UK officials are considering retaining roughly $6.4 billion of gains from 61,000 seized Bitcoin, potentially reimbursing victims only the original investment (~£640m). The High Court will decide whether excess proceeds are returned to victims or retained by government funds under existing confiscation rules.

-

UK Bitcoin seizure may leave victims reimbursed only for original investment, not market gains.

-

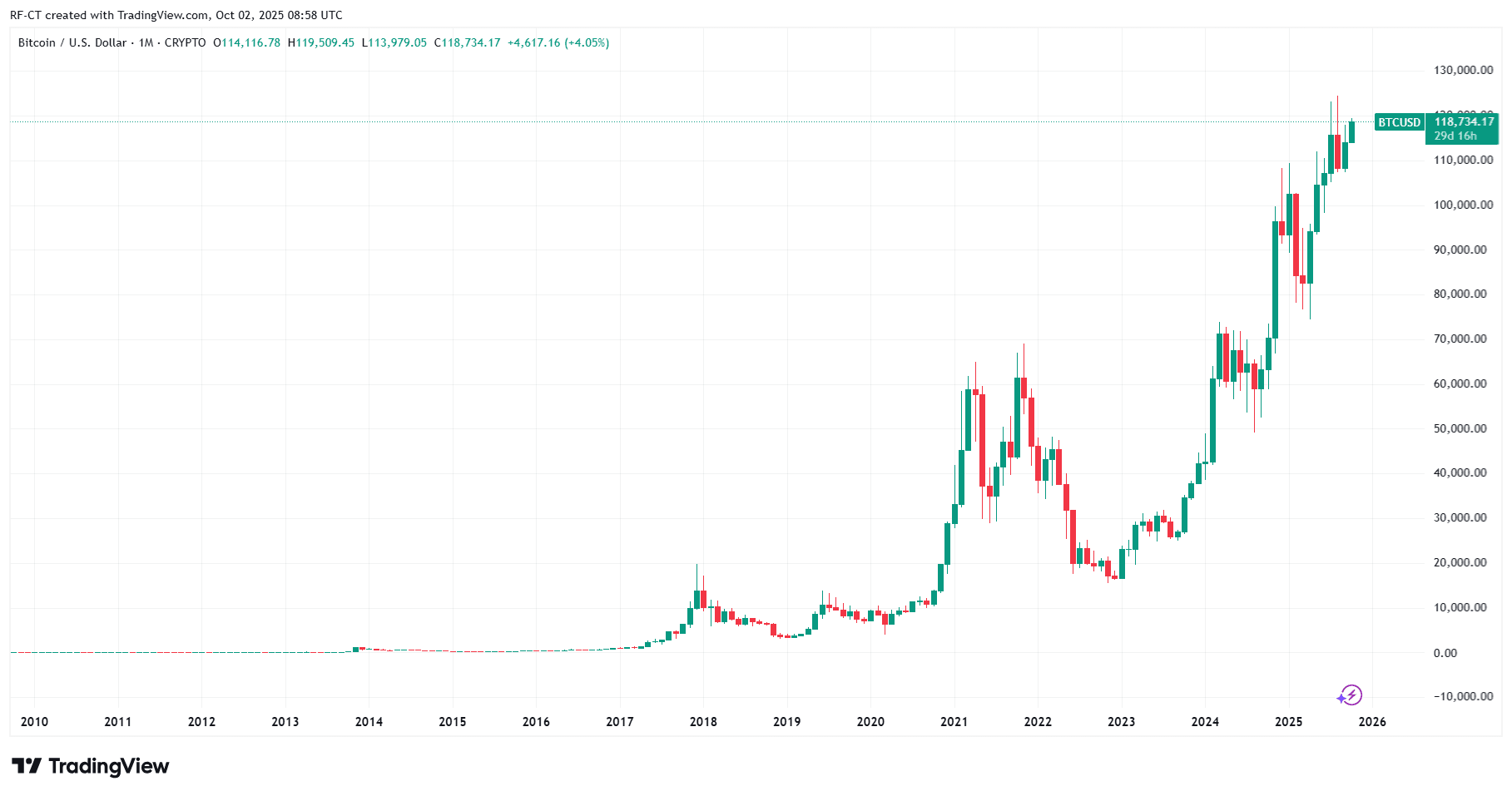

61,000 BTC seized in 2018 is worth roughly $7.24 billion at current rates, creating an excess of about $6.4 billion over original capital.

-

Seizure followed a seven-year investigation into an international fraud that affected 128,000 investors; legal outcomes could take years.

