BNB flips XRP market cap: What this means for third largest cryptocurrency

The BNB market cap broke $180 billion, surpassing both Tether and XRP, but can its dominance continue?

- BNB market cap has surpassed that of XRP and USDT

- The Binance coin reached an all-time high at $1,336.57, the same day

- Still, the battle for altcoin dominance is not over

In a move that shook up crypto rankings, BNB has overtaken XRP in market cap. On Tuesday, Oct. 7, BNB reached an all-time high of $1,336.57, positioning itself as the third-largest crypto asset, overtaking both XRP and Tether’s USDT.

As BNB started flipping XRP, market momentum took over for both coins. While BNB registered a 5.35% daily gain, XRP fell by 4.59%. At its height, BNB’s market cap reached $185 billion before stabilizing at $180 billion. This level puts it above XRP’s market cap of $173 billion.

Now, traders are asking whether this positioning will continue, or whether the recent BNB rally is a fakeout fueled by speculation.

Will BNB market cap surpass XRP in the long run?

For one, BNB’s recent rally has strong support behind it, both in terms of on-chain metrics and price charts. In the past few days, the token held steady above the $1,200 support, as well as key moving averages. This indicates that buyers are still in the driver’s seat.

At the same time, XRP stayed below the crucial $3 resistance level. Moreover, given BNB’s rally, XRP will need its most bullish case to flip BNB again. Still, some experts believe that XRP has a springboard ahead if it manages to reverse the recent decline.

“XRP is also interesting to watch right now, as it keeps testing the structural $3.00 ceiling, and breaking the $3.10–$3.20 range with strong volume would clear immediate resistance and open a move toward $3.30–$3.50,” Arthur Azizov, Founder and Investor at B2 Ventures told crypto.news.

In any case, BNB could also see a minor correction. While most signals lean bullish, the Relative Strength Index at 77.38 indicates slightly overbought conditions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Former Federal Reserve Governor Coogler faced an ethics investigation before resigning.

Nillion will gradually migrate to Ethereum.

Both gold and tech stocks have seen dip-buying, but only bitcoin remains "sluggish."

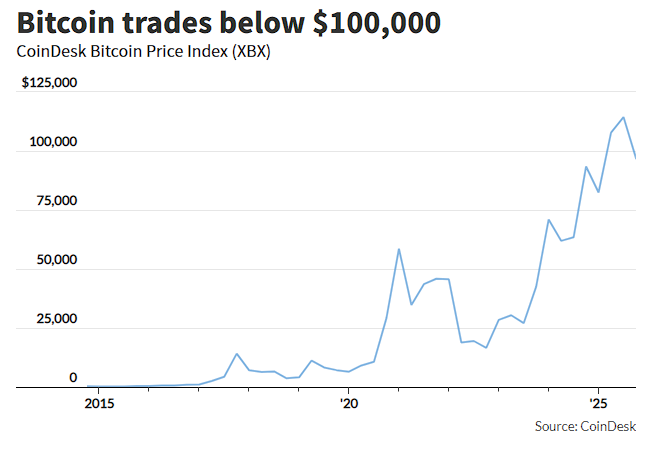

Compared with the capital inflows into tech stocks and gold's sharp rebound after a plunge, bitcoin was a clear exception in Friday's market: it defied the trend by dropping 5%, hitting a six-month low, and has now declined for three consecutive weeks. This contrast highlights the unusual situation in the bitcoin market: even as it maintains a high correlation of 0.8 with the Nasdaq 100 Index, bitcoin exhibits an asymmetric pattern of "falling more on declines and rising less on rallies." Meanwhile, intensified whale sell-offs and concentrated selling by long-term holders are jointly suppressing bitcoin.