- Bitcoin has good momentum and record volume, indicating dominance, although overbought cycles point to near-term cooling.

- Solana has neutral RSI and a bullish strength, which makes it the most sustainable one to include in further growth.

- Chainlink is stalling in consolidation, as over sold RSI indicates the ability to recover but not momentum indicators.

The cryptocurrency markets of the world have shown positive trends today, with Bitcoin continuing to lead the pack, Solana recording a consistent uptrend, and Chainlink maintaining its position. The various prices rose on the board; this was indicative of general purchase interest and improved technical indicators. Nevertheless, the variation in momentum emphasizes the different strengths and risks of every digital asset.

Bitcoin has a great momentum.

Bitcoin rose to 110,862 and improved by 1.31 percent, which indicated that it was still strong in market leadership. The price was far above its 50 period moving average at $109,908, which indicates a lasting positive bias. Besides, the amount of trading increased to approximately 898 million which is a sign of a lot of trading within the session.

Source: Yahoofinance

Momentum indicators supported the move by having the MACD line displaying obvious positive divergence. Meanwhile, the Aroon indicator read a score of 100, which indicates an established upward trend. Nevertheless, the RSI increased to 84.43, which shows that bitcoin has become overbought.

Even though the trend is strongly positive, the technical indicators show a possibility of a slight cooling in the short-run. Overbought levels tend to cause short term pullbacks or consolidations. The net bias however is strongly bullish on the basis of volume and moving average support.

Solana Steadies in Balanced Position

Solana traded at $207.16, rising 2.27 percent as it maintained strong footing above its 50-period moving average at $202.22. The session showed sustained confidence with trading volume reaching over 1.18 million, confirming continued participation. Price movement aligned with steady buying interest, reinforcing Solana’s position.

Source: Yahoofinance

Technical measures indicated positive but balanced momentum compared to Bitcoin. The MACD showed a small positive spread, suggesting moderate upward strength without excessive signals. Likewise, the Aroon indicator at 85.71 confirmed trend strength, while the RSI at 49.27 suggested neutral positioning.

Overall, Solana presented a healthier short-term outlook compared to Bitcoin. Its RSI reading leaves room for further upside without immediate risk of overheating. The combination of strong trend indicators and neutral momentum makes Solana a stable candidate for sustained growth.

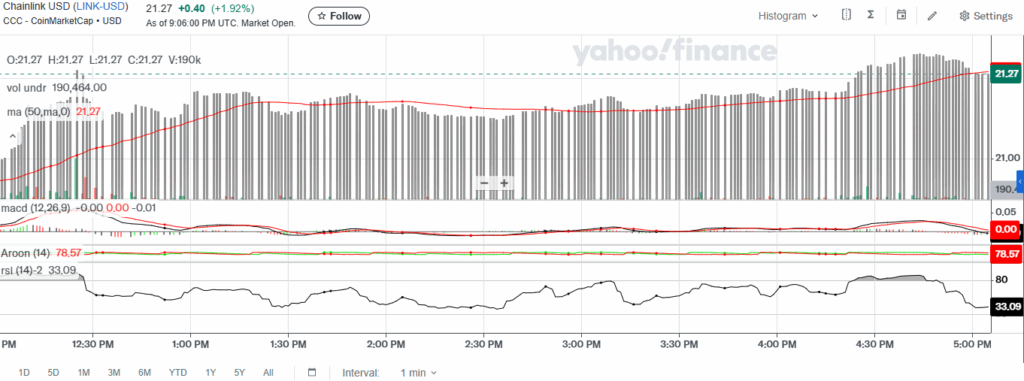

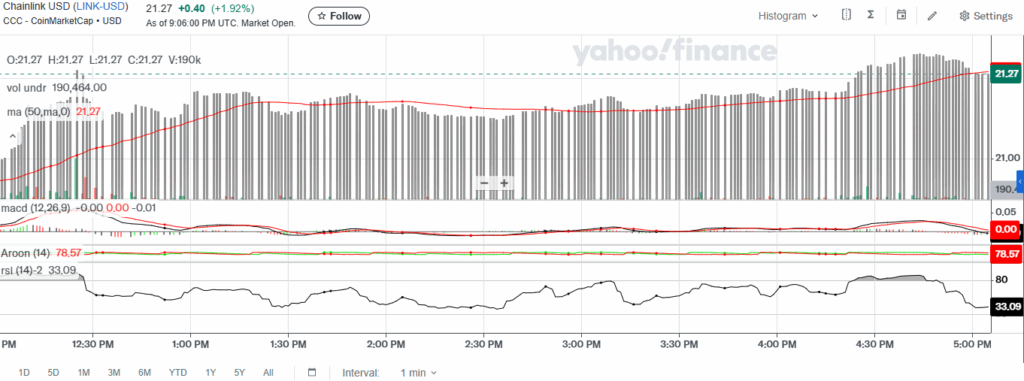

Chainlink Waits for Clear Breakout

Chainlink closed at $21.27 with a 1.92 percent increase, remaining close to its 50-period moving average of $21.27. Volume registered at nearly 190,000, showing participation but without clear breakout levels. The price action suggested consolidation with slight upward tilt into the close.

Source: Yahoofinance

Indicators reflected indecision, as the MACD hovered near the zero line, providing little confirmation of strong direction. At the same time, the Aroon indicator at 78.57 suggested a bullish undertone, but not maximum strength. However, RSI stood at 33.09, placing Chainlink near oversold territory.

The technical setup shows potential for rebound if momentum improves. RSI suggests buyers may step in once oversold levels trigger action. Still, without stronger MACD confirmation, Chainlink remains a waiting candidate for clearer market direction.

![[Bitpush Weekend Key News Review] Bloomberg: Tether's new round of financing includes investments from SoftBank and Cathie Wood; BNY Mellon and BNP Paribas have started testing Ethereum L2 on-chain messaging with SWIFT; Hong Kong's third batch of tokenized bonds may allow subscription via central bank digital currency.](https://img.bgstatic.com/multiLang/image/social/f41f7db2f1e91a55956b2eda58f5a3211759020661027.png)