Key Market Information Discrepancy on September 29th, a Must-See! | Alpha Morning Report

1.Top新闻:Hypurr NFT地板价升至1310 HYPE,约合6.15万美元 2.代币解锁:$OP

Featured News

1.US Stock Crypto Concept Stocks Soar in After-Hours Trading, Bitmine Surges Over 5%

2.NYDIG: Cryptocurrency Treasury Asset (DAT) Company Evaluation Metric mNAV Is Misleading

3.Hypurr NFT Floor Price Rises to 1310 HYPE, Equivalent to $61,500

4.ApeX Announces Launch of APEX Token Buyback Plan, Covering $12 Million Initial Funding and 50% of Future Protocol Revenue

5.Kalshi Lowers Probability of "US Government Shutdown This Year" Prediction to 63%

Articles & Threads

1. "In-Depth Analysis: PerpDEX Shuffling Moment, What's Next for Hyperliquid?"

The decentralized perpetual trading market is undergoing an unprecedented surge in growth and reshaping of the competitive landscape. As of September 2025, the global perp DEX daily trading volume has exceeded $520 billion, a 530% increase from the beginning of the year, with a cumulative monthly trading volume reaching $130 trillion. Behind this growth are breakthroughs in technological innovation, the growing demand for decentralized financial products from users, and regulatory pressure on centralized exchange platforms. The entire sector now holds approximately 26% market share of the crypto derivatives market, a significant leap from single digits in 2024.

Rapid market differentiation is reshaping the competitive landscape. Traditional order book models (such as dYdX, Hyperliquid) dominate the professional trading sector with precise price discovery and deep liquidity, while AMM models (such as GMX, Gains Network) attract retail users with instant liquidity and simplified operations. Emerging hybrid models (such as Jupiter Perps) attempt to combine the strengths of both by seamlessly switching between order book and AMM in a high-speed environment through a keeper system. In terms of data performance, the order book model is gaining more market share, with Hyperliquid handling $2.76 trillion in cumulative trading volume with its CLOB architecture.

2.《Unexpectedly, PunkStrategy Starts to Surge》

On the Ethereum mainnet, a coin named $PNKSTR has surged by about 160% in the past 2 days, with a market cap surpassing $50 million at one point, becoming a dazzling sight in the extremely dry on-chain market. Currently, the token has retraced slightly, with a market cap of around $43 million. The full name of $PNKSTR is "PunkStrategy," which completes the NFT and token loop flywheel through trading CryptoPunks NFT.

Each $PNKSTR transaction incurs a 10% fee, with 8% being deposited into the protocol. Once the protocol's fund pool accumulates enough to cover the cost of purchasing CryptoPunks, the contract will automatically buy a floor-priced CryptoPunks and automatically list it for sale at 1.2 times the purchase price. After a successful sale, the obtained ETH will be used to purchase and burn $PNKSTR tokens.

