What will be the peak of Ethereum?

Based on multiple historical and on-chain indicators, the article's author Michael Nadeau conducts a scenario analysis of the potential peak price of Ethereum in the current bull market, aiming to provide a quantitative reference for Tom Lee's "supercycle" hypothesis. By tracking the 200-week moving average, price-to-realized price ratio, MVRV Z-score, Ethereum-to-Bitcoin market cap ratio, and its ratio to the Nasdaq Index, the article presents a range of specific potential price targets, mainly concentrated in the $7,000 to $13,500 range.

Original Translation: Luffy, Foresight News

Tom Lee recently stated at Korea Blockchain Week that Ethereum's mid-term target price is $60,000, and indicated that Ethereum is currently in a 10-15 year supercycle.

If his judgment is correct, this supercycle will advance in waves, spanning multiple cycles, accompanied by alternating bull and bear markets.

At present, we are in a bull market, but the bull market will not last forever.

Looking back at history, Ethereum dropped by 94% in 2018 and by 80% in 2022, so we have reason to predict that there will still be a significant correction in the future.

Currently, we cannot determine when the correction will occur, but by tracking several key indicators, we can refer to the levels Ethereum reached in past cycles to provide a basis for future trends.

Key Indicator Analysis and Price Targets

200-Week Moving Average

Data Source: The DeFi Report

Currently, Ethereum is trading 92% above its 200-week moving average ($2,400).

In the 2021 cycle, at the market peak, Ethereum was 492% above its 200-week moving average.

Scenario analysis:

- 200% above the 200-week moving average: Ethereum price is $7,300

- 250% above the 200-week moving average: Ethereum price is $8,500

- 300% above the 200-week moving average: Ethereum price is $9,800

- 350% above the 200-week moving average: Ethereum price is $11,000

- 400% above the 200-week moving average: Ethereum price is $12,200

Note: The 200-week moving average is a dynamic indicator, but over time, we are gradually replacing price data from about four years ago in the $3,000-$4,000 range for Ethereum. Therefore, by the end of this year, the volatility of the 200-week moving average is expected to be very small.

Ethereum Price to Realized Price Ratio

Data Source: The DeFi Report, Glassnode

The realized price can serve as an alternative indicator for the cost basis. Since January 1, 2017, the average ratio of Ethereum price to realized price has been 1.6. The current ratio is 1.9.

In the 2017 cycle, the peak ratio was 5; in the 2021 cycle, the peak ratio was 3.5 in April and 2.9 in November.

Scenario analysis (assuming the ratio reaches 2.9):

- If the realized price is $3,000: Ethereum price is $8,700

- If the realized price is $3,500: Ethereum price is $10,200

- If the realized price is $4,000: Ethereum price is $11,600

MVRV Z-Score

Data Source: The DeFi Report, Glassnode

The Z-score is used to measure how many "volatility units" the market value is above or below the on-chain cost basis. The higher the Z-score, the hotter the market; a negative Z-score indicates the market is undervalued.

Since January 1, 2017, Ethereum's average Z-score has been 0.99, indicating an overall optimistic market.

The current Z-score is 1.66, which is above the historical average but not yet overheated.

In the 2021 cycle, the Z-score peaked at 6.5 in April and 3.48 in November.

Scenario analysis:

- If the Z-score is 2.21: Ethereum price is $7,000

- If the Z-score is 2.77: Ethereum price is $8,000

- If the Z-score is 3.33: Ethereum price is $9,000

- If the Z-score is 3.9: Ethereum price is $10,000

Note: Assuming by the end of this year, the realized price rises by 22% (to $3,000). For reference, since April this year, the realized price has already risen by 24%.

