What drives us to go all-in with full leverage on meme coins?

In the end, market makers gained wealth, while retail investors got excitement.

In the end, market makers won the wealth, while retail investors got the thrill.

Written by: Chilla

Translated by: AididiaoJP, Foresight News

The crypto market is changing rapidly. The idea of making easy money is overwhelming structured strategies. At first glance, this phenomenon seems simple, but in reality, it is much more complex and diverse.

This is not only the result of an ever-evolving ecosystem, but also involves sociological factors that may be crucial to understanding the direction of future narratives.

Intent Binding and Self-Control

Autonomy refers to seeing ourselves as the initiators of our own actions and their consequences. This is likely one of the main driving forces that push people into the world of trading, away from jobs where they simply follow others' instructions.

Ultimately, the goal is to achieve freedom and independence. By making our own decisions to achieve financial freedom, we no longer have to submit to the will of others.

Only a few things, such as entrepreneurship, allow for this. And if you think about it, trading is a kind of formulaic, structured activity with clear rules. Generally speaking, that's true. By pressing a series of buttons and maintaining an underlying strategy, you can extract value from the market.

With internet communication devices everywhere, the more immediate the feedback we get from each trade, the stronger our sense of control. This is where the concept of intent binding comes into play.

Through this process, the brain shortens the time gap between action and consequence, giving us the illusion that we are truly in control of the process.

So, what gives people a stronger sense of intent binding and self-control?

Shitcoins

When we can immediately see the consequences of our actions (whether the expected value is positive or negative), we feel like masters of our own fate, which is different from situations where results take a long time to manifest.

Although it may seem strange, structured trading requires time and effort, as well as longer-term thinking, which makes it even further from what the new generation of attention-seekers are interested in.

Attention spans are getting shorter. If results don't appear instantly, people have neither the desire nor the time to sit down and backtest the outcomes of their work.

The result? A trend toward things users can access immediately, such as shitcoins.

Since we've already experienced the dopamine rush after buying (or selling) a meme coin, why bother placing a limit order to provide liquidity to the order book and wait? Dopamine itself can bring a stronger sense of control, even if only on a subconscious level. In reality, however, the situation is often quite the opposite.

So it's no surprise that many traders prefer the frenzy of shitcoin trading—which offers fleeting value but a high sense of self-control—over more structured and slower strategies based on limit orders or mature assets.

But that's not all. This is a mix of multiple motivations, all pointing in the same direction. Neuroscience also tends to align with this trajectory.

The Neuroscience Behind Intent Binding

Don't marry your positions, right? Yes, we've heard KOLs say this so many times that we should have internalized it by now. But this bias is precisely due to the concept of embodiment.

Unlike mainstream tokens, which are seen as cold, distant, and institutionalized, having more direct—almost physical—contact with a "niche" coin that becomes a sense of belonging or identity leads the brain (even more than the wallet) to seek experiences that provide instant gratification and a stronger sense of self.

People would rather hold wif or certain shitcoins, feel like part of a movement, and gain an instant sense of "rightness" by aligning with others, than spend hours tediously perfecting their trading strategies. Buying a coin provides instant input and output: you act, you expect a reward, and you get immediate psychological satisfaction; waiting becomes boring.

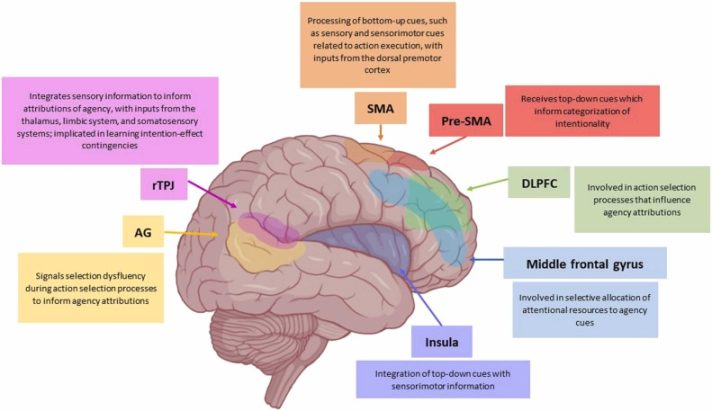

Image from "The sense of agency for brain disorders: A comprehensive review and proposed framework" by Rubina A. Malik, Carl Michael Galang, Elizabeth Finger

From a neuroscience perspective, this is closely related to how the brain encodes intent binding. The feeling of "I caused this outcome" involves the premotor cortex, supplementary motor area, and anterior insula, which integrate intention, action, and result. When the output is immediate, dopamine strengthens the connection between action and reward, making the experience more satisfying and "right."

Conversely, strategies with delayed results cannot activate these circuits in the same way, reducing the subjective sense of self-control and making the process boring or even "wrong."

This resonates with me deeply.

Conclusion

Yes, the narrative of perpetual decentralized exchanges is spreading now, but this does not negate the reasoning above. This is mainly a special case derived from market conditions, where you can get direct rewards by trading points. In fact, this further reinforces the argument of this article.

And what I'm talking about is not shitcoin trading itself, but a different way of trading, where the reward is the action itself, triggering a dopamine rush, rather than the pursuit of final monetary gain.

The sensory stimulation itself is the goal. Market makers win, users lose, but at least they participated. At least they had the illusion of choice, because the consequences followed immediately and were a direct response to their decisions.

This is more like going to a casino than building a strategy. However, it's not for me to judge. I myself am not immune—far from it.

But the resulting concept suggests that the fundamental idea of trading has undergone a complete transformation. In this transformation, intent binding plays an increasingly important role.

In reality, emotion dominates reason.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP & Cardano Price Outlook Hint at Breakouts, But BlockDAG Presale at $0.0013 Steals the Spotlight

Bitcoin Tops $113K While Ethereum Climbs Back Above $4,100

Institutional Ethereum holdings surge as firms expand ETH treasuries

Interview with Cathie Wood: Ark Invest's Three Main Directions—Bitcoin, Ethereum, and Solana Are the Final Choices

We are also keeping an eye on some emerging projects, such as Hyperliquid. This project is reminiscent of the early development stage of Solana.