Market Data

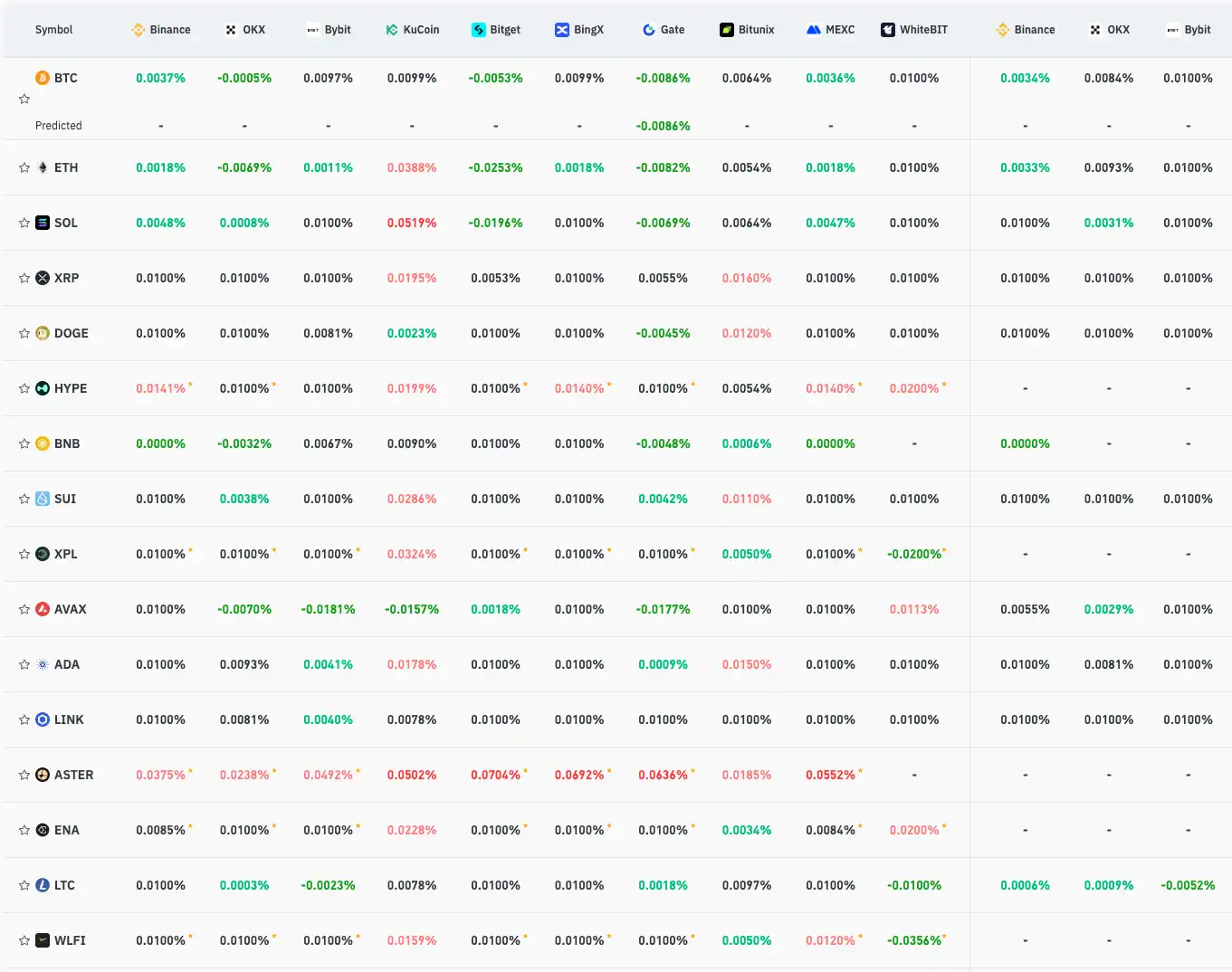

Daily Market Overall Capital Heat (Reflected by Funding Rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Token Unlocks

Funding Rate

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ZEC Value Rises 5.73% as Short Sellers Adjust Positions During Market Fluctuations

- ZEC surged 5.73% in 24 hours to $385.59, defying 9.19% weekly/monthly declines but rising 590.63% annually amid market turbulence. - "Calm Long King" trader increased ZEC short positions to $2.51M (10x leverage) with a $20K unrealized gain, contrasting losses in BTC and SOL shorts. - The trader's $17.29M ZEC short exposure reflects volatile market dynamics, with leveraged positions showing mixed gains/losses as crypto prices swing sharply. - ZEC's 24-hour rebound highlights risks for short sellers in a m

ZEC Rises 4.77% Amid Increased Short Positions and Market Rebound

- ZEC surged 4.77% in 24 hours to $386.31, with a 584.4% annual gain despite recent declines. - A prominent trader increased ZEC short positions to $17.29M, showing a $20k gain but larger losses in BTC and SOL. - Market recovery and short-position adjustments highlight ZEC’s volatility, with analysts warning of potential downward pressure if prices rise further.

ALGO Falls 1.01% While Investors Anticipate Crucial U.S. Inflation Report

- Algorand (ALGO) fell 1.01% in 24 hours to $0.1372, but rose 0.44% weekly/monthly amid market uncertainty. - Investors focus on U.S. inflation data and Fed policy, with Chair Powell signaling cautious rate-cut approach for 2026. - Earnings reports from Airbnb , Coca-Cola , and Coinbase will shape sector sentiment, while unrelated lawsuits impact PRGO and ALVO. - Global volatility in travel/aviation sectors and India's IndiGo disruptions highlight broader market risks unrelated to crypto.

BCH has increased by 32.06% over the past year as the market remains steady

- Bitcoin Cash (BCH) fell 0.19% in 24 hours but rose 32.06% annually, reflecting strong long-term demand and institutional interest. - Analysts highlight BCH's resilience amid stable trading ranges, driven by cross-border transactions and micropayments adoption. - Sustained 6.1% gains over 30 days and 7-day periods underscore BCH's role as a high-utility altcoin in diversified portfolios. - Market stability and growing mainstream recognition position BCH for continued performance amid broader crypto sustai