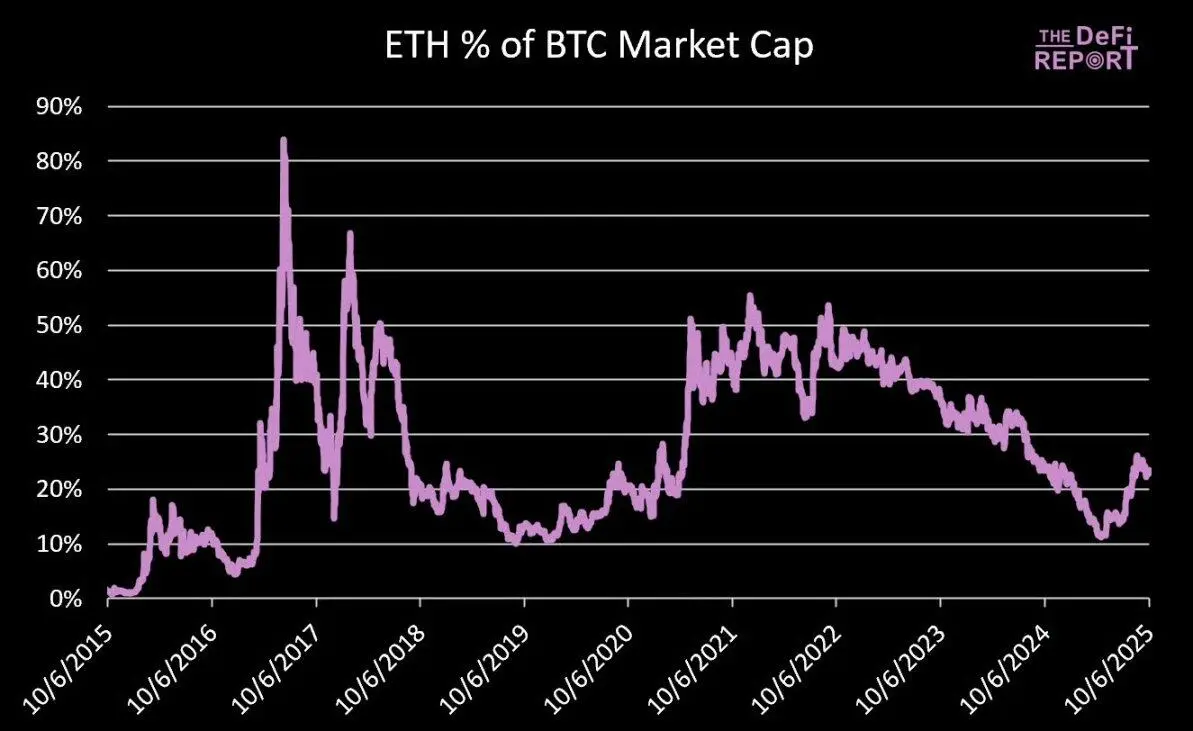

Ethereum to Bitcoin Market Cap Ratio

Data Source: The DeFi Report

Currently, Ethereum's market cap is about 23.4% of Bitcoin's market cap.

In November 2021, Ethereum's market cap reached 55.5% of Bitcoin's market cap.

If Bitcoin's price reaches $150,000 (a 23% increase from now), its market cap will reach $3 trillions.

Scenario analysis:

- If Ethereum's market cap is 35% of Bitcoin's: Ethereum's total market cap is $1.05 trillions, corresponding to a price of $8,658

- If Ethereum's market cap is 45% of Bitcoin's: Ethereum's total market cap is $1.35 trillions, corresponding to a price of $11,132

- If Ethereum's market cap is 55% of Bitcoin's: Ethereum's total market cap is $1.64 trillions, corresponding to a price of $13,559

The core question is whether Bitcoin will see a significant surge. Compared to the previous cycle, will Ethereum's gains relative to Bitcoin be moderate or explosive?

