October Will Decide Everything: Altcoin ETF Awaits Final SEC Verdict

The SEC will make a decision on 16 spot cryptocurrency ETFs in October 2025, involving tokens such as SOL, XRP, and LTC. The new universal listing standards have simplified the process, with LTC and SOL having a higher probability of approval. The market is closely watching the impact of ETF approval on token prices. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

In October 2025, the U.S. Securities and Exchange Commission (SEC) is set to make final decisions on at least 16 spot cryptocurrency exchange-traded funds (ETFs). These applications involve a variety of tokens beyond Bitcoin and Ethereum, such as SOL, XRP, LTC, DOGE, ADA, and HBAR. According to the latest developments, the SEC has withdrawn several delay notices and accelerated the approval process through new universal listing rules, shortening the review period to less than 75 days.

According to crypto journalist Eleanor Terrett, the SEC has requested issuers of LTC, XRP, SOL, ADA, and DOGE ETFs to withdraw their 19b-4 filings, as these documents are no longer required following the approval of the universal listing standards.

Since the approval of Bitcoin and Ethereum spot ETFs, there has been significant capital inflow, which has contributed to price increases. So, can these multiple ETFs be approved this time, and will there be a similar price surge effect?

Final Decision Deadline for Multiple Token ETFs is October

According to information compiled by Twitter blogger Jseyff, the final deadlines for several altcoin spot ETFs are spread throughout October. The first to be reviewed is Canary’s LTC ETF, with a deadline of October 2.

Next are Grayscale’s Solana and LTC trust conversions, with a deadline of October 10, and finally WisdomTree’s XRP fund, with a deadline of October 24.

According to a pending approval list created by Bloomberg ETF analyst James Seyffart, decisions could be made at any time before the final deadline.

These applications come from institutions such as Grayscale, 21Shares, Bitwise, Canary Capital, WisdomTree, and Franklin Templeton. Notably, BlackRock and Fidelity are not participating in this round, but this does not affect the potential impact—if approved, these ETFs could pave the way for larger-scale products in the future.

Since the approval of BTC and ETH spot ETFs, no other tokens have received SEC approval. The SEC has continued its usual practice of delaying decisions on these applications. However, the upcoming final decisions must give the market a clear Yes or No answer.

The market is eagerly awaiting the outcome.

The approval or rejection of Litecoin and SOL, which are the first to be decided, may determine market expectations going forward.

Approval Probability

At the end of July this year, the SEC’s new listing standards mainly focused on the qualification requirements and operational mechanisms for crypto ETPs. First, physical creation and redemption are officially allowed, meaning authorized participants can exchange ETP shares with actual crypto assets instead of cash.

The SEC also announced listing standards for spot ETFs. The new standards, expected to take effect in October 2025, aim to simplify the ETF listing process. The “universal listing standard” requires that crypto assets must have been listed on futures markets of major exchanges such as Coinbase for at least six months. This regulation is intended to ensure sufficient liquidity and market depth for the assets, preventing manipulation.

Litecoin, known as a long-standing altcoin, is considered a prime candidate for early approval due to its maturity and non-security attributes. Litecoin founder Charlie Lee recently stated in an interview that he expects a spot LTC ETF to be launched soon. This view is based on the SEC’s approval of the universal listing standard for crypto ETFs and the inclusion of LTC as one of the 10 assets that meet the criteria.

In the interview, Charlie Lee discussed LTC’s prospects under the evolving regulatory framework. He mentioned that the SEC’s recent approval of universal crypto ETF listing standards is a key driver and emphasized that Litecoin meets the conditions for rapid approval.

As of now, the probability of a Litecoin spot ETF being approved this year on Polymarket has risen to 93%.

