Pi Coin Price Shows First Signs Of Recovery Since All-Time Low

Pi Coin shows its first recovery signs since the 47% crash. Rising inflows and bullish signals may fuel a rebound if $0.256 support holds.

Pi Coin continues to struggle after its recent crash, with the altcoin unable to break free from its persistent downtrend. The cryptocurrency suffered heavy losses in recent weeks, driven by weak market momentum and declining investor confidence.

However, improving sentiment across the broader crypto market this week could offer Pi Coin a chance to recover.

Pi Coin Investors Continue To Pour Money

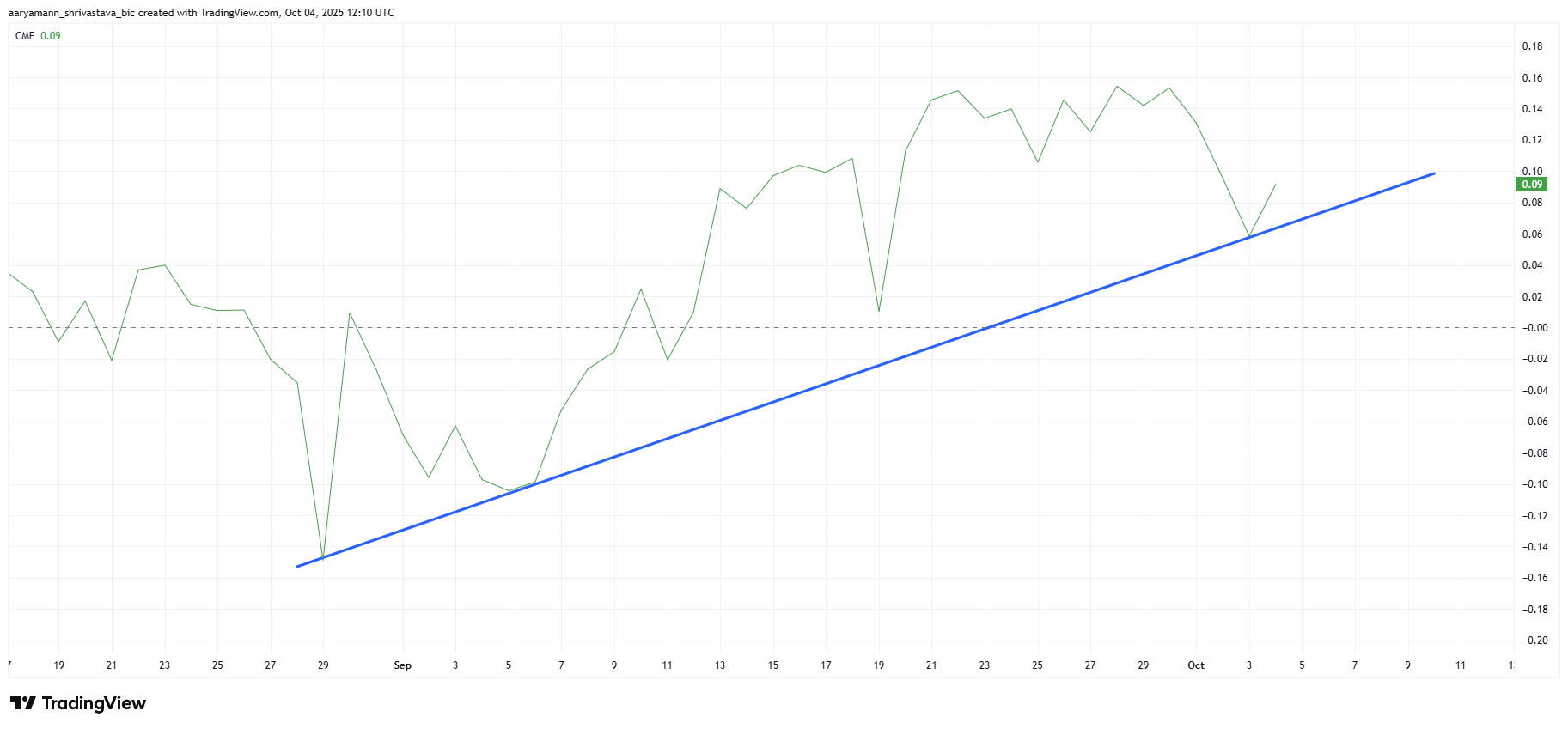

The Chaikin Money Flow (CMF) indicator is currently showing a noticeable uptick, signaling rising inflows into Pi Coin. This trend suggests that investors are regaining confidence and injecting capital back into the asset.

Sustained inflows are essential for fueling upward price movement, particularly after prolonged selling pressure.

The improvement in CMF highlights that Pi Coin may be regaining traction among traders looking to buy the dip.

