Crypto bloodbath sees $19B in leveraged positions erased

Key Takeaways

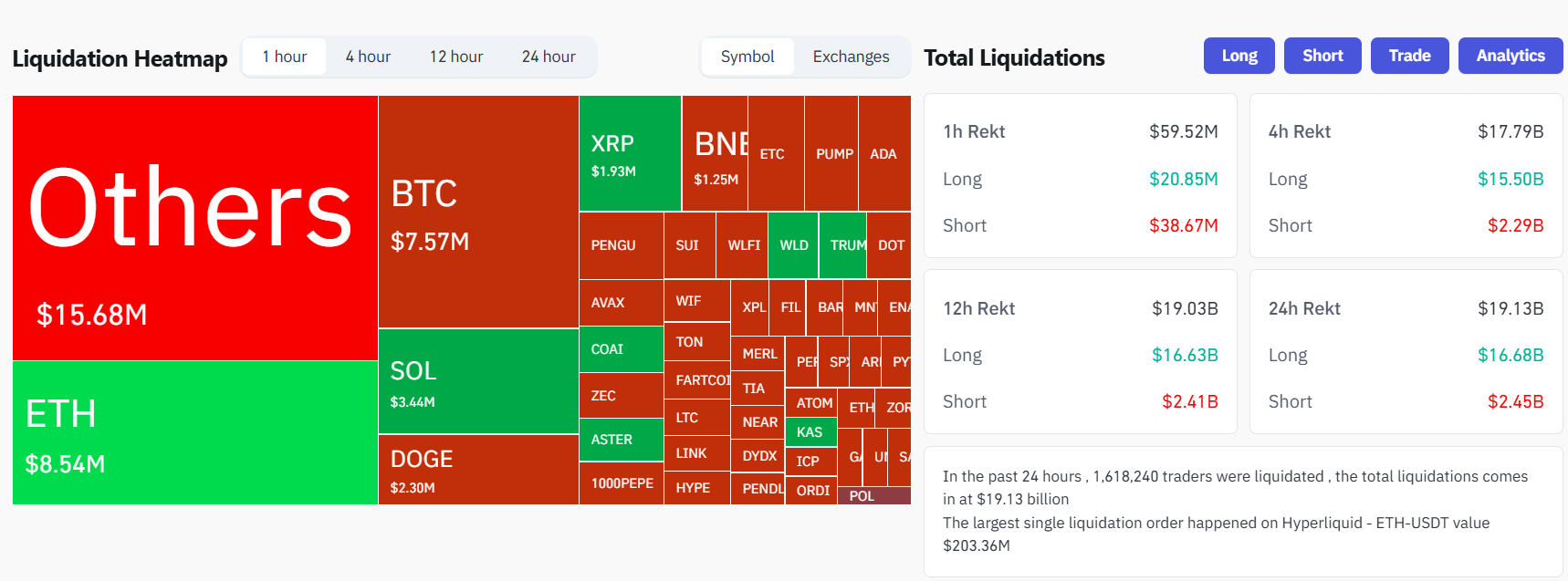

- Over $19 billion in leveraged crypto positions were liquidated in 24 hours, marking the largest single-day wipeout in digital asset history.

- Bitcoin and Ethereum long positions were hardest hit, with over 1.6 million traders affected across major exchanges.

Roughly $19 billion in leveraged crypto positions were liquidated following a brutal sell-off that sent Bitcoin tumbling to $102,000. It was the largest single-day wipeout ever recorded in digital asset markets, according to CoinGlass data .

Most of the liquidations came from long positions, which totaled $16.6 billion in losses, compared to $2.4 billion for shorts.

Over 1.6 million crypto traders were liquidated across major exchanges, with Bitcoin and Ethereum long positions severely impacted during Friday’s US trading sessions.

The liquidation cascade was triggered after President Donald Trump proposed a massive tariff increase on Chinese imports, followed shortly by an announcement of a 100% tariff on Chinese goods in response to China’s planned export restrictions on rare earth minerals.

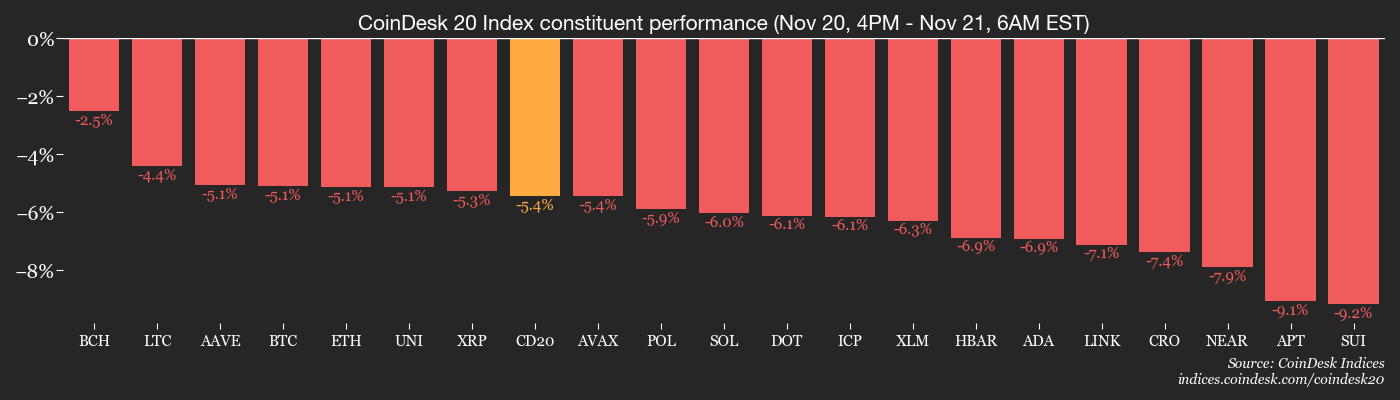

Bitcoin plunged from above $122,000 to around $102,000 on the news. Ethereum dropped below $3,500, while smaller-cap altcoins saw double-digit losses amid evaporating liquidity.

At the time of writing, Bitcoin traded above $113,000 after recovering from earlier lows but remained below its daily high of $122,500, according to CoinGecko data.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Snipers Made $1.3M on Jesse Pollak’s Creator-Coin Debut on Base

Indonesia Detains Hacker Tied to Markets.com Crypto Theft After $398K Loss

CryptoQuant CEO Ki Young Ju Disputes Michael Saylor's Claims That He Will Sell Bitcoin! Here Are the Details

The Canary in the Coalmine: Crypto Daybook Americas