Key Market Information Gap on October 10th, a Must-See! | Alpha Morning Report

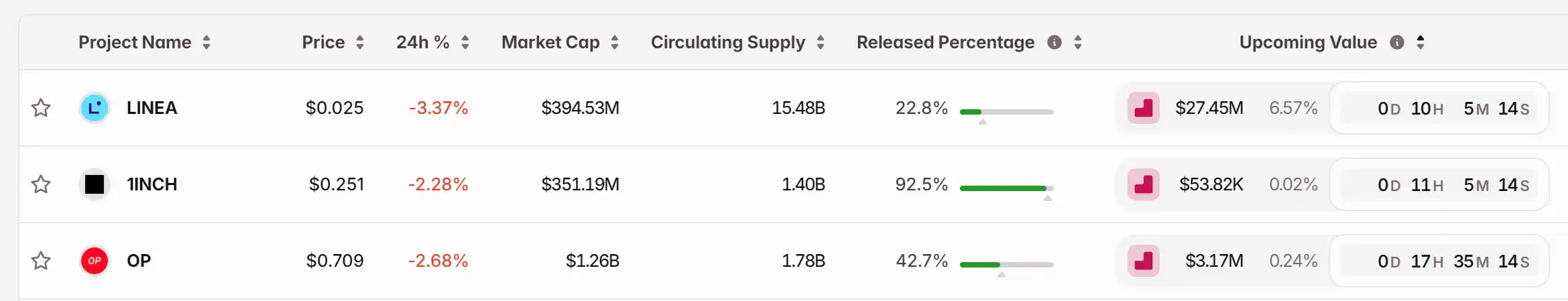

1. Top News: Boosted by Robinhood Listing, ZORA Surges Over 60% in 24 Hours 2. Token Unlocking: $LINEA, $1INCH, $OP

Top News

1.Boosted by Robinhood Listing, ZORA Surges Over 60% in 24 Hours

2.Bitcoin Sees Light Rebound This Morning, Recaptures $120,000 Milestone

3.U.S. Bureau of Labor Statistics Expected to Release CPI Report During Shutdown

4.U.S. Stock Market's Three Major Indexes Open Slightly Higher, Crypto Concept Stocks Mostly Down

5.DCG Invests $10 Million in Two Bittensor Subnet Funds Established by Subsidiary Yuma

Articles & Threads

1.《CZ's Midnight AMA: What's the Secret to Wealth?》

On October 8th, CZ made a rare appearance at the "BNB Super Cycle" AMA hosted by Trust Wallet, sharing the stage with BNB core projects like Aster, Four.meme, and Pancake. CZ responded to recent hot topics in the BNB Chain ecosystem and shared his in-depth insights and thoughts on the future trends of the crypto industry. BlockBeats has compiled his ten most noteworthy answers, covering topics such as the MEME market, Aster's growth, Yzi Labs' investment direction, new opportunities in RWA and AI, and the era-defining significance of "Binance Life."

2.《Industry Insights You Might Have Missed During the National Day Holiday》

The crypto market is heating up across the board, with Bitcoin and Gold hitting new highs together, BNB driving a BSC meme frenzy, Polymarket receiving a $2 billion investment from Intercontinental Exchange to re-enter the U.S., Aster entering a new phase, Monad airdrop imminent, and institutional funds continuing to flow into the Ethereum ecosystem.

Market Data

Daily overall market funding heat (reflected by funding rates) and token unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ICP Price Jumps 30%: Exploring the Driving Forces and Long-Term Investment Outlook

- ICP token surged 30% in Nov 2025 to $4.71, driven by ICP 2.0 upgrades and institutional partnerships with Microsoft , Google, and SWIFT. - Price retreated to $3.50 by Dec 2025 amid waning AI hype, macroeconomic pressures, and speculative trading volatility. - NVT ratio and DCF analyses highlight valuation challenges, with optimistic 2026 price projections ($11.15–$31.89) contingent on real-world adoption and institutional traction. - Market dynamics reveal a duality: innovative infrastructure potential v

AI and Financial Stability in 2025: The Role of ICP Caffeine AI in Transforming Risk Management Amid Market Uncertainty

- ICP Caffeine AI, DFINITY's blockchain-AI platform, reduces AI inference costs by 20-40% while enabling real-time financial risk analysis through hybrid cloud-decentralized infrastructure. - AI-driven risk tools outperform traditional VaR models by 10% in predictive accuracy, achieving 60% efficiency gains for institutions through real-time data processing and regulatory integration. - Despite $237B TVL and 56% ICP price growth, the platform faces challenges including 22.4% dApp activity decline, token vo

Why is Internet Computer (ICP) Experiencing Rapid Growth in Late 2025: An In-Depth Examination of Blockchain Expansion and the Evolution of Decentralized Web Systems

- Internet Computer Protocol (ICP) surges in late 2025 due to protocol upgrades, institutional adoption, and alignment with AI-driven finance trends. - Chain Fusion enables cross-chain interoperability with Bitcoin/Ethereum, while Caffeine AI democratizes dApp development via natural language prompts. - Institutional adoption grows with 2,000+ new developers, $1.14B TVL, and zero-fee transactions attracting financial institutions seeking cost-efficient solutions. - ICP's hybrid cloud/Web3 model addresses e

Grasping the Factors Leading to Solana's Recent 50% Decline in Value

- Solana's 50% price drop in early 2025 stemmed from token unlocks, declining network activity, and the Libra meme token collapse. - Network metrics like active addresses (-40%) and TVL ($2.87B loss) revealed weakening ecosystem trust and liquidity. - Broader crypto market declines (Bitcoin to $86K) and macroeconomic risks accelerated Solana's sell-off amid rising trade war fears. - $500M liquidity migration to Ethereum and institutional ETF launches signaled cautious optimism despite ongoing volatility. -