As new capital enters the market, it could provide the liquidity necessary to stabilize the price and initiate a steady rebound from current levels, provided momentum remains consistent.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Pi Coin CMF. Source:

TradingView

Pi Coin CMF. Source:

TradingView

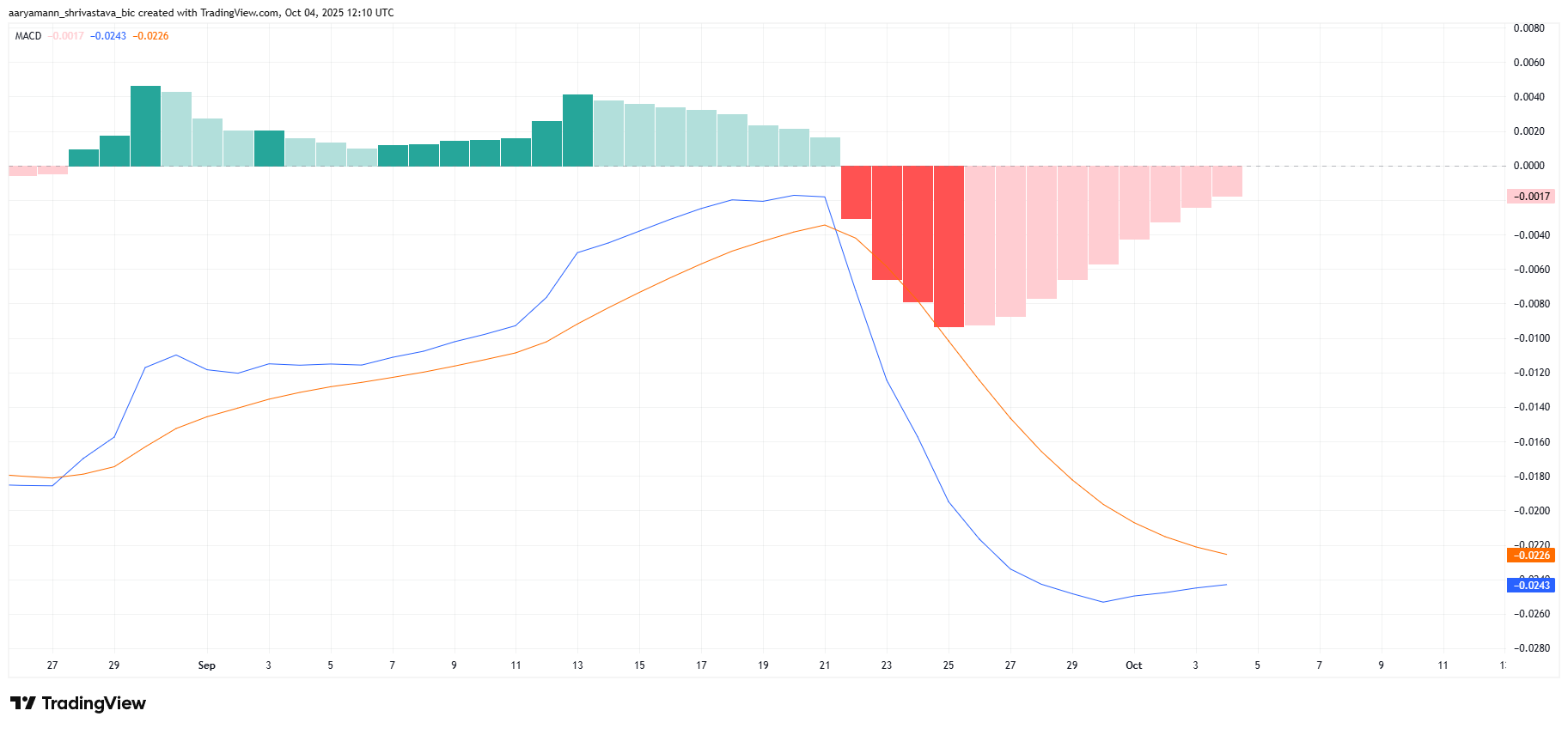

On the technical front, the Moving Average Convergence Divergence (MACD) indicator points to a potential bullish crossover. The indicator line is nearing the signal line, and a crossover would confirm a shift toward positive momentum.

Historically, such movements have preceded recoveries for Pi Coin, signaling possible short-term strength.

If confirmed, this crossover could attract additional investor interest, reinforcing confidence in Pi Coin’s ability to recover. While the broader market’s volatility remains a risk, a sustained bullish signal from MACD would strengthen the case for gradual appreciation over the coming weeks.