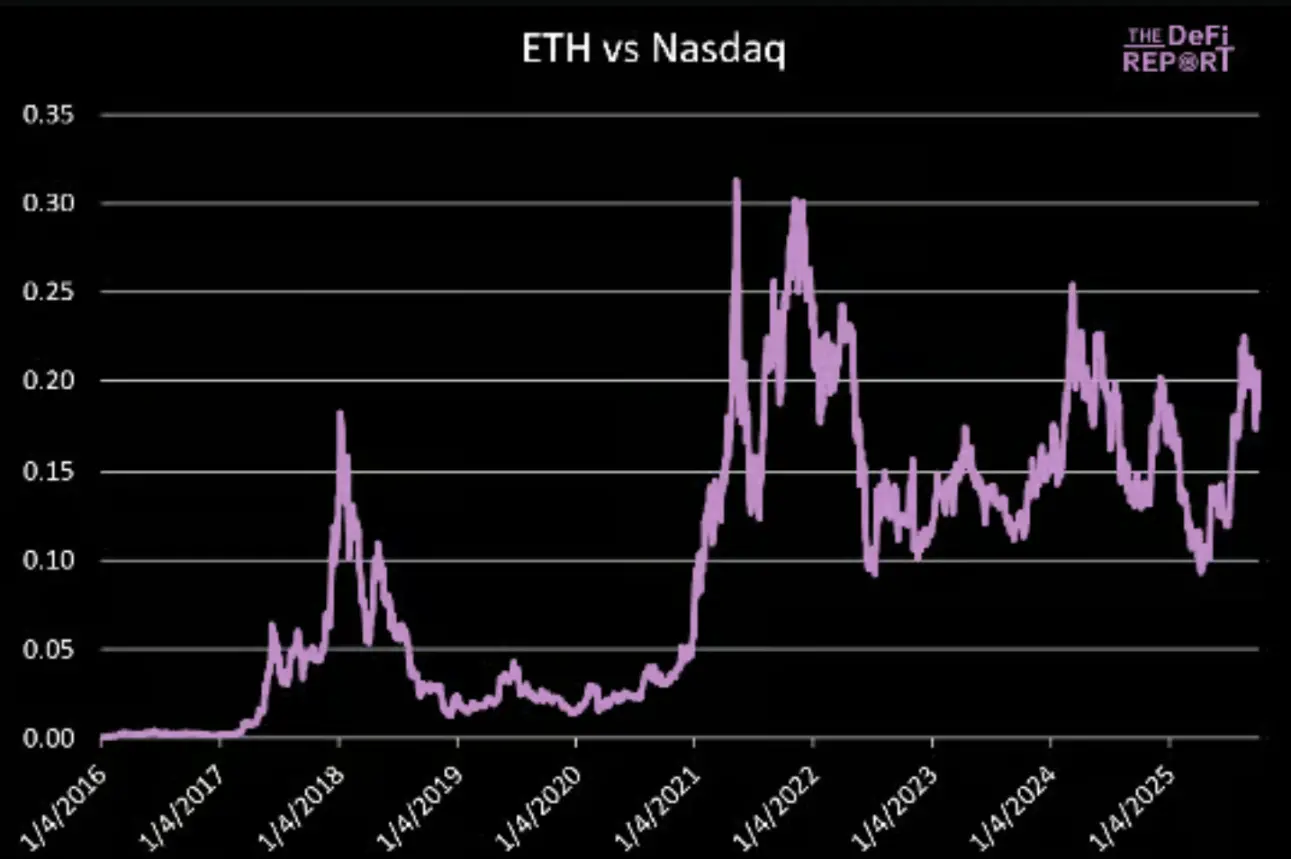

Ethereum to Nasdaq Index Ratio

Data Source: The DeFi Report

In May and November 2021, the peak ratios of Ethereum to the Nasdaq Index were 0.31 and 0.30, respectively.

The current ratio is 0.20, and the current Nasdaq Index is at 22,788 points.

If the Nasdaq Index rises by 5% by the end of this year (up 23% for the year), it will reach 23,927 points.

Ethereum price scenario analysis:

- If the ratio is 0.25: Ethereum price is $5,981

- If the ratio is 0.30: Ethereum price is $7,178

- If the ratio is 0.35: Ethereum price is $8,374

- If the ratio is 0.40: Ethereum price is $9,570

Our baseline assumption is that the upward trend of the Ethereum to Nasdaq Index ratio will continue with the cycle, and this cycle will see a new high (exceeding 0.30).

Summary

Our basic assumptions are as follows:

- Ethereum price is 250% above the 200-week moving average, corresponding to a price of $8,500;

- Realized price reaches $3,000, and if the price to realized price ratio is 2.9, Ethereum price is $8,700;

- Ethereum's market cap reaches 35% of Bitcoin's, and if Bitcoin's price is $150,000, Ethereum price is $8,600;

- Ethereum to Nasdaq Index ratio hits a new high, and if the ratio is 0.35, Ethereum price is $8,300.

If the bull market continues, Ethereum's price may break through $10,000; if the market turns bearish and Bitcoin's peak gains are limited, Ethereum will also come under pressure.

Meanwhile, as market sentiment heats up, more and more discussions about "cycle extension" are emerging, which reminds me of the "supercycle" narrative that was popular in 2021.

As we said before, the baseline assumption remains: Ethereum will reach the cycle peak this quarter.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

On vacation but still earning: Achieve "passive income" during National Day with Bitget GetAgent

GetAgent brings not only profits, but also a sense of liberation.

The Future of Bitcoin Smart Contracts with OP_CAT and sCrypt: In-Depth Analysis with Xiaohui Liu

A new chapter for Bitcoin: OP_CAT activates smart contracts, and the CAT protocol expands application boundaries.

From Plunge to Prosperity: Bitcoin and Ethereum’s Stellar Recovery in Market Value

Raydium Price Targets $1.50 Zone After 4.55% Drop From $2.83 Level