Bitcoin Bottomed Out the Last Seven Times This Signal Flashed, Says Analytics Platform – Here’s the Outlook

New data from the crypto intelligence platform Swissblock reveals that Bitcoin ( BTC ) and altcoins are on the cusp of a reset phase that should have them seeing green.

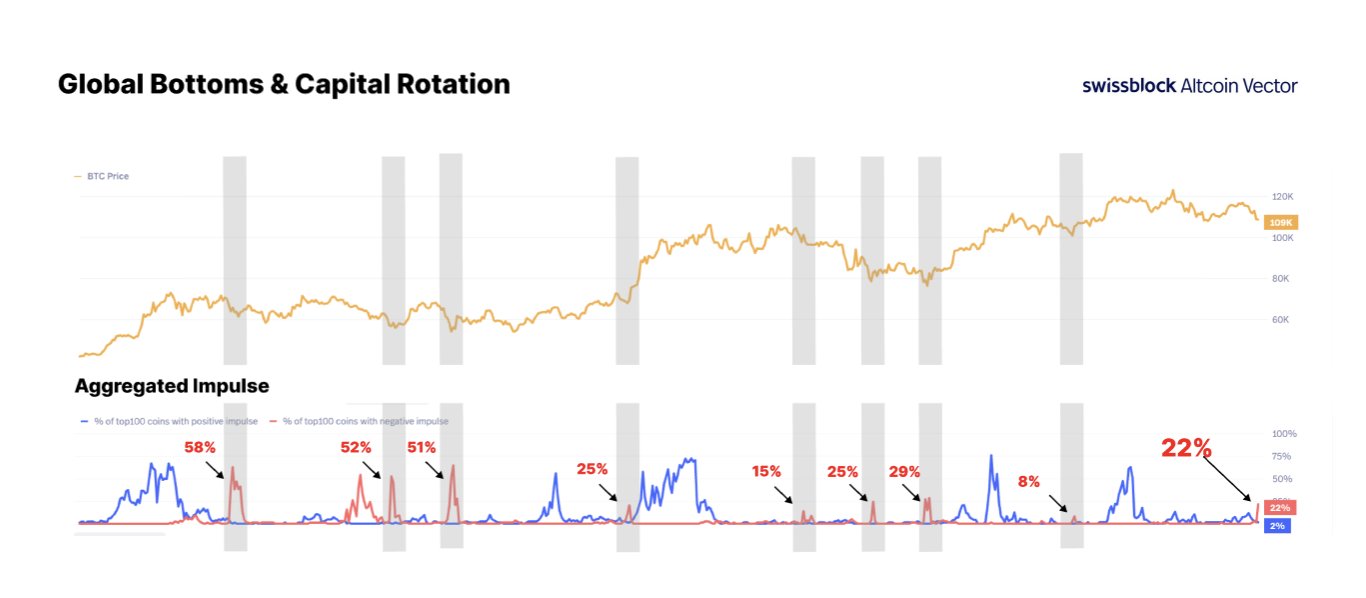

In a new thread on X, Swissblock says the aggregated impulse technical indicator – or the measurement of the exponential price structure of the top 350 digital assets – shows that most assets are about to bottom out and reset.

“We’re in the reset phase. The last 7 times this signal triggered since 2024, it marked a major bottom. What happened next? BTC rallied +20-30%. Altcoins surged +50-150%.

We track this with the most accurate tops and bottoms signal in the market: Aggregated Impulse, by Altcoin Investor, It measures exponential price structure across the top 350 assets.”

Swissblock says the indicator shows 22% of altcoins are at a negative impulse, with bottoms usually forming when 15-25% of them are displaying a negative impulse. According to the crypto analytics platform, Ethereum ( ETH ) and alts tend to rise after the reset completes.

“What’s it telling us now? 22% of altcoins show negative impulse. Historically, bottoms form in the 15-25% zone. Once the reset completes, ETH and alts tend to lead the next rotation.”

