XRP ETF optimism can spark short-term gains but does not guarantee a sustained rally; lasting upside requires stronger on-chain growth, rising daily active addresses, and expanding Open Interest to confirm renewed investor demand.

-

XRP ETF optimism may trigger short-term price relief but lacks structural support for sustained rallies.

-

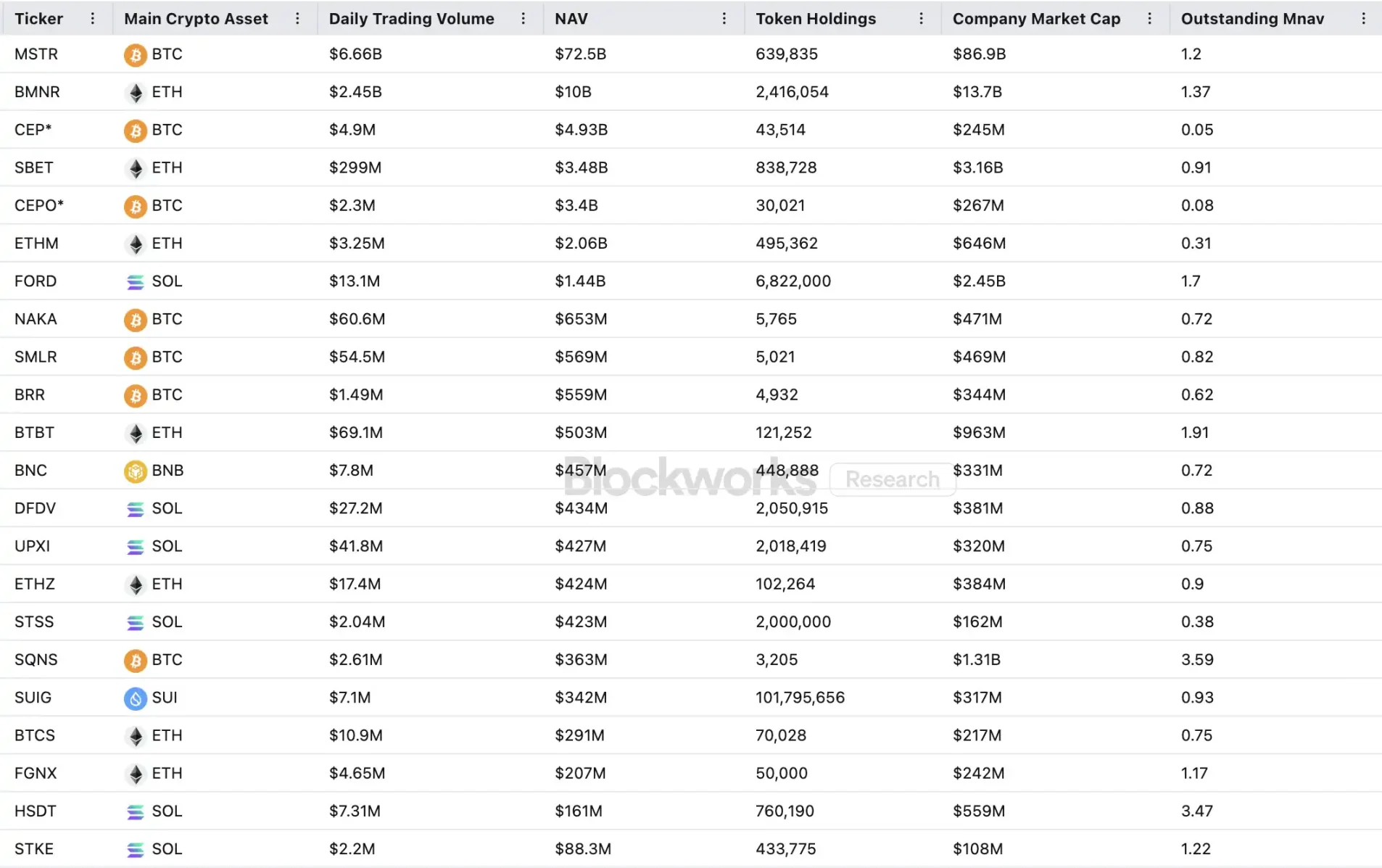

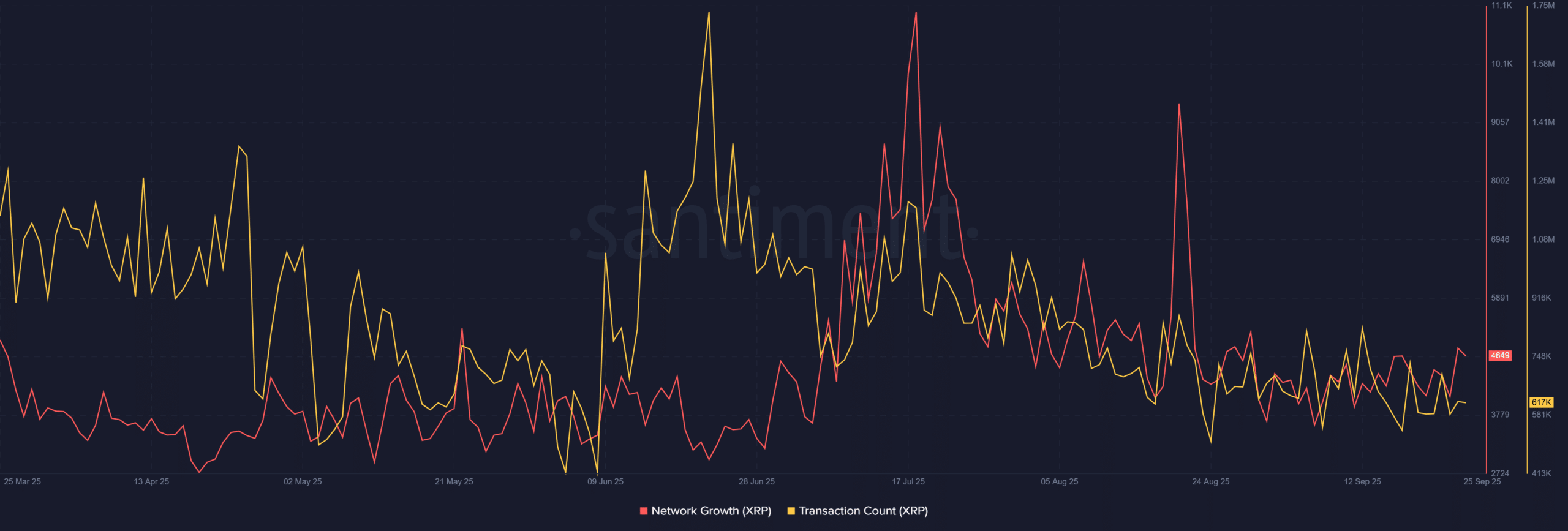

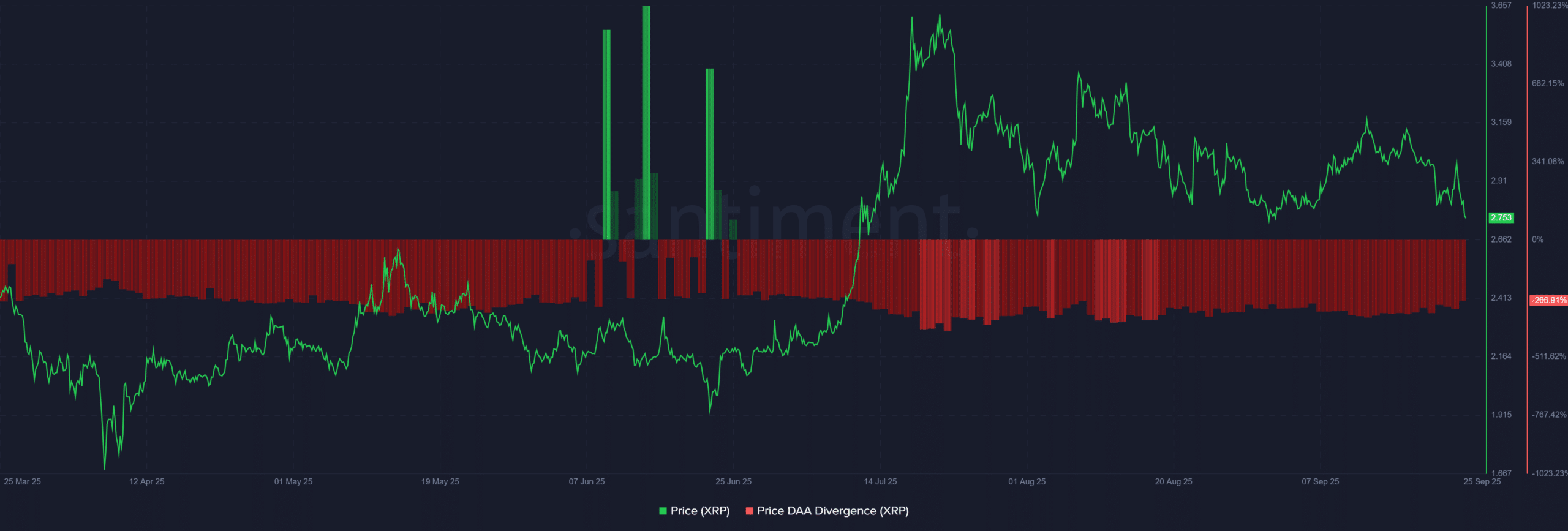

On-chain metrics — network growth, daily active addresses, and transaction volume — remain subdued and diverging from price action.

-

Derivative signals show falling Open Interest ($7.33B, down 3.34%), indicating cautious traders and weaker speculative backing.

Meta description: XRP ETF optimism may spark short-term gains but needs stronger on-chain growth and rising OI to sustain momentum — read COINOTAG analysis now.

Does XRP’s ETF optimism guarantee a sustained rally?

XRP ETF optimism can catalyze short-term rallies, but it does not guarantee sustained gains. Persistent seller dominance, weak network growth and negative daily active address (DAA) divergence show the market lacks the structural demand needed for long-term momentum.

How do on-chain metrics affect XRP’s ETF-driven price action?

On-chain metrics provide direct visibility into user engagement and adoption. XRP’s network growth near 4,849 and transaction counts around 617K are low relative to previous rally-supporting periods.

