Will SHIB Price Crash to 0 After Trump’s 100% Tariff Threat?

Markets were already on edge when Donald Trump reignited the US-China trade war with threats of 100% tariffs and fresh export controls. The result was immediate: global equities tumbled, with the S&P 500 logging its sharpest fall in months. For cryptocurrencies like Shiba Inu (SHIB) , this isn’t just background noise. Meme coins live and die on risk appetite, and when capital flees to safety, SHIB becomes one of the first assets to feel the shock. The question now gripping traders is simple: could this geopolitical clash trigger a crash that drags SHIB closer to zero?

Shiba Inu Price Prediction: Why This News Matters for SHIB Price?

When Donald Trump announced a fresh 100% tariff on Chinese imports along with export restrictions on critical software, global markets immediately shuddered. The S&P 500 logged its sharpest drop since April . For crypto, this matters because risk assets like SHIB thrive on liquidity, retail speculation, and a “risk-on” environment. If global trade tensions escalate, capital flees to safe havens like gold or the dollar, not meme coins.

For SHIB, the panic around trade wars hits doubly hard. First, China remains a big player in crypto mining and liquidity provision. Second, macro uncertainty makes meme coins easy targets for liquidation, as traders dump high-beta assets before touching their Bitcoin or Ethereum holdings.

What the SHIB Price Chart is Telling Us Right Now?

SHIB/USD Daily Chart- TradingView

SHIB/USD Daily Chart- TradingView

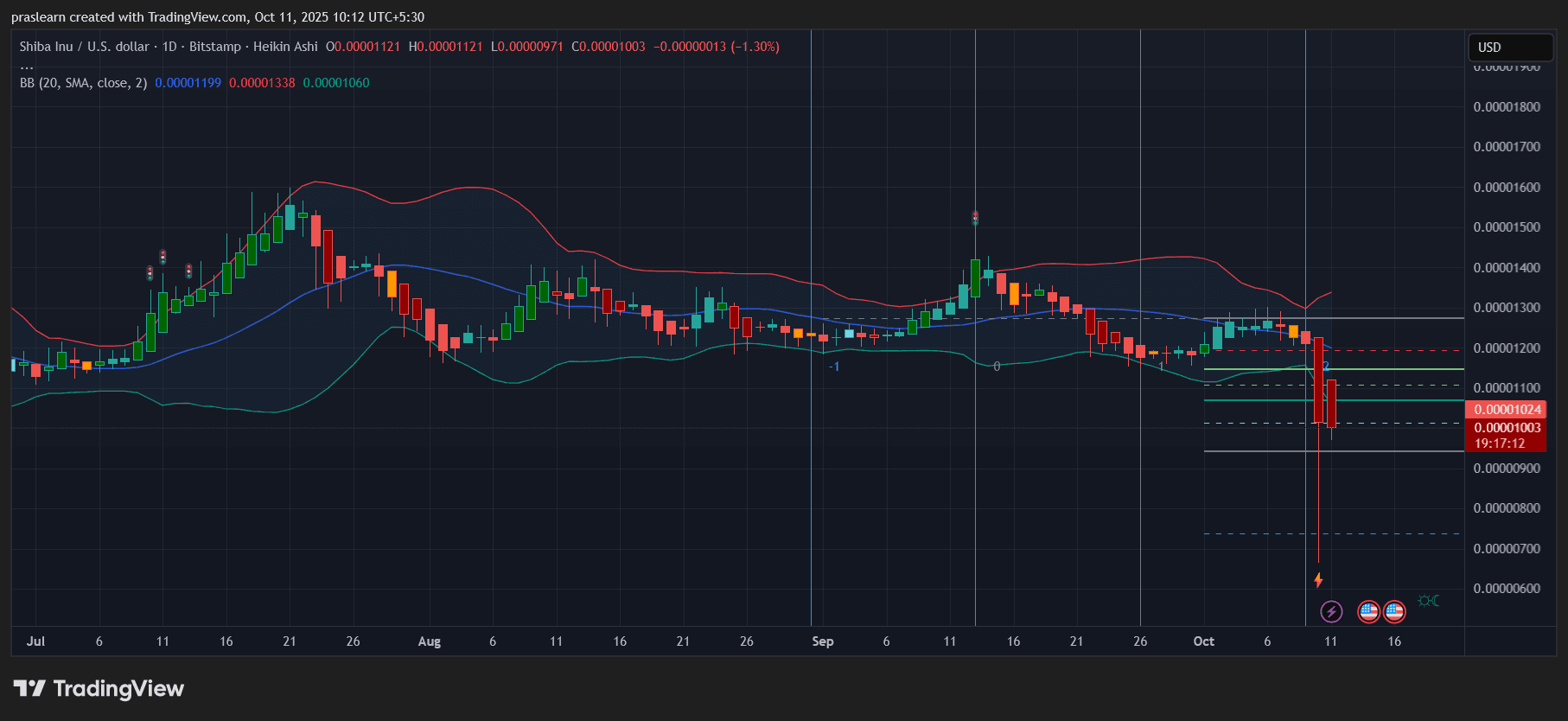

Looking at SHIB’s daily chart, the situation is tense:

- Shiba Inu Price collapsed below the mid-Bollinger band and is now hugging the lower band around 0.0000100.

