Uptober rally builds as on-chain data confirm crypto market strength

The crypto market is rallying after a turbulent week that erased billions from the total market cap and left traders on edge.

- The crypto market kicked off October on a strong note, lifting total value to $4.17 trillion.

- Bitcoin is up $118,000 on the day with a 4% gain, while Ethereum rose 6% to $4,400.

- Other altcoins rallied as well, with the likes of Zcash and Zora posting stronger double-digit gains.

- Analysts believe the bull cycle is still underway, with room for more upside in Uptober.

The uptrend comes as the crypto market stages a broad rebound, with several coins climbing back from recent lows.

Bitcoin ( BTC ) is leading the rebound, surging past $118,000 and gaining roughly 4% in the past 24 hours. Ether ( ETH ) is also back in focus, jumping over 6% to briefly touch $4,400 after sinking to $3,900 during the latest market pullback.

Other major altcoins like Solana ( SOL ) and Binance Coin ( BNB ) rose as well, with SOL climbing 7% to $225, and BNB trading near $1,040. Some smaller-cap altcoins posted even stronger double-digit gains, with Zcash ( ZCASH ) jumping 73% and Zora ( ZORA ) surging nearly 33%.

This rebound is fueled by both price action and renewed sentiment. The total crypto market capitalization is up 4.6% to $4.17 trillion on the day, turning the broader mood from caution to confidence. The ongoing rally comes as anticipation for “Uptober” picks up among traders and market participants, with hopes high for the momentum to hold and push prices to new highs.

