market stress. This warning fuels the debate about data integrity and reliability within centralized trading environments.

There is still no official statement from Binance or other criticized exchanges regarding the allegations. The controversy, however, is likely to spark deeper discussions about reporting standardization and the need for greater transparency in on-chain versus off-chain data.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After the epic crypto liquidation on "10.11", how are the stocks of DAT companies doing?

For companies exposed to the dual risks of the crypto market and the stock market, has the worst already passed?

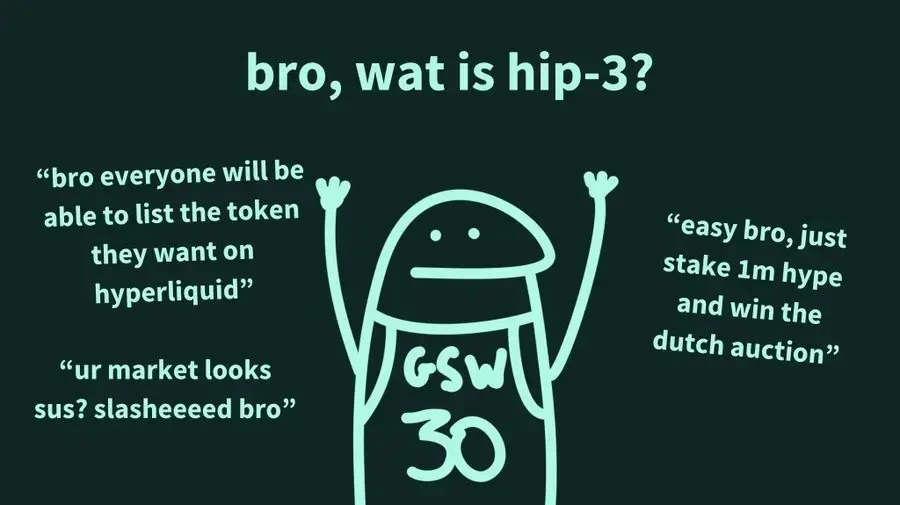

A Simple Explanation of Hyperliquid's HIP-3 Upgrade Today

HIP-3 is a major improvement proposal for the Hyperliquid exchange, aimed at decentralizing the launch process of perpetual contract markets by allowing any developer to deploy new contract trading markets on HyperCore.

Bitcoin price rebounds, fear turns to hope—here are the reasons

Bitcoin rebounds as trade tensions ease and Israeli hostages are released, with buyers returning to the market after last week's cryptocurrency crash.

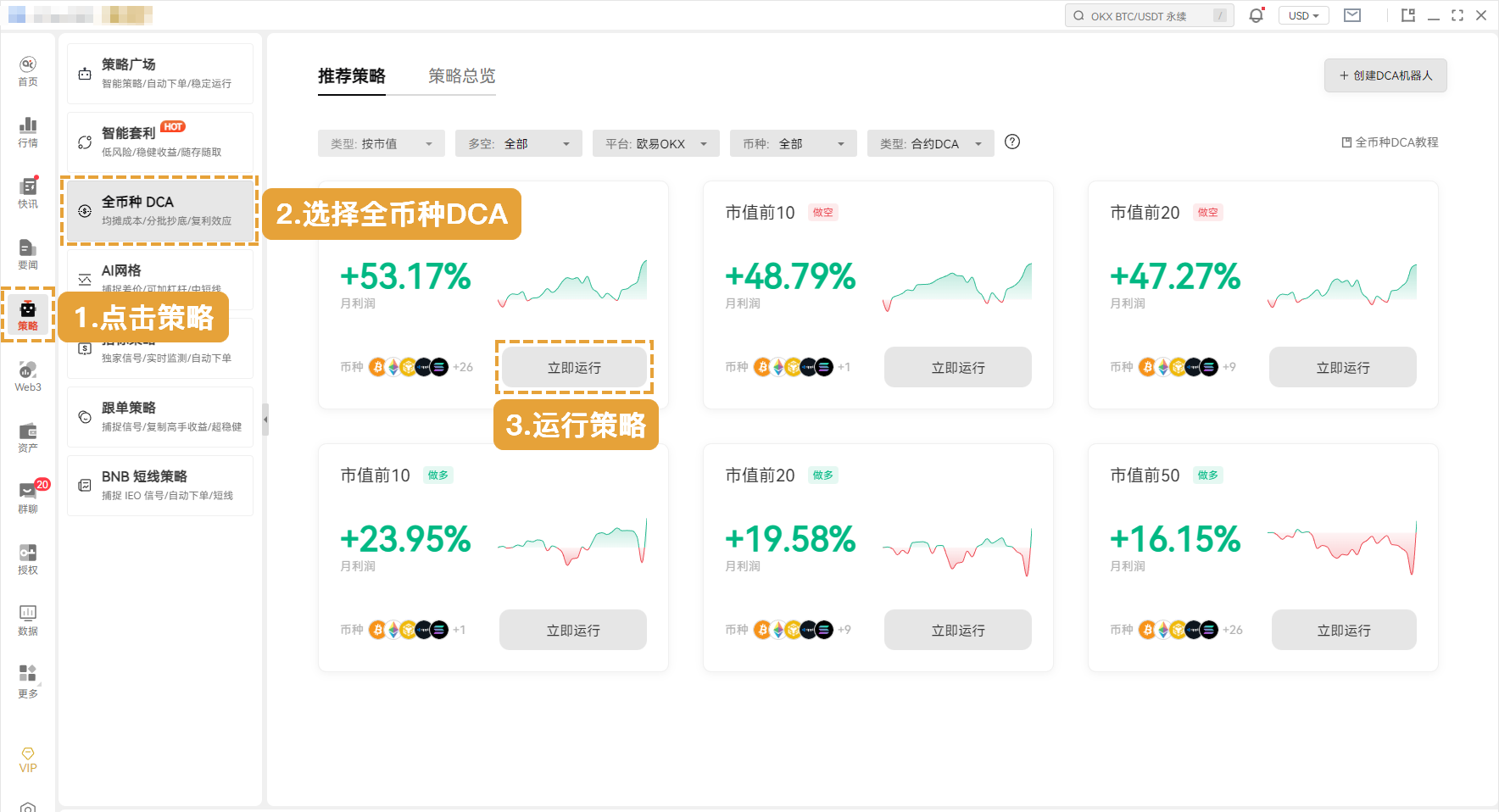

Spot DCA: Use "brainless" operations to outperform 90% of anxious traders!