CAMT guidance: The Treasury and IRS issued interim CAMT guidance allowing many corporations to exclude unrealized gains and losses on digital assets held at fair value from CAMT income, easing potential tax liability for large crypto holders while the agencies finalize rules. This reduces immediate compliance burdens for affected firms.

-

IRS interim guidance excludes certain unrealized digital-asset gains from CAMT calculation.

-

The Senate Finance Committee will hold a hearing titled “Examining the Taxation of Digital Assets” following the guidance.

-

Notice 2025-49 and Notice 2025-46 aim to reduce compliance burdens until final CAMT regulations are issued.

CAMT guidance: Treasury and IRS ease CAMT rules for digital assets — read what exclusions mean for corporate crypto holders and upcoming Senate oversight.

The US Senate Finance Committee is holding a hearing on Wednesday on crypto asset taxation, following the IRS’s release of relief guidance on the Biden-era CAMT tax.

What is the interim CAMT guidance and who does it affect?

CAMT guidance from the Treasury and IRS temporarily clarifies application of the Corporate Alternative Minimum Tax (CAMT) for companies with digital-asset holdings. The notices allow, in many cases, exclusion of unrealized gains and losses on fair-value digital assets from Adjusted Financial Statement Income (AFSI), reducing immediate CAMT exposure for large corporations.

How do Notices 2025-46 and 2025-49 change CAMT calculations?

Notice 2025-49 explains amendments to AFSI under Sections 55, 56A and 59 of the Internal Revenue Code. It specifies that, depending on applicable financial accounting principles, companies may exclude unrealized fair-value changes on digital assets from CAMT income. Notice 2025-46 provides complementary procedural relief to ease compliance while final regulations are drafted.

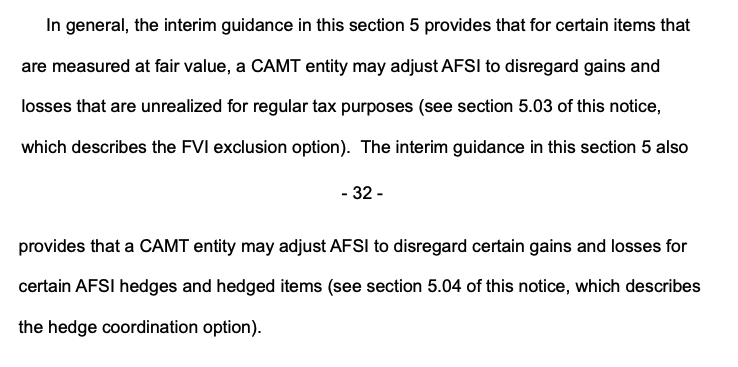

An excerpt from the Notice 2025-49. Source: IRS

An excerpt from the Notice 2025-49. Source: IRS

Why does this relief matter for large corporate crypto holders?

The relief is material because CAMT, enacted as part of the Inflation Reduction Act of 2022, imposes a 15% minimum tax on financial-statement income for large corporations. Without exclusion, companies reporting sizable unrealized gains on digital assets could face substantially higher CAMT liabilities.

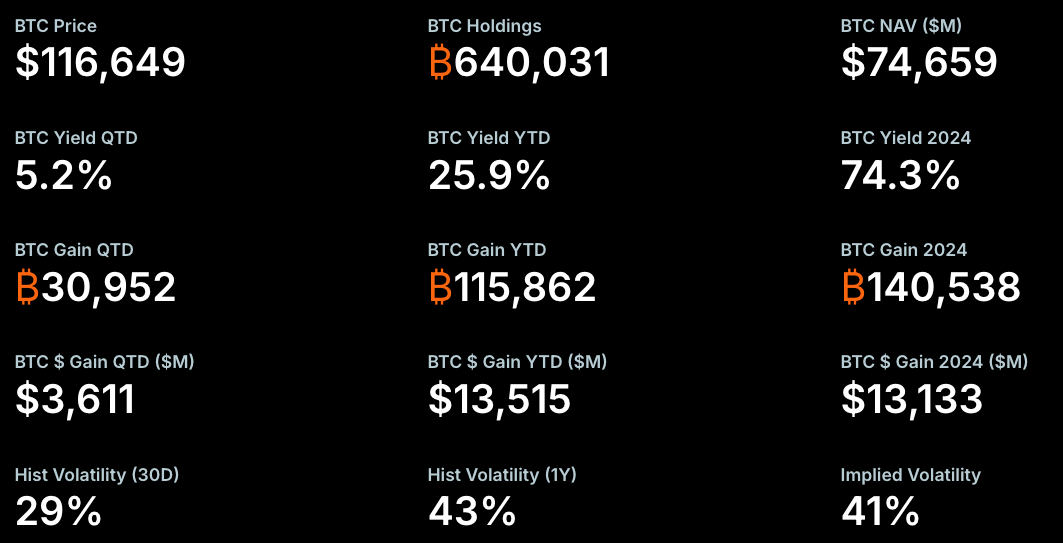

For example, commentary from financial journalists notes that large holders with significant unrealized crypto gains — such as Strategy — could have faced billions in additional CAMT charges absent relief. The interim guidance mitigates that potential impact pending final rules.

When is the Senate Finance Committee hearing and who will testify?

The Finance Committee hearing “Examining the Taxation of Digital Assets” is scheduled for Wednesday. Chair Mike Crapo will lead the session, with participation from industry tax leaders including Lawrence Zlatkin (Coinbase, vice president of tax) and Jason Somensatto (Coin Center, policy director). The hearing follows recommendations from the White House Digital Asset Working Group to adjust tax rules recognizing crypto as a new asset class.

Strategy’s Bitcoin metrics. Source: Strategy

Strategy’s Bitcoin metrics. Source: Strategy

Frequently Asked Questions

Will CAMT apply to unrealized gains on crypto for all companies?

Not necessarily. Application depends on a company’s financial accounting principles and whether the digital assets are held as fair value assets. The interim guidance clarifies eligibility criteria but final regulations will provide definitive rules.

How should companies prepare for final CAMT regulations?

Companies should document accounting treatments for digital assets, assess AFSI impacts, consult tax counsel, and monitor Treasury and IRS updates. The interim notices provide temporary clarity but firms should prepare for potential reconciliation when final rules arrive.

Key Takeaways

- Regulatory relief: Interim guidance permits excluding some unrealized digital-asset gains from CAMT AFSI.

- Oversight: The Senate Finance Committee will review digital-asset taxation in a public hearing.

- Action: Corporations should review accounting classifications, tax positions and update compliance workflows ahead of final CAMT rules.

Conclusion

The Treasury and IRS interim CAMT guidance offers immediate relief for many corporations holding digital assets by clarifying exclusions for unrealized fair-value gains and losses. Market participants, tax professionals and lawmakers will watch the Senate hearing for further policy direction as final CAMT regulations are developed. COINOTAG will monitor updates and provide follow-up analysis.