Crypto traders blame Trump’s tariffs in search of ‘singular event’: Santiment

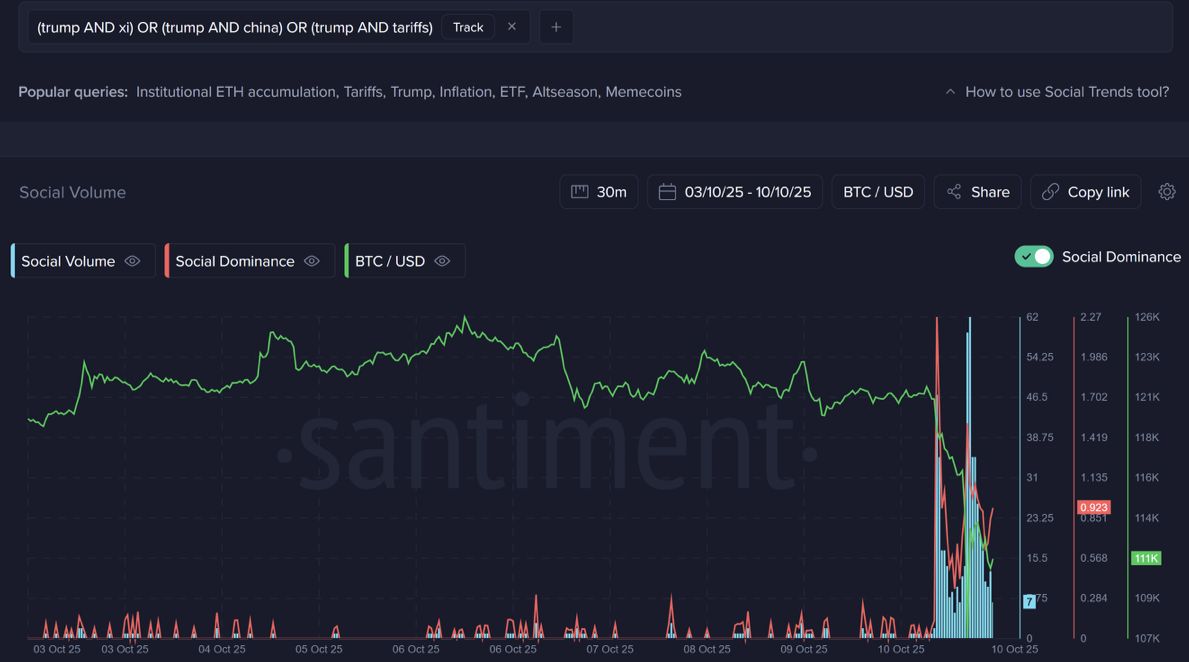

Crypto retail traders were quick to blame Friday’s broader crypto market decline on US President Donald Trump announcing a 100% tariff on China, as they often look for something to point the finger at during downturns, according to Santiment.

Analysts, however, say the reason for the market slump runs deeper than the tariffs alone.

“This is typical 'rationalization' behavior from retailers, who need to point to a singular event as the reason for a cataclysmic downturn in crypto,” Santiment said in a report on Saturday.

“After the crash, the crowd quickly jumped to collectively come to a consensus as to what the flush could be attributed to,” Santiment said, referring to the increase in social media discussions related to both the crypto market and US-China tariff concerns.

US and China developments will be vital for retail traders

Although the geopolitical event was a catalyst for the market decline, it wasn’t the only factor, according to analysts from The Kobeissi Letter, who also pointed to “excessive leverage and risk” in the crypto market. The analysts noted its heavy long bias, with around $16.7 billion in long positions liquidated versus just $2.5 billion in shorts, a ratio of nearly 7-to-1.

The significant liquidation event came as Bitcoin (BTC) fell more than 10% within 24 hours, with the BTC/USDT futures pair on Binance falling to as low as $102,000 following Trump’s tariff announcement.

Santiment said that developments between the US and China will “be central” in shaping crypto retail investors’ trading decisions, at least in the short term.

Bitcoin falling under $100,000 predictions may emerge

Santiment added that if talks between Trump and Xi improve and lead to “positive news,” retail sentiment toward crypto is likely to get better.

However, if tensions escalate, traders should brace for more pessimistic price forecasts. “Expect for the 'Bitcoin sub-100K' prediction floodgates to begin opening up,” Santiment said, adding:

“Bitcoin, whether we like it or not, is behaving more like a risk asset than a safe haven during times of country tensions.”

