Glassnode Co-Founders Call for Major Crypto Bottom, Predict Q4 Breakout Rallies

The co-founders of the market intelligence firm Glassnode believe that crypto is gearing up for a strong fourth quarter after last month’s correction.

Jan Happel and Yann Alleman, who go by the pseudonym Negentropic, tell their 63,900 followers on X that crypto printed a bottom late last month based on Swissblock’s Aggregated Impulse metric, which tracks the exponential price structure of the top 350 assets.

Happel and Alleman say that while crypto can still witness pullbacks in the coming days, the market is poised for breakout rallies.

“Major bottom confirmation.

We’re nearing a breakout similar to April and June — be patient, the biggest move is ahead.

Macro hurdles this week may bring volatility, but dips are opportunities to average in.”

Looking at Bitcoin, the pair says they expect BTC to dip above $110,000 before igniting rallies.

“We are getting close, volatility short term will pick up, a retrace to the low $112,000 to high $111,000 for BTC is within expectations, before moving higher into early October.”

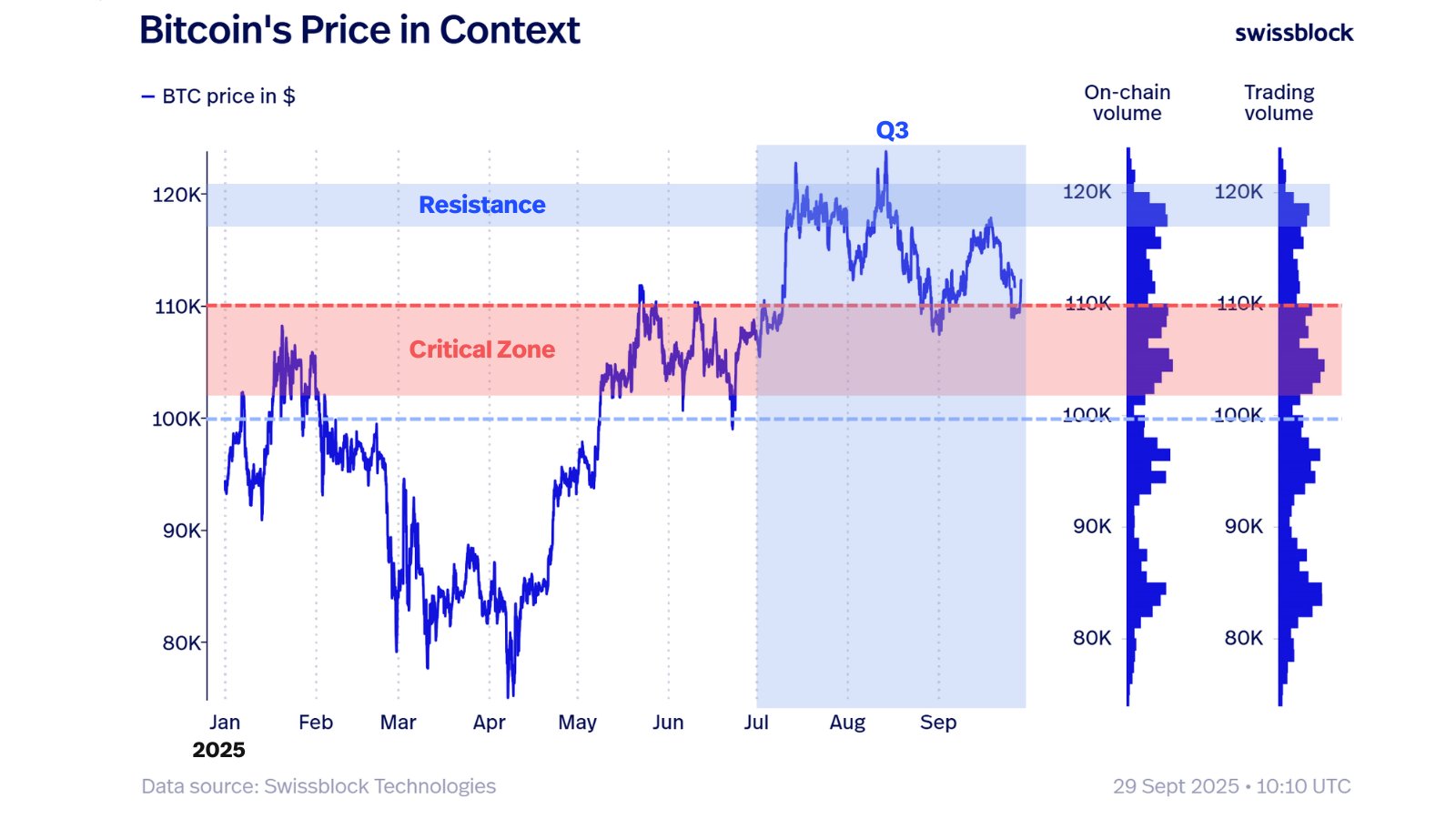

Meanwhile, crypto analytics firm Swissblock sees the $110,000 price level as a must-hold area for bulls.

“Bitcoin, what is the plan?

Starts a week that ends one month and kicks off another, marking the start of Q4.

Q3 began by conquering $110,000:

Holding it is the key pivot—lose it and momentum stalls, defend it and the bullish path stays alive.”

Source: Swissblock/X

Source: Swissblock/X

At time of writing, Bitcoin is trading for $114,003.

Generated Image: DALLE3

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DeFi Faces a Trust Challenge: Balancer Recovers $8 Million Following $128 Million Hack

