Bitget Daily Digest(October 13)|Portal to Bitcoin mainnet launch and $50M funding; BTC and ETH rebound in short term, over $8.5B liquidated in 24 hours;

Today's Outlook

- The Polygon (MATIC) developer conference "Polygon Connect" will kick off in Singapore at 18:00 on October 13, 2025, with a focus on L2 scaling solutions and ecosystem development.

- The Acala (ACA) community vote on a proposal regarding DEX parameter adjustments will conclude, with the results expected to be announced at 06:00 on October 14, 2025.

- The Digital Asset Summit London Web3 industry conference is ongoing, focusing on digital assets, blockchain technology, and future trends.

Macro Hot Topics

- Portal to Bitcoin, the Bitcoin-first protocol, announced that its mainnet will launch on October 13, 2025. The project has raised an additional $50 million, bringing total funding to $92 million.

- According to the CoinMarketCap event calendar, Aethir, Wilder World, The Sandbox, Turbo, dYdX, and several other projects will have major events from October 12 to 13, 2025.

- The European Banking Authority warns that there are risks during the EU MiCA crypto regulatory transition period, as some entities may attempt to circumvent the new rules. MiCA will formally take effect at the end of 2024, with the transition window lasting until July 1, 2026. (Reported 7 days ago)

- Forbes reports that U.S. President Trump, via his media company, indirectly holds approximately $870 million worth of Bitcoin, potentially making him one of the largest Bitcoin investors in the U.S. (October 10)

Market Performance

- BTC and ETH rebounded in the short term as market sentiment remained fearful. Over $625 million in liquidations occurred in the past 24 hours, mainly from short positions.

- U.S. stocks closed significantly lower across the board: the Dow Jones dropped 1.90%, the Nasdaq fell 3.56%, and the SP 500 declined 2.71%, impacted by trade tensions and potential government shutdown.

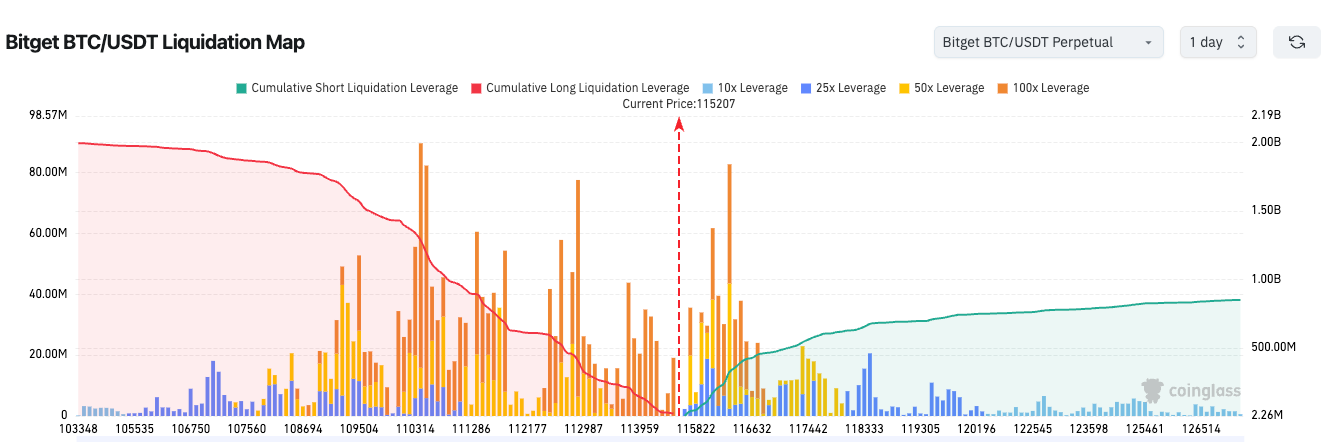

3.Bitget liquidation map: Current BTC price is 115,184 USDT. There have been massive liquidations in the 115,000–116,000 USDT range on 10x–100x leverage. A breakout in this range could trigger another round of high volatility.