Sentiment plunged after the crypto market decline, with the Crypto Fear Greed Index, which measures overall crypto market sentiment, dropping to a “Fear” level of 27 in Saturday’s update.

That represents a sharp 37-point fall from Friday’s “Greed” reading of 64, its lowest level in nearly six months.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Top Crypto Market News Today: Gnosis Executes Hard Fork While DeepSnitch AI Rallies 96%

Experienced Analyst Predicts When Bitcoin’s Decline Will Stop

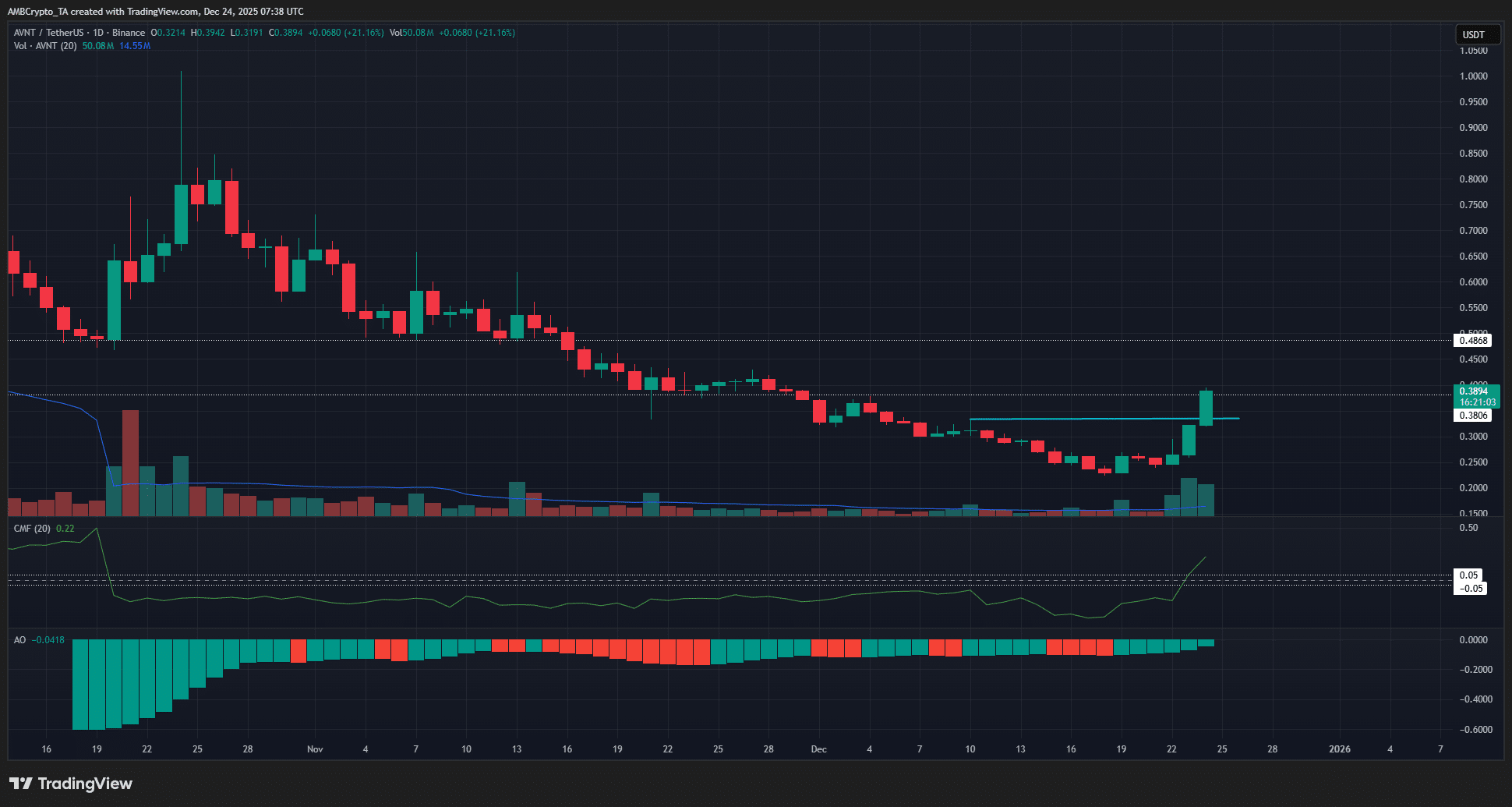

Avantis rallies 24% in a day – Can AVNT squeeze toward $0.40?

Mt. Gox–Linked Wallets Move 1,300 BTC to Exchanges as Analyst Flags New Outflows