Is This the Last Chance for Bitcoin to Break $130K in 2025?

Bitcoin price is sitting at a crossroads. After climbing back above 122,000, the chart shows momentum building, but the real driver isn’t just technicals—it’s the Federal Reserve. The central bank just cut rates for the first time this year, yet inflation remains sticky and job growth is slowing. Traders are betting on more cuts, but the Fed’s own minutes reveal hesitation. That tension between easing and inflation could decide whether Bitcoin price smashes through 125,000 or tumbles back toward 115,000.

Why the Fed Matters for Bitcoin Price Prediction Right Now?

The latest Federal Reserve minutes reveal a sharp divide inside the central bank. Officials are battling two enemies at once: stubborn inflation and a weakening job market. They cut rates by a quarter point, but inflation readings remain above target and job growth is slowing. Traders are betting on two more cuts this year, but the Fed is cautious. Any hint of stronger inflation could delay or cancel those cuts.

For Bitcoin price, this uncertainty matters. Lower rates usually fuel risk-on assets like BTC, as liquidity flows into speculative markets. But higher-than-expected inflation or stagflation fears could keep pressure on financial markets. The October 28–29 FOMC meeting is the next big catalyst.

What the Chart Is Telling Us?

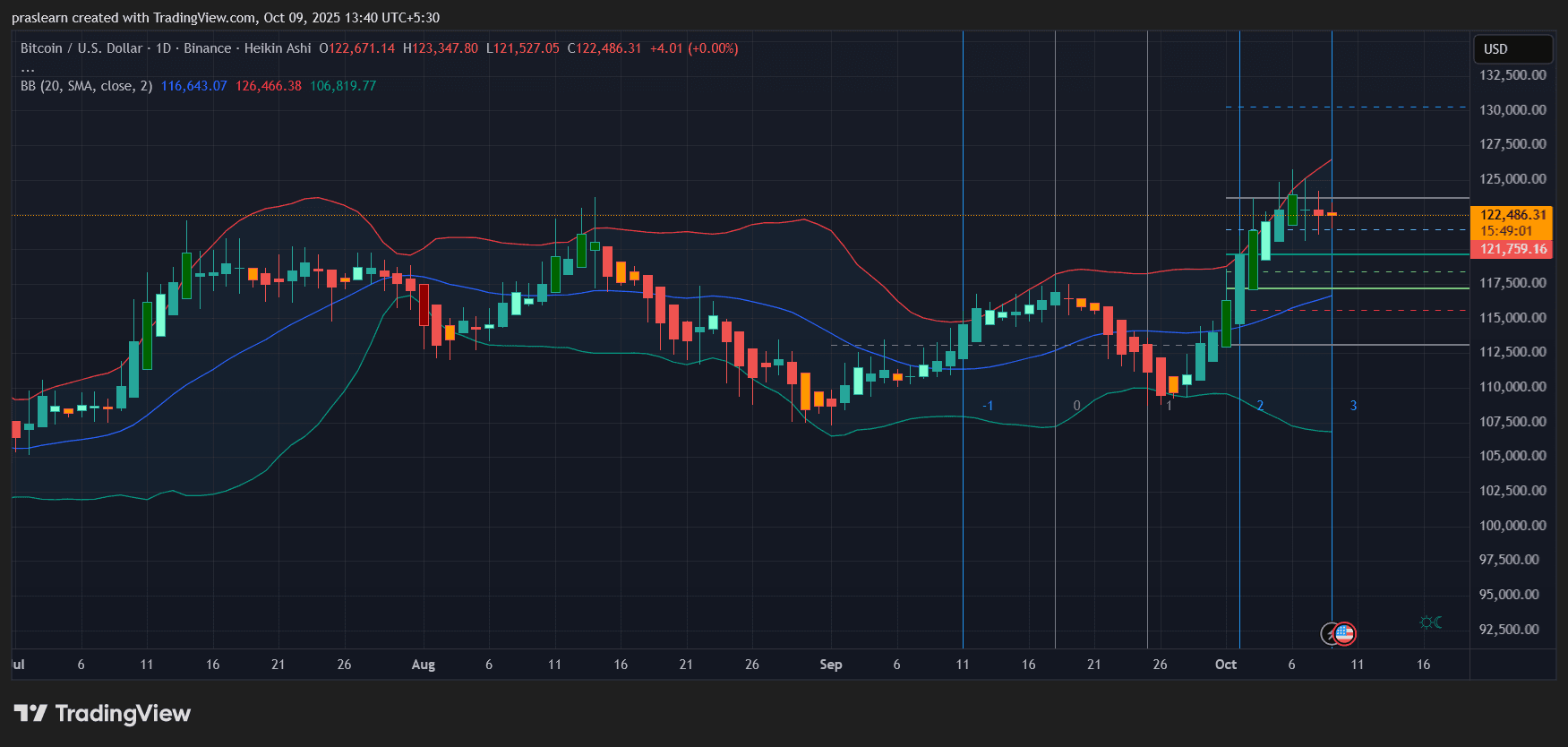

BTC/USD Daily chart- TradingView

BTC/USD Daily chart- TradingView

On the BTC price daily chart, price is consolidating near 122,500 after a sharp breakout from September lows around 108,000. Bollinger Bands show BTC hugging the upper band at 126,400, indicating strong momentum but also the risk of overextension.

The key levels to watch:

- Support: 121,700 (near-term) and 116,600 (Bollinger midline, also recent demand zone).

- Resistance: 126,500 (Bollinger upper band) and 130,000 (psychological round level).

If BTC price closes convincingly above 126,500 , it opens the door to a rally toward 132,500 in the short term. But failure to hold above 121,700 could trigger a pullback to 117,500.

Will Rate Cuts Fuel BTC’s Next Leg Up?

The Fed’s dual mandate is pulling in opposite directions. Rate cuts boost employment and growth but risk worsening inflation. Stagflation fears, raised by Minneapolis Fed President Neel Kashkari , add another layer of uncertainty. If the Fed prioritizes growth and cuts rates again in October, Bitcoin could see a breakout above 130,000 as liquidity returns.

But if inflation surprises to the upside and the Fed holds back, risk assets could stall. BTC’s correlation with equities and gold suggests volatility either way.

What Traders Should Watch This Month?

The next three weeks are critical. Leading indicators are:

- FOMC meeting on October 28–29: confirms if cuts continue.

- Inflation prints mid-October: higher-than-expected data could spoil the rally.

- Technical breakout: whether BTC closes above 126,500 resistance.

Until then, BTC is likely to trade in a volatile range between 117,500 and 126,500.

Bitcoin Price Prediction: Breakout or Breakdown?

If the Fed delivers a dovish signal, $BTC can push beyond 130,000 before year-end, riding liquidity inflows. But if inflation data comes in hot, $Bitcoin price could retrace back toward 112,500–115,000 in a corrective move.

Right now, the chart leans bullish, but the Fed holds the trigger. October’s decision could define whether Bitcoin price sets a new 2025 high or faces another sharp correction.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

HashKey prospectus in detail: 1.5 billion HKD loss over three years, 43% equity controlled by Wanxiang Chairman Lu Weiding

Despite HashKey's significant total revenue growth over the past two years, with rapid expansion in trading volume and client base, the underlying financial pressure remains evident: ongoing losses, long-term negative operating cash flow, and consistently high net debt all contribute to continued uncertainty regarding its financial resilience ahead of its IPO.

A Good Opportunity to Buy the Dip? In-depth Analysis of “Real Yield” DeFi Tokens

The market has indeed offered better entry points, but the narrative of "real yield" needs to be carefully scrutinized.