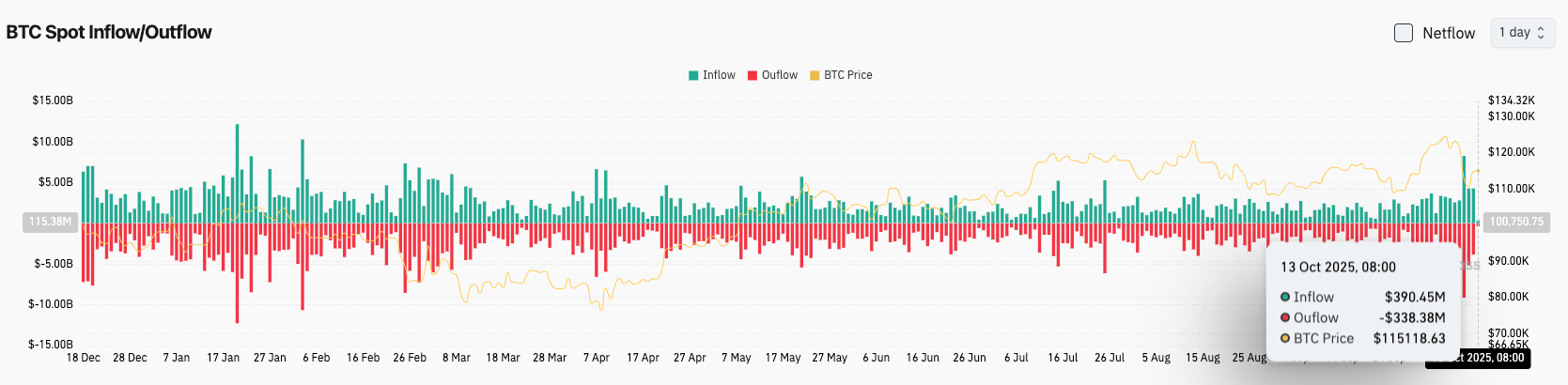

4.In the past 24 hours, BTC spot inflows totaled $390 million, with outflows at $338 million, resulting in a net inflow of $52 million.

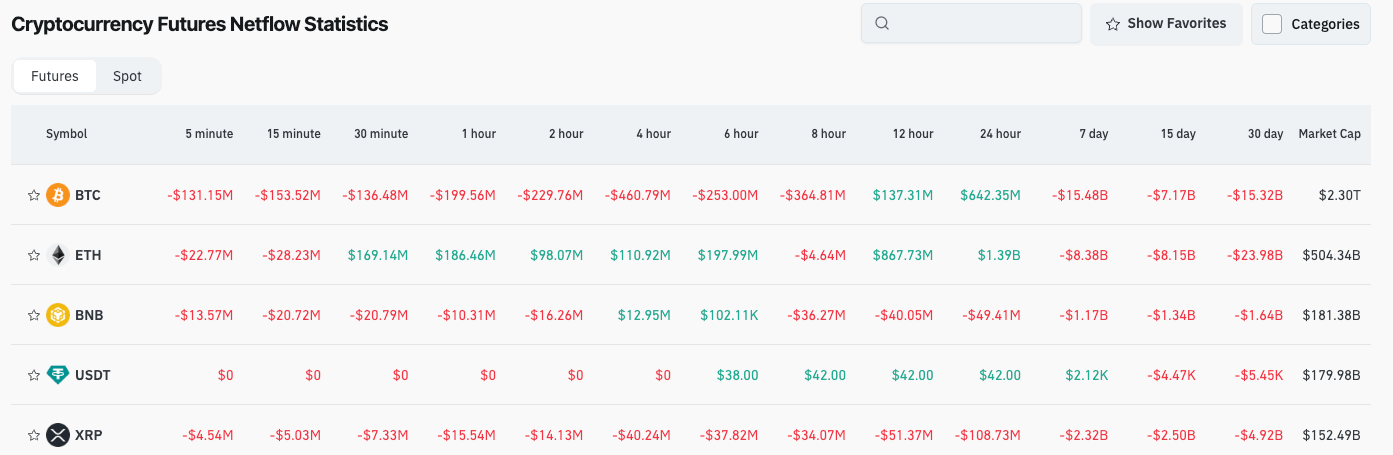

5.Net outflows from perpetual contract trading of BTC, ETH, BNB, XRP, and others led the market in the past 24 hours, suggesting potential trading opportunities.

News Updates

- The world’s third-largest stablecoin, USDe, briefly depegged sharply to as low as $0.65 (October 11), but has since recovered close to $1.

- On October 13, the crypto market rebounded after a sharp drop, but there were still over 180,000 liquidations across the network in the past 24 hours.

- U.S. President Trump, via his media company, indirectly holds about $870 million in Bitcoin, potentially making him one of the world’s largest Bitcoin holders.

- Bitcoin Core officially released its v30.0 version.

Project Updates

- Bitcoin Core has officially released version 30.0.

- Ethereum is considering the EIP-7791 proposal to increase gas revenues for contract developers.

- CipherOwl completed a $15 million round in crypto compliance funding.

- Aethir will unlock 1.26B tokens on October 12, 2025.

- Wilder World releases a major update to “The Final Frontier” roadmap.

Disclaimer: This report is AI-generated and verified by human editors for information accuracy only. It does not constitute any investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CoinShares Dismisses Tether Insolvency Fears, Reaffirms Financial Strength

Philippines Flood Control Scandal Linked to Crypto Laundering Operations

Bitwise CIO Explains Why They Launched XRP ETF

Top Cryptos to Watch for 2026 Investment Opportunities