Pi Coin MACD. Source:

TradingView

Pi Coin MACD. Source:

TradingView

PI Price Needs A Push

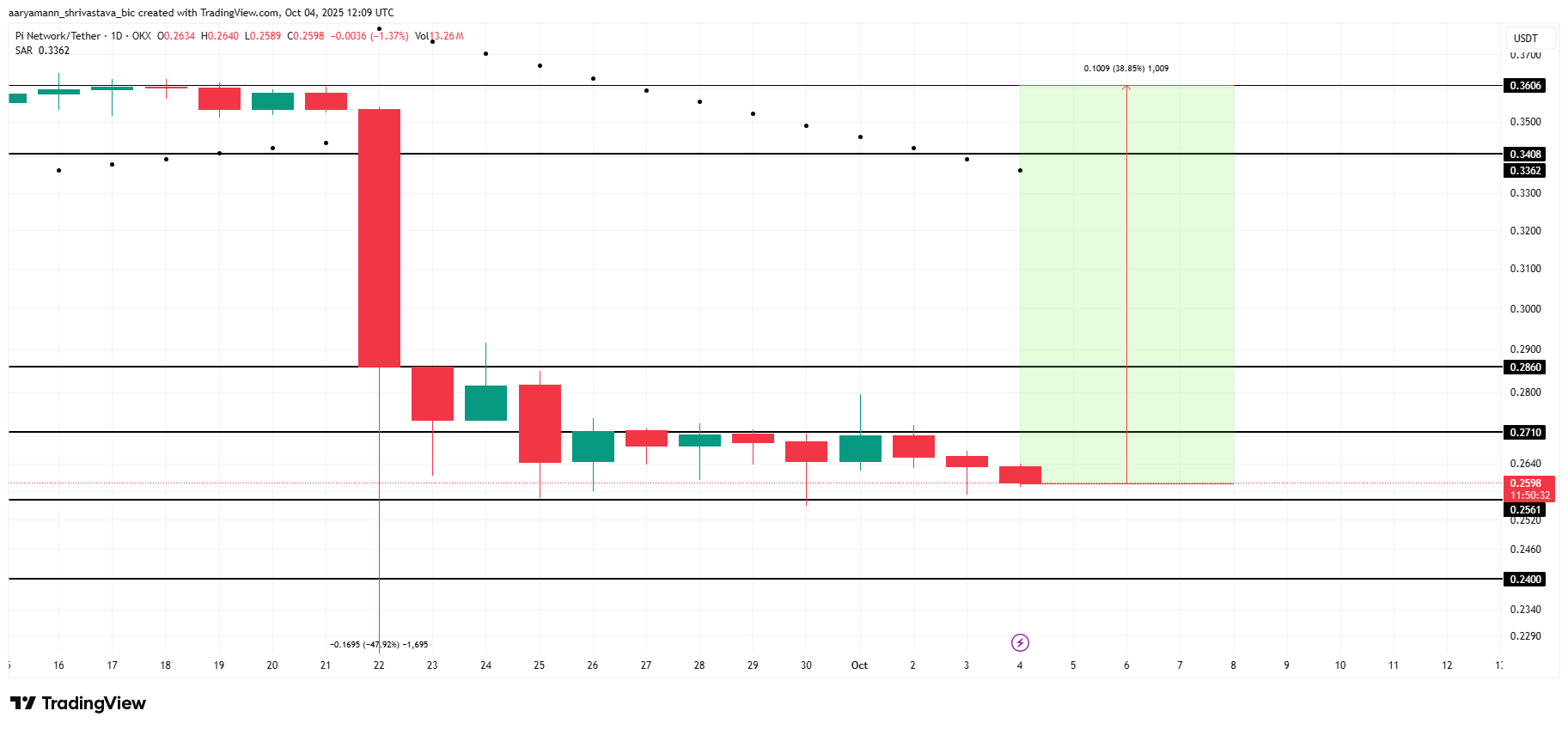

At the time of writing, Pi Coin is trading at $0.259, just above the critical support level of $0.256. This zone has acted as a key foundation for the token, preventing further declines during recent market turbulence.

To fully recover from its 47% crash, Pi Coin must rally by approximately 38.8%. While this target remains ambitious, rising inflows and improving technical indicators could gradually push the token toward recovery if current conditions persist.

Pi Coin Price Analysis. Source:

TradingView

Pi Coin Price Analysis. Source:

TradingView

A sustained uptrend could help Pi Coin break through resistance levels at $0.271 and $0.286.

However, failure to maintain bullish momentum could send it below $0.256, with potential losses extending to $0.240, invalidating the current optimistic outlook.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Tom Lee responds to X's debate with Fundstrat over differing bitcoin outlooks

Egrag Crypto: Selling XRP Now Makes No Sense. Here’s Why

What are Intent Based Architectures?

Bitcoin could face severe headwinds amid macroeconomic growth warnings, analyst says