- Balancer proposes $8M repayment plan after $128M exploit, returning funds to liquidity providers via pro-rata in-kind distribution. - Whitehat actors receive 10% bounties in rescued tokens; non-socialized model ensures pool-specific funds go only to affected LPs. - Exploit exposed systemic risks in DeFi's composable pools, with attackers exploiting rounding errors despite 11 prior audits by four firms. - Governance vote will finalize distribution framework, with claim interface enabling 90-180 day token

AI-driven SaaS Revolution: PetVivo Reduces Expenses by 50-90%, C3.ai Collaborates with Microsoft

- PetVivo.ai cuts veterinary client acquisition costs by 50-90% using AI agents, achieving $42.53 per client vs. $80-$400 industry norms. - C3.ai's Microsoft partnership boosts stock 35% as Azure integration enables enterprise AI scalability through unified data operations. - AI-driven SaaS models like PetVivo's $3/lead platform and C3.ai's 19-27% revenue growth highlight AI's disruptive potential in traditional industries. - Both companies face challenges scaling beta results and converting pilots to long

Ethereum News Today: "Turbulence or Trust? $15 Billion in Crypto Options Set Market Dynamics Against Institutional Hopefulness"

- Bitcoin and Ethereum face $15B options expiry on October 31, 2025, risking amplified volatility amid sharp price declines. - Institutional confidence grows as Bitcoin/ETH ETFs see $217.5M inflows, contrasting crypto's 33-45% drawdowns vs. stable tech stocks. - Tom Lee's firm BMNR boosts ETH holdings to 2.9% of supply, betting on $5,500 mid-2025 and $60K+ 2030 targets. - Deribit data shows Bitcoin's bullish positioning (put-call ratio 0.54) vs. Ethereum's balanced approach, with max pain levels at $100K a

VIPBitget VIP Weekly Research Insights

This year's market has been driven primarily by the growth of DATs, ETFs, and stablecoins. Strong institutional inflows indicate that mainstream U.S. capital is now entering the crypto market. However, after the October 11 black swan event, the market underwent a significant correction due to deleveraging. Even so, several indicators now suggest that a bottom may be forming. Our recommended assets are BTC, ETH, SOL, XRP, and DOGE.