- Crypto Fear & Greed Index hits 64, signaling Greed

- Sharp jump from last week’s 44, which indicated Fear

- Market sentiment now reflects bullish investor outlook

The Crypto Fear & Greed Index has seen a sharp increase, rising from 44 (Fear) last week to 64 (Greed) today. This jump marks a notable change in investor sentiment, suggesting growing optimism in the cryptocurrency market .

The index, which gauges emotions and sentiments from various sources including volatility, market volume, social media trends, and market momentum, is widely used to assess whether the market is fairly valued. A reading of 64 lands firmly in the “Greed” territory, indicating investors are becoming more confident—perhaps too confident.

What’s Driving the Greed?

Several factors may be behind this rapid change in sentiment.

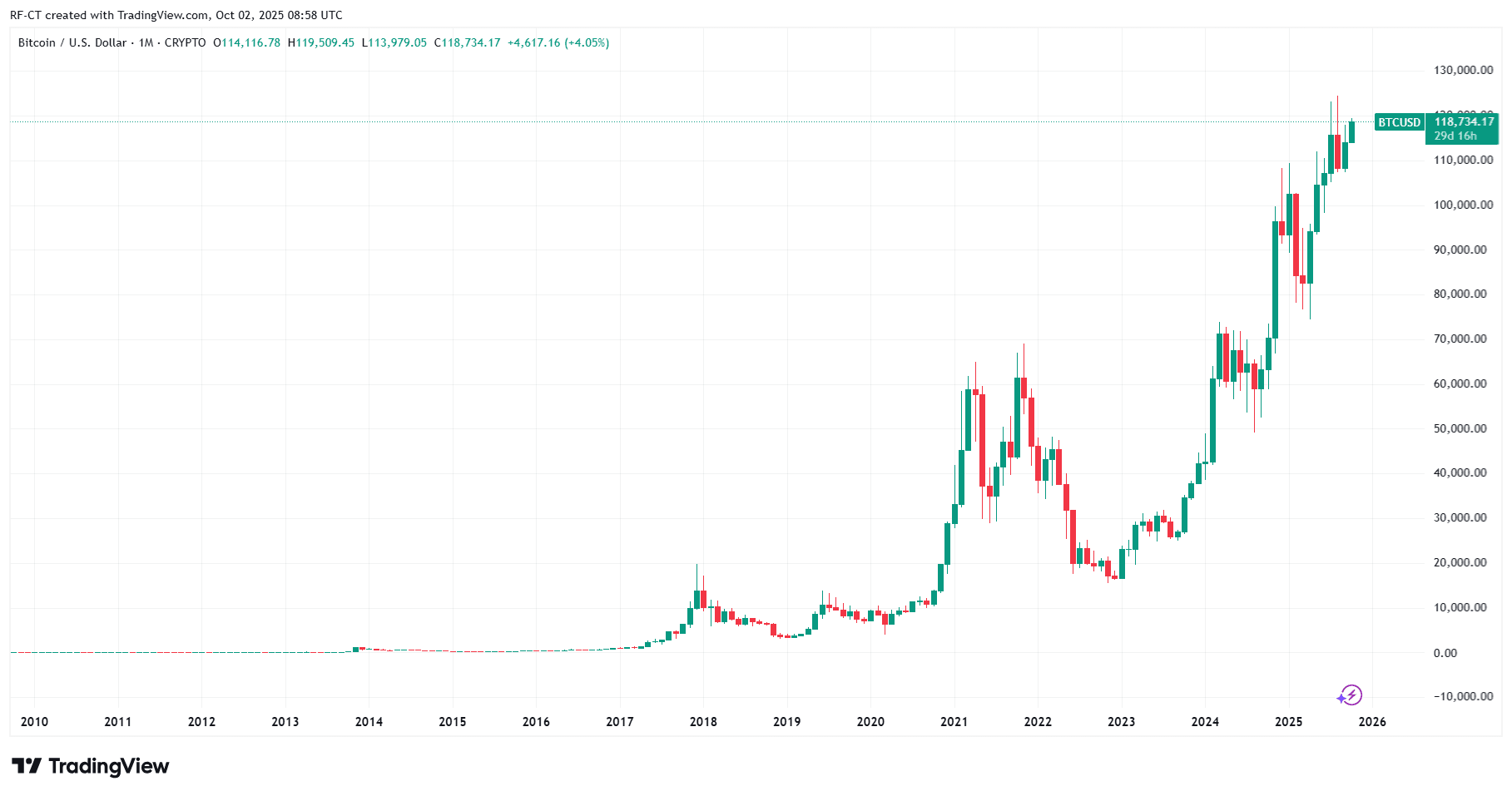

First, the recent rebound in Bitcoin and altcoin prices has reignited bullish hopes. BTC ’s steady recovery and Ethereum ’s strong weekly close have improved the market outlook.

Second, institutional interest in crypto has picked up, with increasing ETF activity and positive signals from major financial entities. This kind of institutional backing often boosts investor confidence.

Additionally, macroeconomic indicators such as stable inflation data and potential interest rate pauses by central banks are supporting risk assets like crypto. When external economic pressures ease, investors tend to turn back to high-reward assets.

What This Means for Investors

While a “Greed” reading might seem like a positive signal, it can also suggest the market is overheated. Historically, extreme greed often precedes market corrections.

For traders and investors, this is a time to proceed with caution. Consider reviewing portfolios, setting stop-losses, and being alert for signs of reversal. Although sentiment is strong, crypto markets remain volatile and unpredictable.