Trader Says Bitcoin Could Crash by Double Digits, Outlines Path Forward for Ethereum and XRP

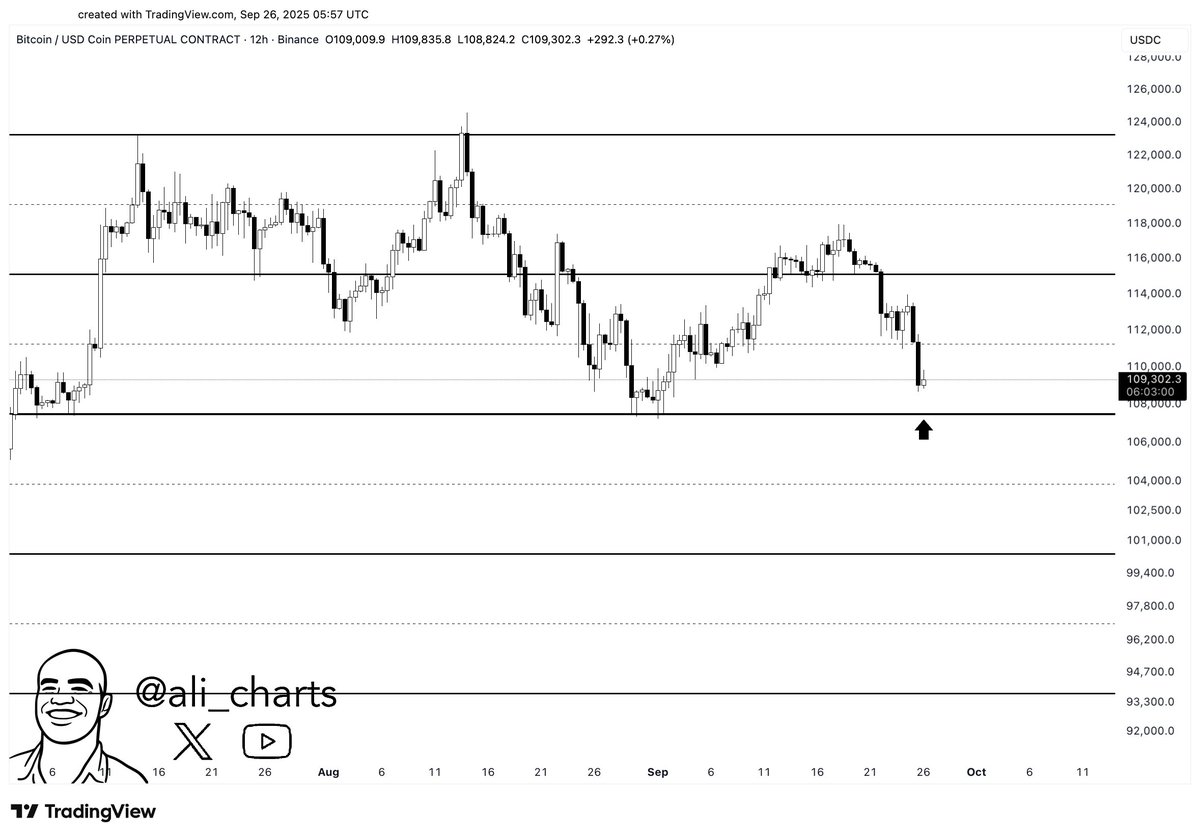

Cryptocurrency analyst and trader Ali Martinez is warning of a massive Bitcoin crash if BTC fails to hold one key level as support amid this week’s market decline.

Martinez tells his 158,100 followers on X that Bitcoin may decrease more than 14% from its current value if the flagship crypto asset fails to hold $107,200 as support.

“$107,200 is the crucial support for Bitcoin. Lose it, and $100,000 or even $93,000 come into play.”

Source: Ali Martinez/X

Source: Ali Martinez/X

Bitcoin is trading for $109,020 at time of writing, down 2% in the last 24 hours.