Source: Swissblock/X

Source: Swissblock/X

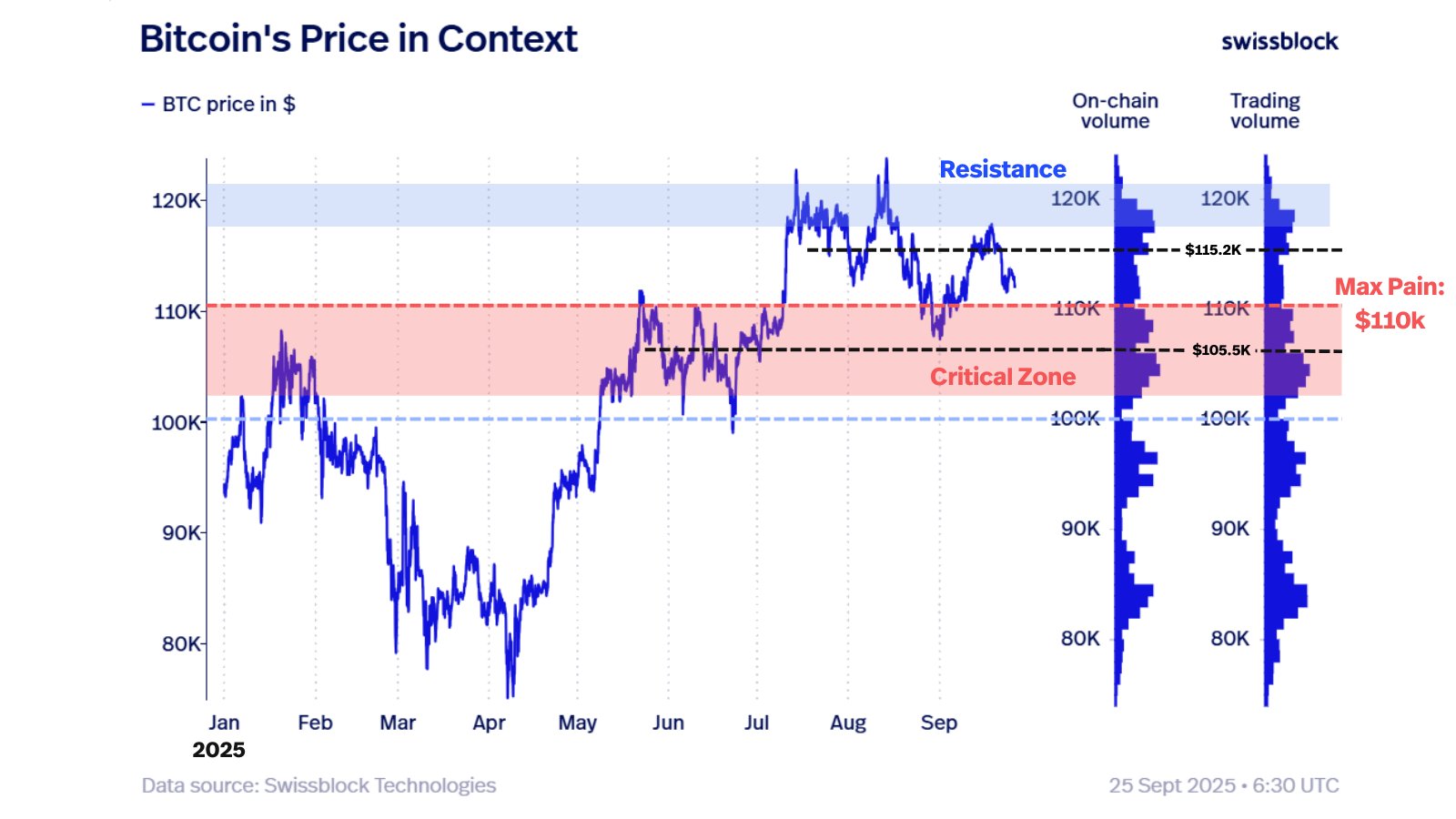

Concluding its analytics with the crypto king, Swissblock says that a retest of the $110,000 area appears imminent and if it were to fail, it could be feeling “max pain.”

“Bitcoin lost $113,000 and hovers under $112,000: a retest of $110,000 looks imminent. BTC sits in a delicate balance: Above $115,200 ? opens $120,000. Below $110,000 ? exposes $105,500-$100,000. $110,000 = max pain. Likely to be touched, leaving Friday’s options worthless.”

Source: Swissblock/X

Source: Swissblock/X

Bitcoin is trading for $109,053 at time of writing while Ethereum is valued at $3,948.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hyperliquid News Today: ZEC Surges 25%, Triggering $17 Million in Liquidations and Underscoring Crypto Market Volatility

- A top trader lost $3.28M as Zcash's 25% surge triggered massive short liquidations in 12 hours. - Hyperliquid faced $4.9M losses from a Popcat meme coin trade, with a trader using $3M to open $20M leveraged positions. - Crypto markets show heightened volatility, with cascading liquidations exposing DeFi platforms' risk management gaps. - Regulators scrutinize leveraged trading risks as HYPE token demand declines and futures open interest drops to $1.56B.

Zcash News Today: Zcash's Enhanced Privacy Features Ignite Debate Between Crypto Privacy and Transparency

- Zcash (ZEC) surged 1,500% since October, driven by institutional interest and Winklevoss's rebranding of Leap Therapeutics into a Zcash treasury vehicle. - The Winklevoss-backed Cypherpunk Technologies now holds 1.25% of ZEC supply, positioning Zcash as "encrypted Bitcoin" amid privacy vs. transparency debates. - Zcash's technical indicators show bullish momentum, with shielded transactions and Project Tachyon addressing scalability while facing Bitcoin maximalist criticism. - Market capitalization surpa

Bitcoin Latest Updates: Institutional Trust Fuels the Synergy Between Bitcoin and Tech Stocks

- Institutional investors like Harvard and Wall Street giants increasingly link Bitcoin and tech stocks, boosting both asset classes through diversified portfolios. - Harvard tripled its BlackRock Bitcoin ETF stake while expanding tech holdings, reflecting growing institutional confidence in crypto and growth equities. - Bitcoin ETFs face volatility amid market jitters, yet top investors remain bullish on tech and AI-driven innovation's long-term returns. - Macroeconomic factors like Trump's affordability

Ethereum Updates: ETF Outflows Trigger Market Decline While Major Holders Increase Their Positions

- Ethereum's price fell below $3,200 amid failed rebounds and massive ETF outflows, intensifying selling pressure as macroeconomic uncertainties drive institutional rotation into safe-haven assets. - Whale accumulation of 460,000 ETH ($1.6B) contrasts with mega-whale liquidations, while technical indicators show fragile support at $3,050 and bearish momentum below $3,280. - BitMine's 3.5M ETH ($12.7B) treasury acquisition highlights institutional interest, though ETF redemptions and a broken $3,653 resista