When price moves without accompanying growth in addresses and transactions, rallies often prove short-lived. Santiment and CoinGlass data highlight this divergence.

What do Open Interest and derivatives data reveal?

Open Interest in XRP derivatives recently slid by 3.34% to $7.33 billion. Falling OI typically signals traders cutting exposure and reduced leverage supporting the market.

Historically, meaningful uptrends in XRP have coincided with rising OI. The current decline points to fading speculative conviction even as ETF narratives build.

Is declining address activity warning of deeper cracks?

Daily Active Addresses (DAA) divergence is a key warning. Price appreciation amid falling DAA implies weaker organic participation.

Negative DAA divergence suggests retail and on-chain users are not matching market enthusiasm, increasing the risk that ETF-driven rallies will lack lasting fundamentals.

Source: Santiment

How significant was the ETF debut volume?

The REX-Osprey XRPR ETF recorded approximately $37.7 million in trading volume on launch day, ranking among the larger ETF debuts this year. Franklin Templeton’s related filing was extended into November, keeping regulatory timelines in focus.

Initial ETF flows matter, but sustained institutional inflows and on-chain adoption ultimately determine long-term price trajectories.

Can ETF optimism offset on-chain weakness?

ETF approval can provide temporary relief or spikes in price. However, without renewed network growth, rising DAA and expanding Open Interest, ETF-driven moves risk fading quickly.

