Robert Kiyosaki Predicts Dollar Collapse and Bets on Bitcoin and Ethereum

- Kiyosaki recommends Bitcoin and Ethereum against dollar devaluation

- Investors see gold and silver as financial protection

- Ethereum gains prominence for smart contracts and adoption

"Rich Dad, Poor Dad" author Robert Kiyosaki has once again expressed concern about the dollar's stability and reinforced his advocacy for assets like Bitcoin, gold, silver, and, most recently, Ethereum. In a post on X last week, the investor warned that keeping money in banks could be detrimental given the loss of value of fiat currencies.

Known for his criticism of the Federal Reserve and the way the U.S. government conducts its monetary policy, Kiyosaki has warned his followers about the risks of a potential financial system collapse. He believes that protecting assets requires seeking alternatives outside the traditional banking system—including cryptocurrencies and precious metals.

"Hold gold, silver, Bitcoin, Ethereum. Avoid counterfeit currency," he declared, emphasizing that tangible and decentralized assets are the best way to weather a potential financial crisis.

END of US Dollar?

Adding to my gold, silver, Bitcoin, and Ethereum stack.

Savers of US dollars are losers.

Be a winner.

Take care.

—Robert Kiyosaki (@theRealKiyosaki) October 8, 2025

The support for Ethereum is noteworthy. Until recently, Kiyosaki didn't usually mention altcoins in his recommendations. Now, however, he's demonstrating recognition for the Ethereum network's potential, citing its role in the development of smart contracts, asset tokenization, and growing institutional adoption.

SILVER over $50.

$75 next?

Silver and Ethereum hot, hot, hot.

—Robert Kiyosaki (@theRealKiyosaki) October 10, 2025

With inflation still worrying investors and the current US president dealing with domestic and international economic challenges, the search for assets considered "safe havens" in the face of instability is growing. In this context, Bitcoin, Ethereum, and metals like gold and silver are once again in the spotlight of analysts and influential figures like Kiyosaki.

The statement reiterates the position the author has defended in recent years: that the current system is unsustainable and that only decentralized or intrinsically valuable assets will be able to protect investors in the long term. His warning serves as a reminder to those seeking to diversify and protect their capital in times of uncertainty.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Tonight, the largest crypto options expiration in history is coming!

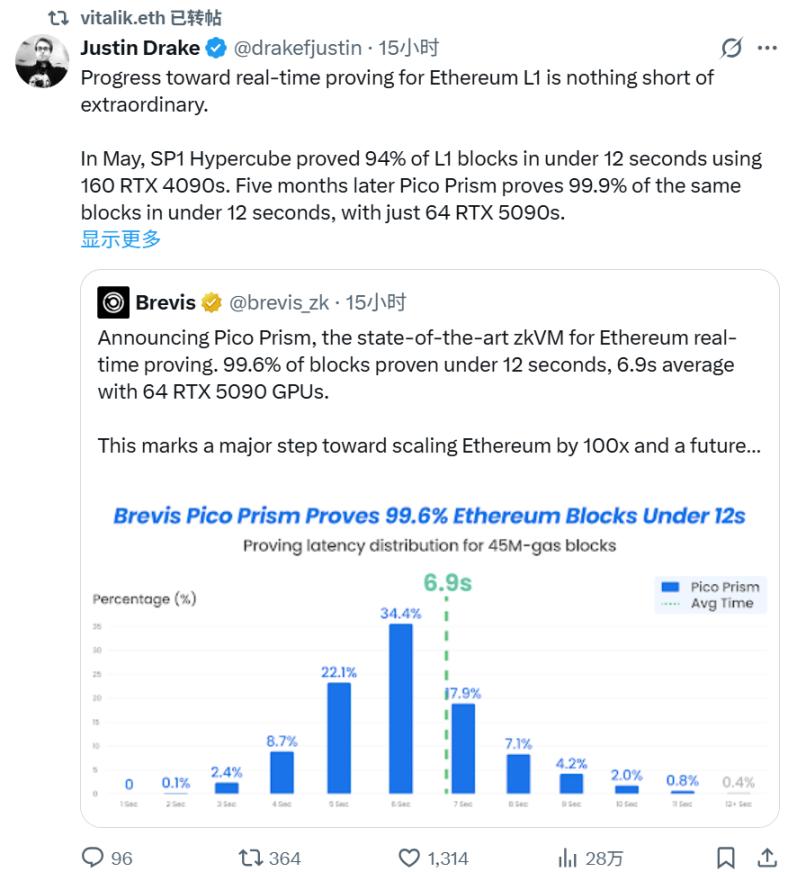

The Ethereum community collectively applauds: Has ZK technology finally moved from the lab to production-grade tools?