Market conditions trigger major Ethereum sell-off

Ethereum’s price has retreated significantly, hitting its lowest point since early August. The cryptocurrency dropped to around $3,800, representing a 20% decline from its monthly high. This downward movement mirrors similar patterns seen across the broader cryptocurrency market, with Bitcoin and Ripple also experiencing substantial losses.

The sell-off appears to be driven by several factors working in combination. Market sentiment has turned cautious, and technical indicators are pointing toward continued pressure on prices.

Liquidations and institutional outflows intensify

One of the most concerning developments has been the surge in liquidations. Over the past week, nearly $1 billion in leveraged positions were liquidated across the cryptocurrency market. Monday alone saw bullish positions worth over $490 million get closed out as exchanges automatically terminated positions when collateral requirements weren’t met.

The liquidation pressure continued through the week, with another $413 million in positions closed on Friday. These forced sales create additional downward momentum as they essentially become automatic selling pressure in a declining market.

Institutional interest also appears to be waning. Spot Ethereum funds experienced significant outflows, shedding more than $547 million in assets. This represents a sharp reversal from the previous week when these same funds attracted $556 million in new investments. The outflows suggest that larger investors are becoming more cautious about Ethereum’s near-term prospects.

Economic concerns add to market pressure

External economic factors are also contributing to the bearish sentiment. Federal Reserve officials have been expressing concerns about inflation becoming more persistent if interest rates are cut too quickly. Comments from officials like Beth Hammack, John Williams, and Raphael Bostic have reminded investors that monetary policy might remain restrictive for longer than anticipated.

Political developments have added another layer of uncertainty. Former President Donald Trump’s announcement of potential new tariffs on various imported goods, including pharmaceuticals and furniture, has raised concerns about inflationary pressures. When investors worry about inflation, they often become more risk-averse, which typically hurts speculative assets like cryptocurrencies.

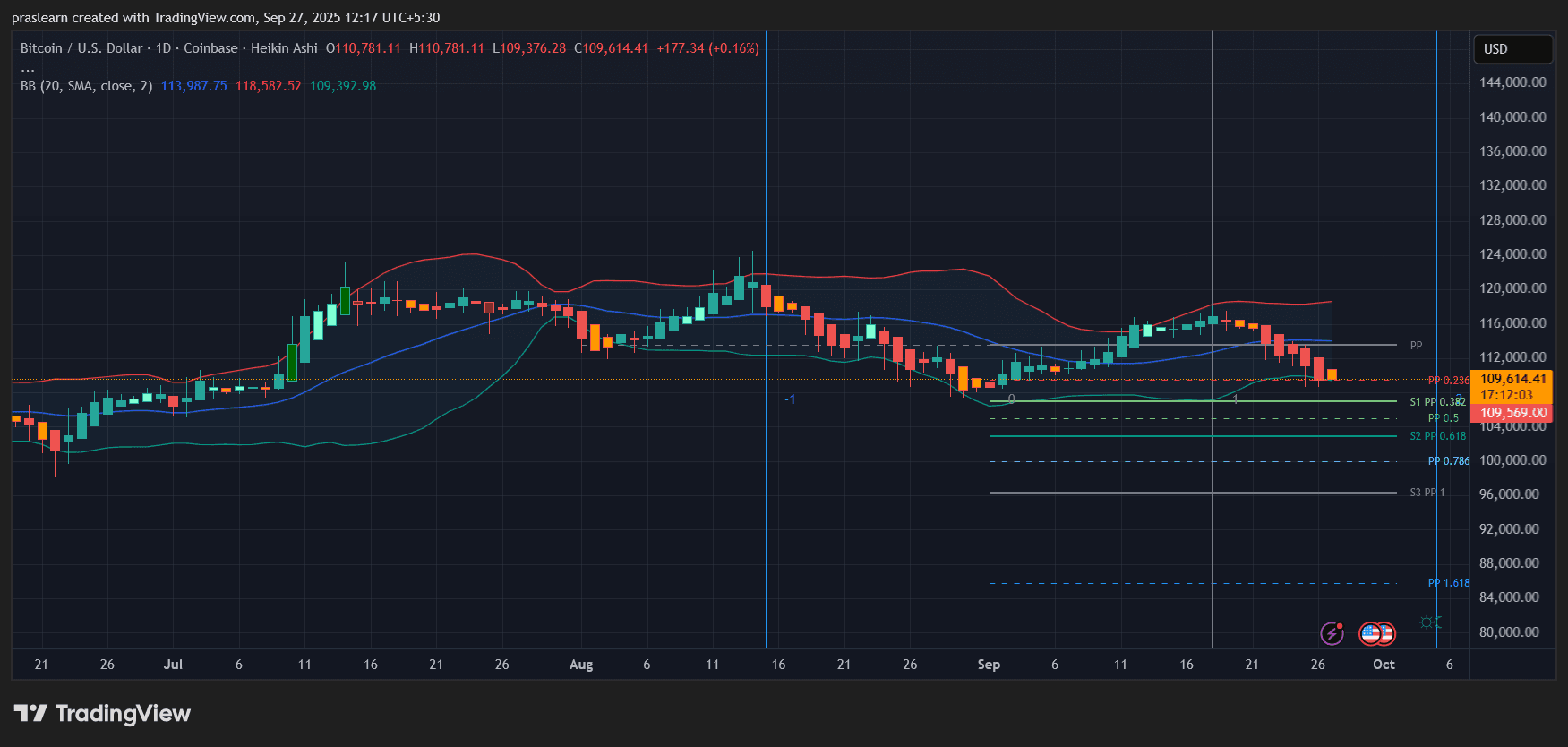

Technical analysis points to further downside

From a technical perspective, Ethereum’s chart shows some concerning patterns. The price has broken below both the 23.6% Fibonacci retracement level and the 50-day exponential moving average. These are typically considered important support levels, and their breach suggests weakening momentum.

Perhaps more significantly, the chart appears to be forming what technical analysts call a triple-top pattern. This pattern suggests that Ethereum tried and failed three times to break through resistance around the $4,978 level. The pattern’s neckline sits at the 23.6% retracement level, and measuring the distance from the triple-top point to this neckline suggests potential for further decline.

If this pattern plays out completely, it could point toward a drop to around $3,300, which would represent about a 16% decline from current levels. This price target also coincides with the 50% Fibonacci retracement level, making it a technically significant area.

Of course, technical patterns don’t always play out as expected. For the bearish scenario to be invalidated, Ethereum would need to reclaim the $4,400 level convincingly. That would suggest that buying pressure has returned and the downward momentum has been broken.

Despite the current bearish sentiment, there are some potential positive catalysts on the horizon. The possibility of Vanguard entering the cryptocurrency space could bring significant institutional interest. Additionally, upcoming network upgrades and the gradual acceptance of cryptocurrency investments by retirement funds could provide longer-term support.

Market conditions remain fluid, and cryptocurrency prices are notoriously volatile. While the current technical picture looks challenging for Ethereum, sentiment can shift quickly in this space. The coming weeks will be crucial in determining whether this is a temporary correction or the beginning of a more sustained downturn.