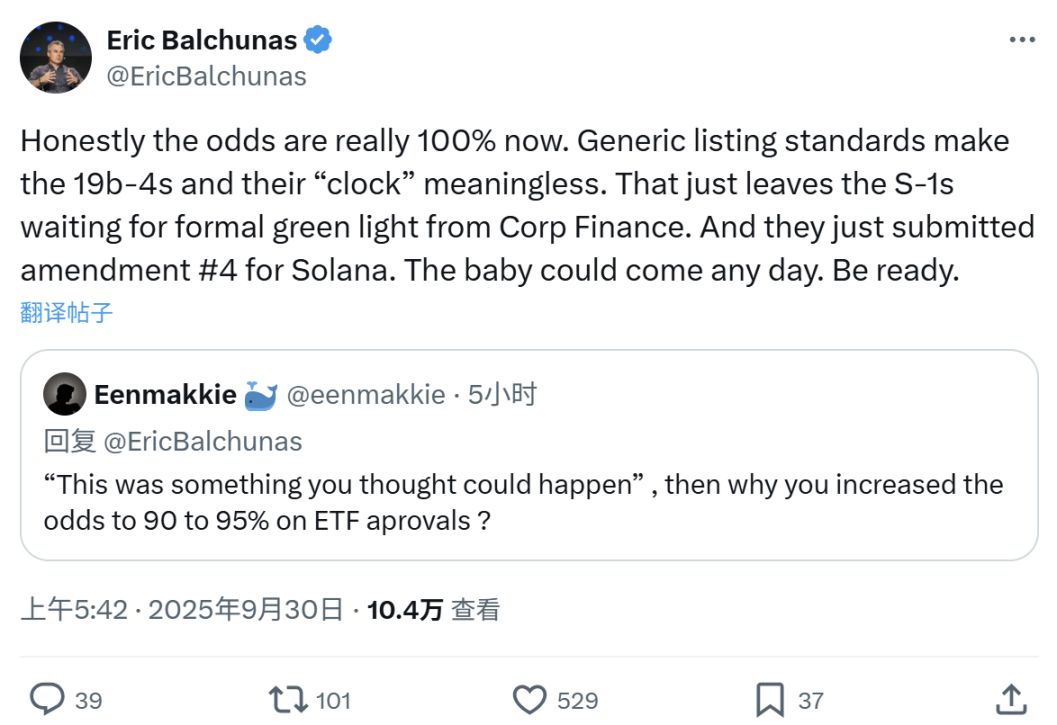

Regarding the SOL spot ETF, Bloomberg ETF analyst Eric Balchunas stated, “To be honest, the success rate for SOL spot ETF approval is now close to 100%. The universal listing standard has rendered the 19b-4 filings and their timelines meaningless. Now, only the S-1 form matters. The baby could be born at any time—be prepared.”

It is worth noting that ADA is the last token awaiting a decision at the end of October, and the probability of its ETF being approved on Polymarket has also risen to 93%.

The SEC’s decisions in early October will clearly set the tone for the market.

Previously, the SEC approved the Hashdex Crypto Index ETF. Recently, the Hashdex Nasdaq Crypto Index US ETF (NCIQ) added support for XRP, SOL, and XLM, enabling the product to provide U.S. investors with exposure to BTC, ETH, XRP, SOL, and XLM through a single investment tool.

Earlier, the SEC approved the conversion of the Bitwise 10 Crypto Index Fund into an ETF, covering assets including BTC, ETH, XRP, SOL, ADA, SUI, LINK, AVAX, LTC, and DOT.

Will Approval Benefit Token Prices?

Bitfinex analysts previously predicted that the approval of crypto ETFs could trigger a new round of altcoin season or rebound, as these approvals would provide traditional investors with more exposure to crypto investments.

However, some analysts do not agree with this view.

Bloomberg ETF analyst James Seyffart stated that the current market is seeing an altcoin rally driven by digital asset financial companies (DATCO) rather than traditional token price increases. Seyffart pointed out that institutional investors prefer multi-crypto portfolio products over single altcoin ETFs. He emphasized that institutional funds are more inclined to gain crypto exposure through regulated products rather than directly holding tokens, and this structural shift could permanently change the pattern of altcoin price surges.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Decoding VitaDAO: A Paradigm Revolution in Decentralized Science

Mars Morning News | ETH returns to $3,000, extreme fear sentiment has passed

The Federal Reserve's Beige Book shows little change in U.S. economic activity, with increasing divergence in the consumer market. JPMorgan predicts a Fed rate cut in December. Nasdaq has applied to increase the position limit for BlackRock's Bitcoin ETF options. ETH has returned to $3,000, signaling a recovery in market sentiment. Hyperliquid has sparked controversy due to a token symbol change. Binance faces a $1 billion terrorism-related lawsuit. Securitize has received EU approval to operate a tokenization trading system. The Tether CEO responded to S&P's credit rating downgrade. Large Bitcoin holders are increasing deposits to exchanges. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

The central bank sets a major tone on stablecoins for the first time—where will the market go next?

The People's Bank of China held a meeting to crack down on virtual currency trading and speculation, clearly defining stablecoins as a form of virtual currency with risks of illegal financial activities, and emphasized the continued prohibition of all virtual currency-related businesses.