Plasma founder Paul Faecks denies insider selling after the XPL token plunged over 50%, stating team and investor allocations are locked for three years with a one-year cliff and that no team tokens were sold.

-

Plasma founder denies team token sales

-

XPL dropped from ~$1.70 to $0.83 in days, per TradingView price data

-

Onchain sleuths reported >600M XPL movements from a team vault before launch

Plasma XPL price crash: founder denies insider selling; learn what onchain data shows and how to verify flows. Read the timeline and key takeaways.

What happened in the Plasma XPL price crash?

Plasma XPL price crash saw the token spike to almost $1.70 on Sunday and fall to $0.83 by Wednesday, erasing over 50% of value. Founder Paul Faecks publicly denied team selling, reiterating that team and investor allocations remain locked for three years with a one-year cliff.

How did onchain analysis and TWAP selling claims emerge?

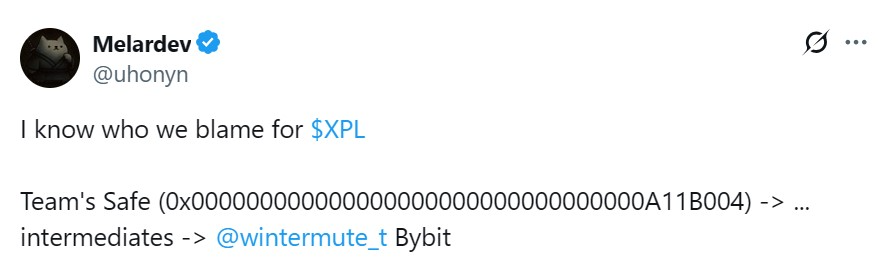

Community analysts used onchain tracing to follow XPL flows and flagged large transfers from a wallet identified as the Plasma team vault. Independent sleuth ManaMoon reported more than 600 million XPL moved to exchanges in the lead-up to the launch. Observers suggested the pattern resembled time-weighted average price (TWAP) selling, where a large position is split into many smaller orders executed at intervals.

XPL/Tether perpetual contract chart on Binance. Source: TradingView

XPL/Tether perpetual contract chart on Binance. Source: TradingView

Why does the Plasma team deny involvement?

Paul Faecks told the community that no team members sold XPL and that allocations are locked with vesting terms. He also denied any commercial relationship with market makers cited by users, saying the team has only public information regarding outside trading firms.

Community members remained skeptical. A user, crypto_popseye, questioned whether wording in Faecks’ statement left ecosystem and growth allocations ambiguous, suggesting those categories could have been sold despite team allocations being locked.

Source: Melardev

Source: Melardev

When did onchain probes flag large transfers?

Onchain probes identified significant transfers in the days preceding the token launch window. Observers reported more than 600 million XPL moved toward exchange addresses shortly before the price spike and subsequent dump. TradingView price data recorded the intraday peak and the rapid decline over the following sessions.

How are community analysts verifying token flows?

Analysts cross-check public blockchain explorers, exchange deposit addresses, and transaction timestamps. They compare wallet balances before and after transfers and look for clustering of outgoing transactions to exchange-controlled addresses. These methods produced the community’s alerts about large XPL movements.

Frequently Asked Questions

Did the Plasma team sell XPL tokens?

Plasma founder Paul Faecks denied any team sales, stating team and investor allocations are locked for three years with a one-year cliff. Onchain analysts have reported large transfers from a wallet identified as a team vault, which the community continues to investigate.

What is TWAP selling and why is it suspected?

TWAP (time-weighted average price) breaks a large sell into many smaller orders executed at intervals to reduce market impact. Community members suspected TWAP after identifying repeated, evenly sized outflows to exchanges ahead of the price collapse.

Key Takeaways

- Founder denial: Paul Faecks says no team token sales and confirms vesting locks.

- Onchain alerts: Independent analysts reported >600M XPL moved from a team vault to exchanges.

- Community scrutiny: Observers cite possible TWAP-like patterns and call for transparent accounting of ecosystem and growth allocations.

Conclusion

The Plasma XPL price crash triggered intense onchain scrutiny and public denials from founder Paul Faecks. While team allocations are claimed to be locked, community investigators have pointed to large transfers tied to a team vault and exchange deposits. Ongoing onchain analysis and transparent disclosure from the project will be critical to restore confidence.