SEC Suspends QMMM Holdings Trading Over Suspected Stock Manipulation

Contents

Toggle- Quick breakdown

- SEC flags social media-driven hype

- Regulators widen probe into Crypto treasuries

Quick breakdown

- SEC action: Trading in QMMM Holdings suspended for 10 days due to suspected manipulation.

- Social media hype: Promotions by “unknown persons” allegedly inflated stock value and volume.

- Wider scrutiny: SEC and FINRA probing multiple firms that pivoted to crypto treasuries.

The U.S. Securities and Exchange Commission (SEC) has temporarily halted trading of QMMM Holdings, a crypto treasury company, citing concerns over possible stock manipulation. The suspension, announced on Monday, will remain in effect for 10 trading days.

“The Commission temporarily suspended trading in the securities of QMMM because of potential manipulation,” the agency said in a notice on Monday.

SEC flags social media-driven hype

According to the SEC notice, the suspected manipulation came from “unknown persons” urging investors via social media to buy QMMM shares. The regulator stated that these recommendations appeared to be designed to artificially inflate both the price and trading volume of the stock.

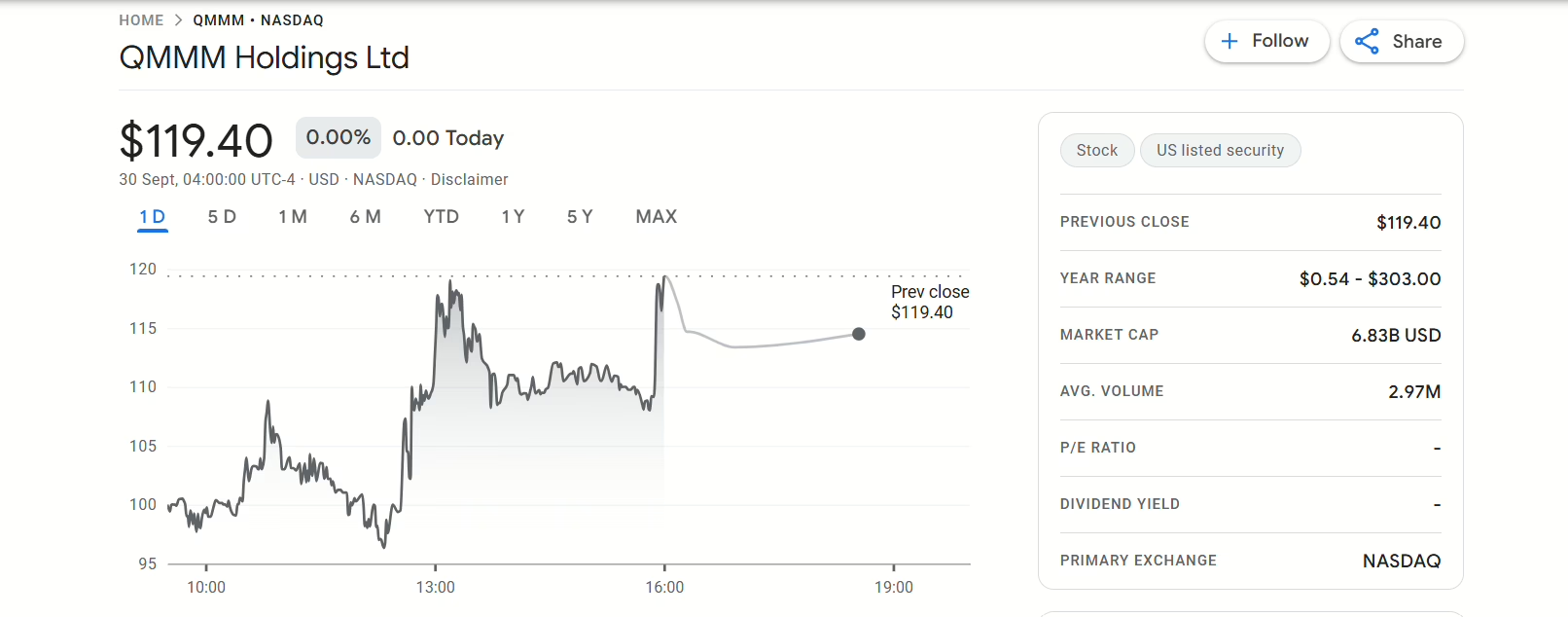

QMMM’s shares skyrocketed by more than 1,700% in the past month after the firm revealed plans to buy and hold Bitcoin, Ether, and Solana. The firm also said on September 9 that it will integrate artificial intelligence with blockchain to build a platform combining crypto analytics and a Web3 autonomous ecosystem. The firm also plans to establish a “diversified cryptocurrency treasury” focused on Bitcoin. That same day, its stock surged from $11 to a record $207, according to data from GoogleFinance.

Shares in QMMM over the past month saw significant gains on the announcement of its crypto plans.

Shares in QMMM over the past month saw significant gains on the announcement of its crypto plans.

Regulators widen probe into Crypto treasuries

The suspension comes days after The Wall Street Journal reported that the SEC and the Financial Industry Regulatory Authority (FINRA) contacted several firms involved in crypto treasury strategies. Regulators are examining unusual trading activity before companies publicly disclosed their cryptocurrency plans.

With over 200 firms joining the crypto treasury trend, analysts warn that the market could be overcrowded and at risk if company valuations become overly dependent on volatile crypto holdings.

Notably, the Financial Conduct Authority (FCA) has significantly streamlined its approval process for cryptocurrency firms in the United Kingdom, reducing the timeline from 17 months to roughly five months. This change signals a notable shift in the UK’s regulatory stance on cryptocurrencies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hong Kong stablecoins see their first batch of players exit the market

At least four Chinese-funded financial institutions and their branches, including Guotai Junan International, have withdrawn from applying for Hong Kong stablecoin licenses or have temporarily suspended related attempts in the RWA sector.

BlackRock Holds 3.8% of Bitcoin Amid Institutional Shift

Metaplanet Acquires 5,268 BTC for $615 Million

Trending news

MoreBitpush Daily News Selection: Forbes: Elon Musk becomes the first person in history with a net worth exceeding $500 billions; Strategy bought 42,706 bitcoins in Q3 this year, worth over $5 billions; Sui Group Holdings plans to cooperate with Ethena to launch two stablecoins

Hong Kong stablecoins see their first batch of players exit the market