COINOTAG analysis: “ETF catalysts are useful, but sustainable rallies require alignment between investor demand and fundamental on-chain activity,” says a COINOTAG market analyst.

Source: Santiment

Frequently Asked Questions

Will spot ETF approval automatically push XRP to new highs?

No. Spot ETF approval can drive price spikes but does not automatically produce new highs without parallel on-chain growth, higher DAA and increased derivative Open Interest to validate demand.

How should traders use on-chain data to manage risk?

Traders should monitor DAA, network growth, transaction volume and Open Interest. Declines in these metrics amid rising prices suggest heightened risk of pullbacks; align position sizing with confirmed on-chain support.

Key Takeaways

- XRP ETF optimism: May create short-term upside but is insufficient alone for sustainable rallies.

- On-chain weakness: Low network growth (~4,849) and subdued transactions (~617K) limit organic demand.

- Derivatives caution: Falling Open Interest ($7.33B, -3.34%) signals reduced speculative conviction—monitor for rebound before assuming strength.

Conclusion

ETF developments provide a bullish narrative for XRP, but current on-chain metrics and derivatives activity do not yet confirm a durable trend. XRP ETF optimism may translate into temporary gains, yet lasting upside requires clear improvements in network growth, daily active addresses and Open Interest. COINOTAG will continue to monitor Santiment and CoinGlass indicators and update this analysis as new data arrives.