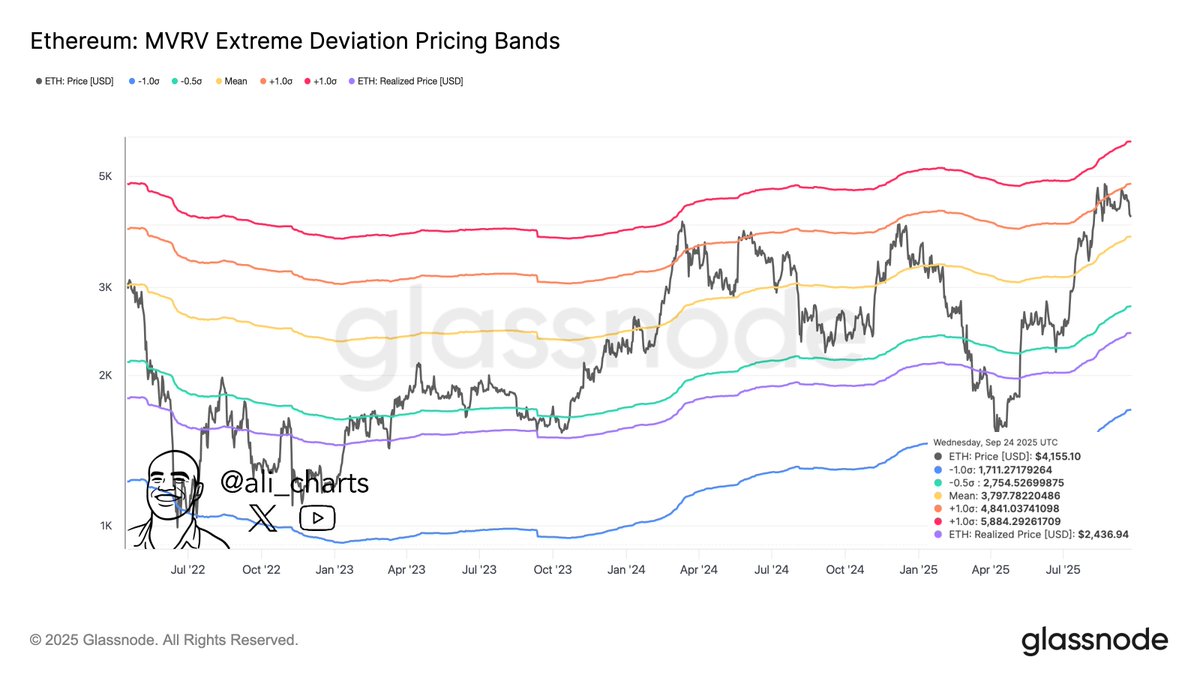

Next up, the analyst says that based on the MVRV (Market Value to Realized Value) Extreme Deviation Pricing Bands, if Ethereum holds $4,841 as a support level ETH may soon hit a new all-time high.

The MVRV Extreme Deviation Pricing Bands are used in on-chain analysis to identify potential market tops and bottoms.

“Ethereum must break $4,841 to reverse the downtrend and aim for $5,864. Fail, and a correction to $2,750 comes into play.”

Source: Ali Martinez/X

Source: Ali Martinez/X

ETH is trading for $3,953 at time of writing, down 1.2% in the last 24 hours.

