US Revises Q2 GDP Growth to 3.8%

- US GDP growth revised to 3.8%.

- Increased consumer spending and investment.

- US economy sees strongest performance since 2023.

The US Department of Commerce revised Q2 2025 GDP growth up to 3.8%, a notable increase driven by consumer spending and fixed investment, marking the strongest rate since Q3 2023.

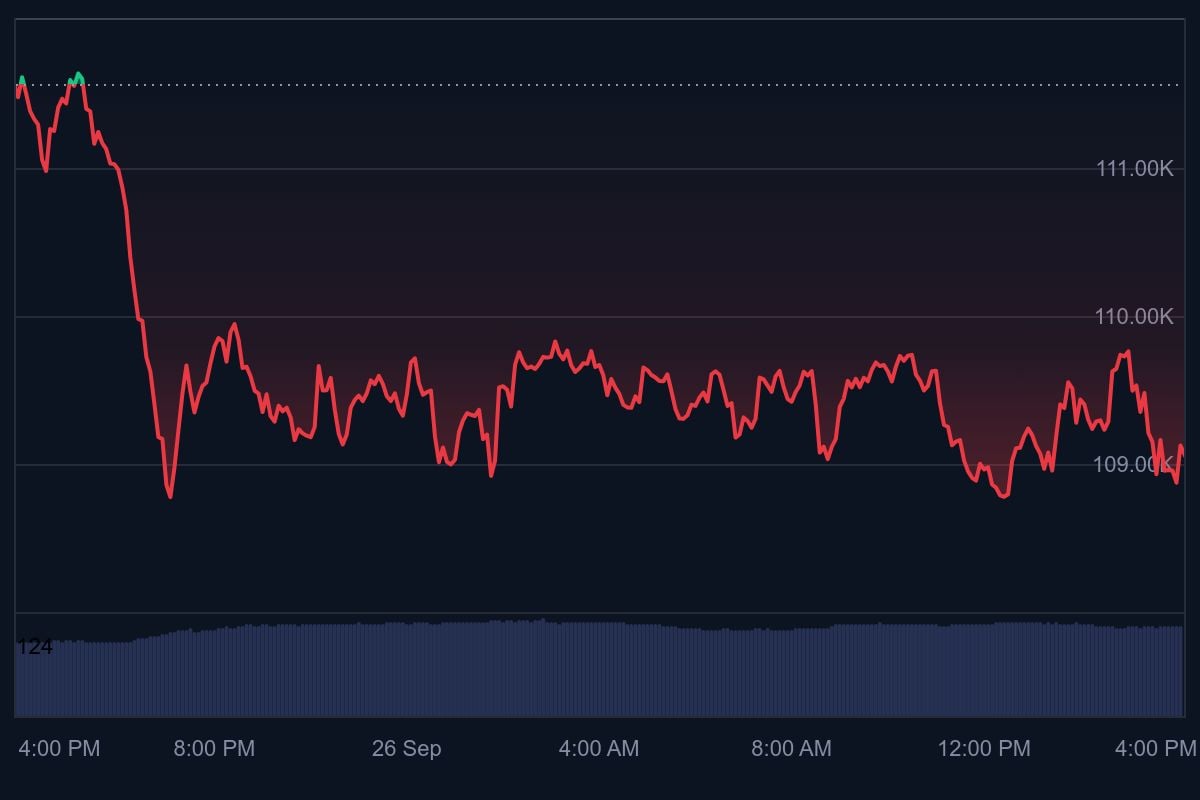

This revision impacts major cryptocurrencies like BTC and ETH, potentially altering investor risk perceptions and influencing institutional and retail fund flows.

Section 1

The US Department of Commerce revised its Q2 2025 GDP growth estimate upward to 3.8% from the previously reported 3.3%. This positive adjustment highlights notable economic strength, primarily driven by increased consumer spending and nonresidential fixed investment.

The Bureau of Economic Analysis (BEA) led the revision announcement, emphasizing consumer spending and investment as key contributors. This change reflects the most robust economic performance since Q3 2023, according to their official release.

Section 2

Such GDP revisions can impact the cryptocurrency sector by affecting risk perceptions and potential fund allocations. No direct shifts in funding or grants have been noted specific to this GDP change within the crypto sector as of yet.

The market impact is notable for cryptocurrencies like BTC and ETH, which may experience enhanced inflows during such economic enhancements. Institutional investors often evaluate these macroeconomic signals for potential adjustments to their investment strategies.

“The upward revision to real GDP primarily reflected an upward revision to consumer spending and nonresidential fixed investment,” said Brian B. McCarthy, Chief Economist, US Department of Commerce, Bureau of Economic Analysis.

Section 3

While direct regulatory responses or official statements from US agencies have not emerged, economic upgrades like this can subtly influence policy and institutional strategies. However, precise on-chain data related to this GDP change is yet to be confirmed.

Historical patterns suggest a potential increase in DeFi activities, driven by institutional risk-taking. Past GDP upgrades have led to growing on-chain metrics, such as TVL and trading volumes within major cryptocurrencies, illustrating a response to improved economic sentiment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dubai Royal-Backed Fund MGX Buys 15% of TikTok U.S. Business in Major Stake Deal: Report

Bitcoin Might Lose $100,000 Level If This Happens

Fear dominates market as BTC, ETH struggle for support