- A flash wick dragged SHIB down toward the 0.0000070 zone, showing how thin liquidity is during panic.

- Resistance has shifted lower to 0.0000119 and 0.0000133. These levels must be reclaimed for recovery to begin.

- Support sits precariously at 0.0000095, and a failure here risks a slide toward the 0.0000070 flash-crash zone.

This is the type of setup where meme coins either dead-cat bounce or unravel.

Short-Term Outlook: Is a Relief Rally Possible?

In the next 7 to 14 days, SHIB price could see a reflex bounce if markets stabilize. Bollinger bands are widening, suggesting volatility is only just beginning. If SHIB can close back above 0.0000110, traders may front-run a rally back to 0.0000120–0.0000130. But the probability of this depends on whether broader equities calm down. If Trump escalates further or China retaliates harder, every bounce may get sold.

Medium-Term Shiba Inu Price Prediction: Where Can SHIB Go in the Next 30–60 Days?

Macro headwinds make this dangerous. A trade war can depress liquidity for months, and SHIB price doesn’t have a strong fundamental driver right now beyond community hype. The base case is consolidation between 0.0000090 and 0.0000120. The bearish case is more painful: losing 0.0000090 could expose SHIB to 0.0000070, and eventually, the psychological 0.0000050 zone.

Unless whales or developers trigger some new catalyst, SHIB is unlikely to revisit September highs anytime soon.

Shiba Inu Price Prediction: Will SHIB Price Really Crash to 0?

The blunt answer is no. Meme coins rarely go to absolute zero unless abandoned. SHIB still has a large, active community and ongoing ecosystem projects. However, in a world of tariffs, rare earth fights, and a crumbling S&P, Shiba Inu price could bleed significantly lower before finding new buyers. A move back to 0.0000070 is realistic if markets worsen.

Final Verdict

Donald Trump’s tariff threat has spooked global markets, and SHIB is caught in the crossfire. The chart is bearish in the short term, with only slim chances of recovery unless risk sentiment improves. While a true crash to 0 is unlikely, $SHIB holders should brace for a grind lower and respect support zones closely. In other words, panic selling might be premature, but blind optimism is just as dangerous.

📈 Want to Trade SHIB?

Start now on Bitget: Sign Up Here

Check Live SHIB Chart: SHIB/USDT on Bitget

or You an check the Crypto Exchange Comparison.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The private key to $15 billion worth of Bitcoin was accidentally cracked by the US.

Is my on-chain wallet still my wallet?

When Tether Becomes More Valuable Than ByteDance: Who Is Paying for the Crypto World's "Money Printer"?

Tether’s pursuit of a $500 billion valuation has sparked controversy. Its high profits rely on the interest rate environment and stablecoin demand, but it faces challenges related to regulation, competition, and sustainability. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of the generated content are still in an iterative update phase.

French Banking Titan Launches Groundbreaking Stablecoin Tied to the Euro

In Brief ODDO BHF launches Euro-pegged stablecoin EUROD on Bit2Me for broad market access. EUROD aligns with E.U.'s MiCA framework, enhancing trust with bank support. EUROD aims to fill corporate demand and diversify currency in a dollar-dominated arena.

Trending news

MoreThe private key to $15 billion worth of Bitcoin was accidentally cracked by the US.

[Bitpush Daily News Selection] Li Lin, Shen Bo, Xiao Feng, and Cai Wensheng plan to jointly establish a $1 billion Ethereum treasury company; Federal Reserve's Musalem: May support another rate cut, policy not predetermined; Charles Schwab: Clients' interest in its crypto products is rising, with crypto site visits up 90% year-on-year

![[Bitpush Daily News Selection] Li Lin, Shen Bo, Xiao Feng, and Cai Wensheng plan to jointly establish a $1 billion Ethereum treasury company; Federal Reserve's Musalem: May support another rate cut, policy not predetermined; Charles Schwab: Clients' interest in its crypto products is rising, with crypto site visits up 90% year-on-year](https://img.bgstatic.com/multiLang/image/social/8adb0f5428cbad636affb1d78db93e2b1760758383908.png)