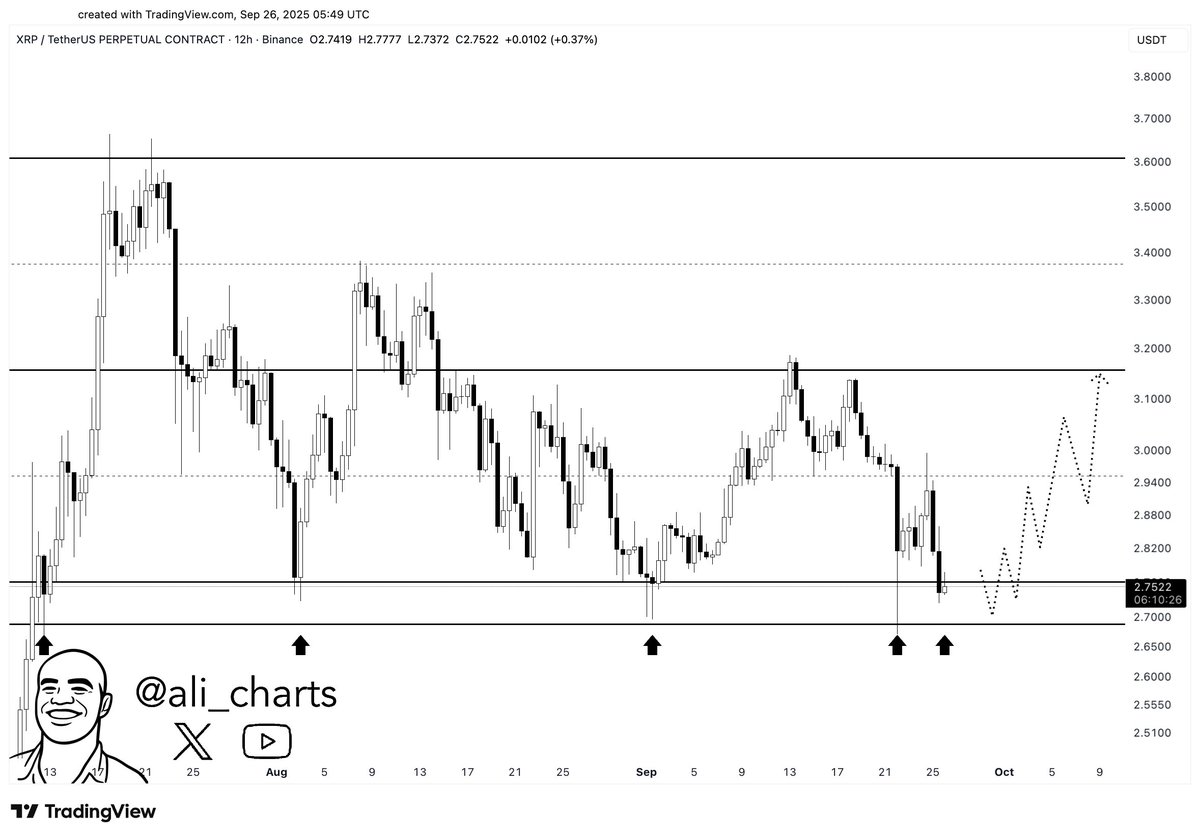

Looking at XRP , the analyst says that the payments token must hold $2.70 as support to potentially regain bullish momentum in the near term.

“XRP must hold $2.70 support to keep the chance of a rebound to $3.20 alive!”

Source: Ali Martinez/X

Source: Ali Martinez/X

XRP is trading for $2.74 at time of writing, down 3.2% on the day.

Featured Image: Shutterstock/IgorZh

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hyperliquid News Today: ZEC Surges 25%, Triggering $17 Million in Liquidations and Underscoring Crypto Market Volatility

- A top trader lost $3.28M as Zcash's 25% surge triggered massive short liquidations in 12 hours. - Hyperliquid faced $4.9M losses from a Popcat meme coin trade, with a trader using $3M to open $20M leveraged positions. - Crypto markets show heightened volatility, with cascading liquidations exposing DeFi platforms' risk management gaps. - Regulators scrutinize leveraged trading risks as HYPE token demand declines and futures open interest drops to $1.56B.

Zcash News Today: Zcash's Enhanced Privacy Features Ignite Debate Between Crypto Privacy and Transparency

- Zcash (ZEC) surged 1,500% since October, driven by institutional interest and Winklevoss's rebranding of Leap Therapeutics into a Zcash treasury vehicle. - The Winklevoss-backed Cypherpunk Technologies now holds 1.25% of ZEC supply, positioning Zcash as "encrypted Bitcoin" amid privacy vs. transparency debates. - Zcash's technical indicators show bullish momentum, with shielded transactions and Project Tachyon addressing scalability while facing Bitcoin maximalist criticism. - Market capitalization surpa

Bitcoin Latest Updates: Institutional Trust Fuels the Synergy Between Bitcoin and Tech Stocks

- Institutional investors like Harvard and Wall Street giants increasingly link Bitcoin and tech stocks, boosting both asset classes through diversified portfolios. - Harvard tripled its BlackRock Bitcoin ETF stake while expanding tech holdings, reflecting growing institutional confidence in crypto and growth equities. - Bitcoin ETFs face volatility amid market jitters, yet top investors remain bullish on tech and AI-driven innovation's long-term returns. - Macroeconomic factors like Trump's affordability

Ethereum Updates: ETF Outflows Trigger Market Decline While Major Holders Increase Their Positions

- Ethereum's price fell below $3,200 amid failed rebounds and massive ETF outflows, intensifying selling pressure as macroeconomic uncertainties drive institutional rotation into safe-haven assets. - Whale accumulation of 460,000 ETH ($1.6B) contrasts with mega-whale liquidations, while technical indicators show fragile support at $3,050 and bearish momentum below $3,280. - BitMine's 3.5M ETH ($12.7B) treasury acquisition highlights institutional interest, though ETF redemptions and a broken $3,653 resista