On-chain data back Uptober crypto market rally

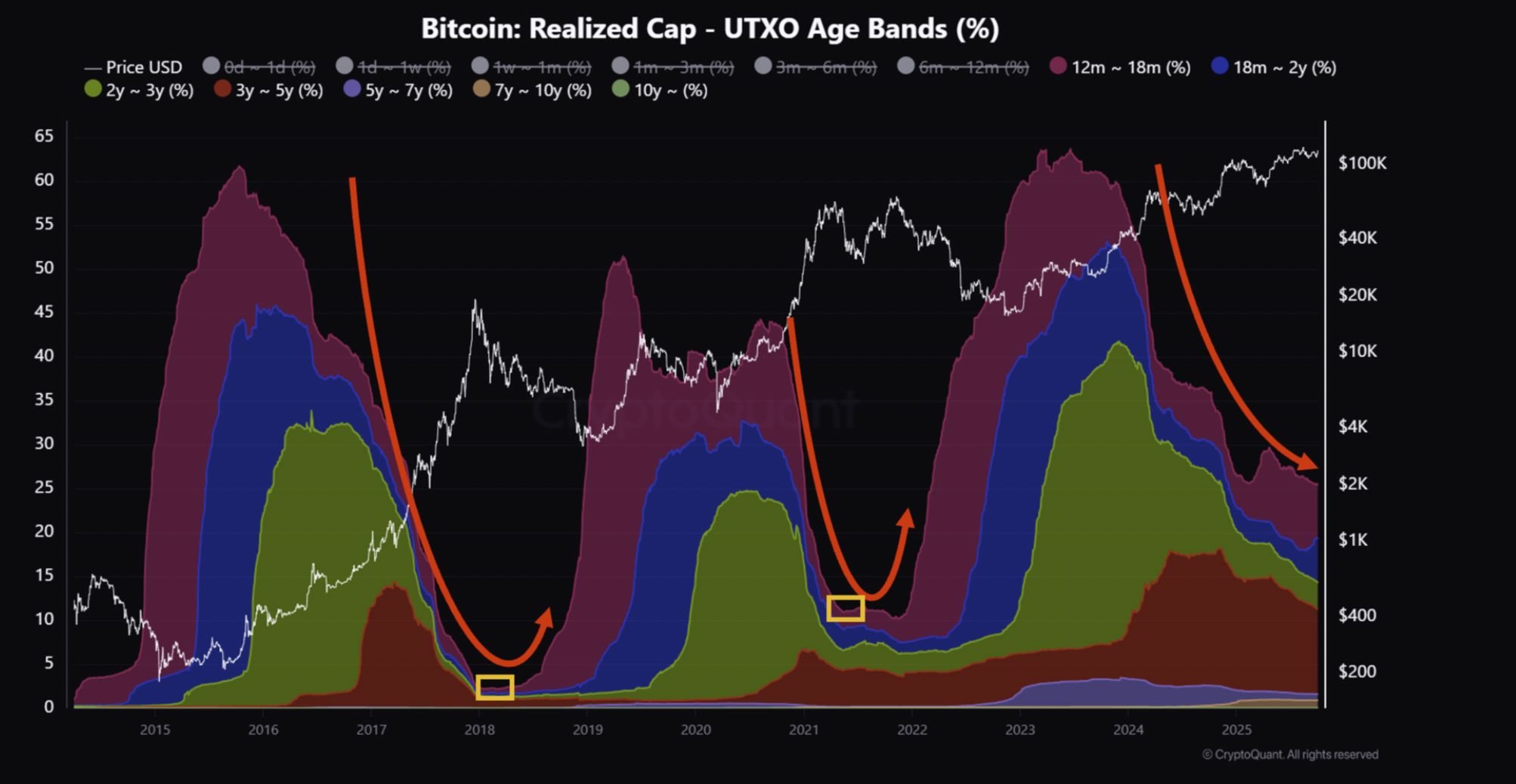

Supporting the outlook, a new CryptoQuant analysis suggests that the crypto market rally may still have room to run. Per the report , the current bull cycle is “slow but still in progress,” with long-term Bitcoin holders gradually reducing their positions but not yet signaling a market top.

Historically, the late stage of a bull run has been marked by a sharp drop in the share of BTC held for more than a year, as early investors sell into strength and new capital flows into the market. That shift has typically signaled the beginning of a transition from bullish momentum to the early stages of a bear cycle.

At present, the share of Bitcoin held long-term is declining at a much slower pace. This suggests the cycle is maturing but has not yet reached its peak.

Bitcoin Realized Cap chart | Source: CryptoQuant

Bitcoin Realized Cap chart | Source: CryptoQuant

“The current market is progressing slowly within the bull cycle, but there are no signs of an imminent end,” the report noted, adding that a stronger upward move could still be ahead.

Price action and on-chain trends together point to a market with more room to grow. While volatility is likely to persist, signals suggest October’s rally is supported by long-term strength rather than short-term speculation.

If history holds, this month could again prove to be a major one for Bitcoin and altcoins, with the potential to push the market toward new highs in the weeks ahead.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Securitize Gains EU Approval for Tokenized Market System on Avalanche

SpaceX Moves $105 Million in Bitcoin as New Treasury Activity Draws Attention

Cardano News Today: While ADA Faces Challenges, Mutuum's Robust DeFi Approach Draws $18.9M During Presale

- Mutuum Finance (MUTM) raised $18.9M in Phase 6, with token price rising 250% to $0.035 amid strong demand from 18,200 holders. - The project combines P2C/P2P lending with smart contract automation and a buy-and-distribute mechanism to create a deflationary, non-custodial DeFi alternative. - CertiK/Halborn audits and Q4 2025 testnet plans highlight security focus, while 45.5% token allocation to presale and card-based payments boost accessibility. - MUTM's $0.04 Phase 7 price hike and $0.06 launch target

Bitcoin’s Steep Drop in Late 2025: The Intersection of Broader Economic Risks and Changing Market Sentiment

- Bitcoin plummeted from $126,000 to $81,000 in late 2025 amid a $1T crypto market contraction driven by macroeconomic, regulatory, and behavioral factors. - The Fed's delayed rate-cut signals and elevated interest rates intensified capital flight from high-beta assets like Bitcoin to safer investments. - SEC's regulatory ambiguity and institutional "whale" BTC withdrawals exacerbated selling pressure, while miners added technical downward momentum. - Investor sentiment reached historic lows, with $3.79B i