UK Bitcoin seizure: officials weigh keeping $6.4B windfall from seized Bitcoin instead of full restitution to victims. Read the latest analysis and next steps.

UK officials are weighing whether to keep roughly $6.4 billion in gains from Bitcoin seized in a major Chinese fraud case instead of returning it to victims.

What is the UK Bitcoin seizure controversy?

UK Bitcoin seizure refers to the legal and policy debate over whether the UK should retain excess gains from 61,000 Bitcoin seized in 2018 from fraud suspects, or return total proceeds to victims. The central issue is whether courts will award victims only original capital (~£640 million) or the full, current value of the crypto holdings.

How might victims be compensated under current rules?

Under the Proceeds of Crime Act, confiscated assets typically flow into government funds with court-ordered compensation where appropriate. The High Court may limit compensation to the original invested amount, which would mean victims receive roughly £640 million instead of the full market value of the seized Bitcoin.

United Kingdom officials are weighing whether to retain billions of dollars in gains from seized Bitcoin tied to a large fraud, rather than redistributing the full market value to victims, according to reporting by Financial Times (mentioned as the reporting source in plain text).

Court documents and official guidance indicate the High Court may reimburse victims only the original value of the investment — approximately £640 million (about $862 million). The seized 61,000 Bitcoin was worth nearly $7.24 billion at the time of reporting, leaving an excess of roughly $6.4 billion above the original capital.

UK Treasury headquarters. Source: Wikimedia

Related: US DOJ files to seize $225M in crypto tied to pig butchering schemes

Why is this considered the largest crypto seizure?

The assets were seized from Chinese national Zhimin Qian and assistant Seng Hok Ling, who recently pleaded guilty. London police described the action as “the single largest cryptocurrency seizure in the world,” reflecting both the scale of the fraud and the size of the holdings.

Metropolitan Police Economic Crime investigators pursued a seven-year probe into international money laundering. Qian pleaded guilty to acquiring and possessing criminal property; Ling pleaded guilty to transferring criminal property.

Between 2014 and 2017, the fraud scheme reportedly stole assets from more than 128,000 investors in China. Those assets were converted to Bitcoin as the suspects left the country using false documents and stored the proceeds in crypto wallets that were later located by investigators.

In September 2018, attempts to launder proceeds through property purchases triggered surveillance that ultimately led to arrests in April 2024 and the recovery of encrypted devices, cash, gold and cryptocurrency.

Related: Germany seizes $38M in crypto from Bybit hack-linked eXch exchange

How does this seizure compare to other recent crypto confiscations?

Large-scale crypto forfeitures are increasingly common. Recent examples include Canadian police seizing $40 million in crypto from TradeOgre, and US authorities confiscating millions tied to ransomware and other crimes.

The US Department of Justice and US Secret Service have both reported large crypto recoveries in recent years, including multi-hundred-million-dollar actions. Sweden’s justice minister has urged authorities to target enforcement actions that yield significant recoveries.

In June, US exchange Coinbase publicly assisted US Secret Service seizures totaling $225 million related to scam proceeds, a fact disclosed by the agency and industry statements (sources cited in plain text).

Frequently Asked Questions

Who are the victims of the seized Bitcoin fraud?

The victims are primarily investors in China who lost funds between 2014–2017 in a large fraud scheme led by Zhimin Qian. Authorities estimate about 128,000 individuals were affected, with proceeds later converted into Bitcoin.

Will victims receive the full market value of the seized Bitcoin?

Not necessarily. The High Court may order compensation equal to original investment value (~£640m), not the full current market value. Any decision will hinge on legal interpretation of restitution rules under the Proceeds of Crime Act.

How long could legal disputes over the proceeds take?

Officials warn that legal challenges could be complex and protracted, potentially lasting years, as courts address ownership claims, compensation formulas and government use of confiscated gains.

Key Takeaways

- Seized assets: 61,000 BTC were recovered, currently valued at roughly $7.24B.

- Compensation dispute: Officials may return only original capital (~£640m), leaving ~ $6.4B unallocated to victims.

- Legal timeline: Court decisions and appeals could take years; outcomes will set precedent for future large-scale crypto confiscations.

Conclusion

The UK Bitcoin seizure raises fundamental questions about restitution and the treatment of crypto windfalls. COINOTAG will continue to monitor High Court developments and legal rulings that will determine whether victims receive market-value restitution or only original investment amounts. Readers should expect prolonged litigation and further policy debate on asset forfeiture rules.