VC Fundraising in Crypto Sector Consolidates Under Corporate Capital Inflows

Crypto VC fundraising is consolidating fast—fewer rounds, bigger checks, and a clear investor preference for DeFi, AI, and blockchains. Smaller projects risk being sidelined unless they align with institutional capital flows.

A new report on VC fundraising in the crypto space provides interesting conclusions. The sector is undergoing deep consolidation, with fewer projects receiving substantially more capital.

Sectors like DeFi, AI, and blockchains are getting a lot of interest, whereas RWAs, DePIN, NFTs, and GameFi are falling by the wayside. Aligning with major players’ preferences may be the only way to receive fresh inflows.

Crypto VC Fundraising Analyzed

A few months ago, VC fundraising in the crypto space was in full swing, with institutional investment powering $10 billion in inflows in Q2 alone. Since then, however, this sector has apparently cooled somewhat, as token launches began taking precedent over traditional VC routes.

A new report aims to fully quantify the data and identify useful trends. Throughout September 2025, crypto VC fundraising rounds fell dramatically on several points. Compared to the previous month, the total number of rounds fell by 25.3%, and this magnified to 37.4% next to September 2024.

In other words, the number of fundraising rounds isn’t just falling; the rate of decline is increasing at breakneck speed.

However, this data is slightly misleading. Although the number of distinct VC fundraising events in crypto dropped like a rock, there’s vastly more capital involved. Looking at the raw value of total fundraising, last month had a 739.7% increase year-over-year.

A Consolidating Market

In total, this represents around $5.1 billion in total VC fundraising capital for the crypto sector. As prominent firms aim for major IPOs, these aggressive rounds are ballooning in size and diminishing in total number.

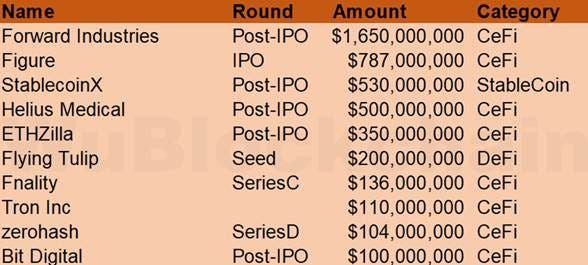

Last month, multiple single fundraising rounds surpassed the total capital raised in September 2024:

Crypto Fundraising Last Month. Source:

Wu Blockchain

Crypto Fundraising Last Month. Source:

Wu Blockchain

In light of this trend, it’s critically important that we discover which sectors are gaining the most attention.

CeFi and DeFi were naturally the largest areas, nearly representing half of total investment capital between them. AI development and L1/L2 blockchains tied for third place behind them, with tools and wallets lagging narrowly behind.

Although the RWA market has traded well on stock tokenization hype, data suggests that VC fundraising is ignoring this crypto subsector. A recent report shows that these assets are significantly underperforming, and last month, they only achieved a 6.5% market share when bundled with DePIN.

In other words, large institutional investors like Goldman Sachs, Pantera Capital, and Galaxy Digital are dominating this VC fundraising ecosystem, and they can be particular about their crypto interests.

This consolidated environment may produce significant challenges to smaller projects, but it also has real opportunities.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Numerai Strives to Become the Final Hedge Fund Globally, Powered by AI and a $500 Million Valuation

- Numerai, an AI-driven hedge fund, raised $30M in Series C funding led by university endowments, valuing it at $500M—five times its 2023 valuation. - The funding, combined with J.P. Morgan’s $500M capacity commitment, aims to scale Numerai’s AUM toward $1B by expanding AI teams and institutional products. - Leveraging a global data science tournament and Ethereum-based cryptocurrency (NMR), Numerai’s model aggregates machine learning signals into a Meta Model for trading. - With a 25.45% net return in 202

LUNA has dropped by 82.86% compared to last year as the market downturn continues

- LUNA plummeted 82.86% YoY amid sustained market sell-off, with 24-hour, 7-day, and 30-day declines of 5.07%, 12.11%, and 23.88% respectively. - Broader crypto market correction and macroeconomic uncertainty drove investor flight to cash, exacerbating LUNA's liquidity pressures without token-specific catalysts. - LUNA ecosystem remains stagnant with no new developments since 2025, leaving token vulnerable to declining trading volumes and market capitalization. - Analysts predict prolonged bearish pressure

XRP News Today: The Crypto World’s Delicate Balance Between Progress and Volatility

- CoinMarketCap and Reserve launch CMC20, a DeFi-native index token tracking top 20 cryptos on BNB Chain, blending blockchain transparency with diversified institutional-grade access. - Trump's WLFI crypto project suffers $2.85B value drop due to phishing attacks and poor key storage, exposing security risks in high-profile consumer-facing crypto ventures. - CredShields and Checkmarx partner to combat smart contract flaws via AI audits and enterprise security frameworks, addressing 48% of major DeFi breach