Ethereum accumulation has surged as long-term holders added over 1.6M ETH in recent days while Open Interest reset wiped more than $5B in leverage, creating a cleaner market that could support a steadier ETH recovery if macro and on-chain flows remain supportive.

-

Long-term holders added ~1.6M+ ETH across mid- and late-September.

-

Derivatives Open Interest (OI) saw a ~ $5B+ wipeout across major venues.

-

On-chain conviction and lower leverage may enable a healthier ETH price reset.

Ethereum accumulation surges as long-term holders add 1.6M+ ETH while an Open Interest reset wipes $5B of leverage — read the data-driven outlook for ETH price action.

What is Ethereum accumulation right now?

Ethereum accumulation refers to sustained net inflows into wallets that hold ETH long term. Data shows long-term holders and accumulator addresses added roughly 1.6 million ETH across September, signaling increased conviction even as derivatives markets deleveraged.

How did long-term holders and accumulators behave in September?

On September 18, accumulator addresses recorded a record inflow of ~1.2 million ETH, per on-chain monitoring data. Another ~400,000 ETH were added on September 25, indicating repeated large buys by wallets that historically retain assets rather than sell.

These flows align with institutional and retail interest in ETH exposure, and suggest some participants are positioning for sustained exposure rather than short-term trading.

Source: CryptoQuant (plain text)

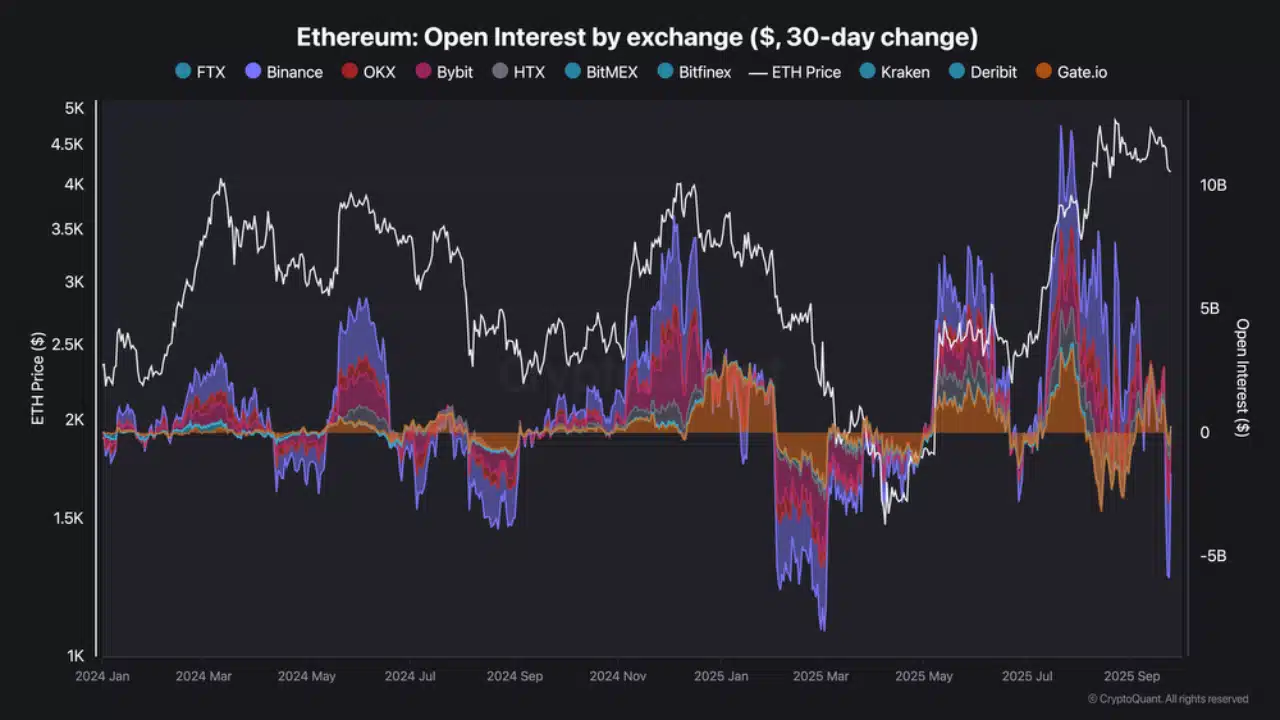

Why did Open Interest reset matter for ETH?

Open Interest (OI) reset removes excess leveraged positions, reducing the risk of forced liquidations that can amplify volatility. Between September 23–24, major venues saw multi-billion-dollar OI declines, with Binance alone losing over $3B on the 23rd and another ~$1B the following day.

Bybit and OKX recorded losses of approximately $1.2B and $580M, respectively. The net effect: roughly $5B+ of leverage pulled from the market, leaving a cleaner price structure.

How does the OI reset change short-term ETH risk/reward?

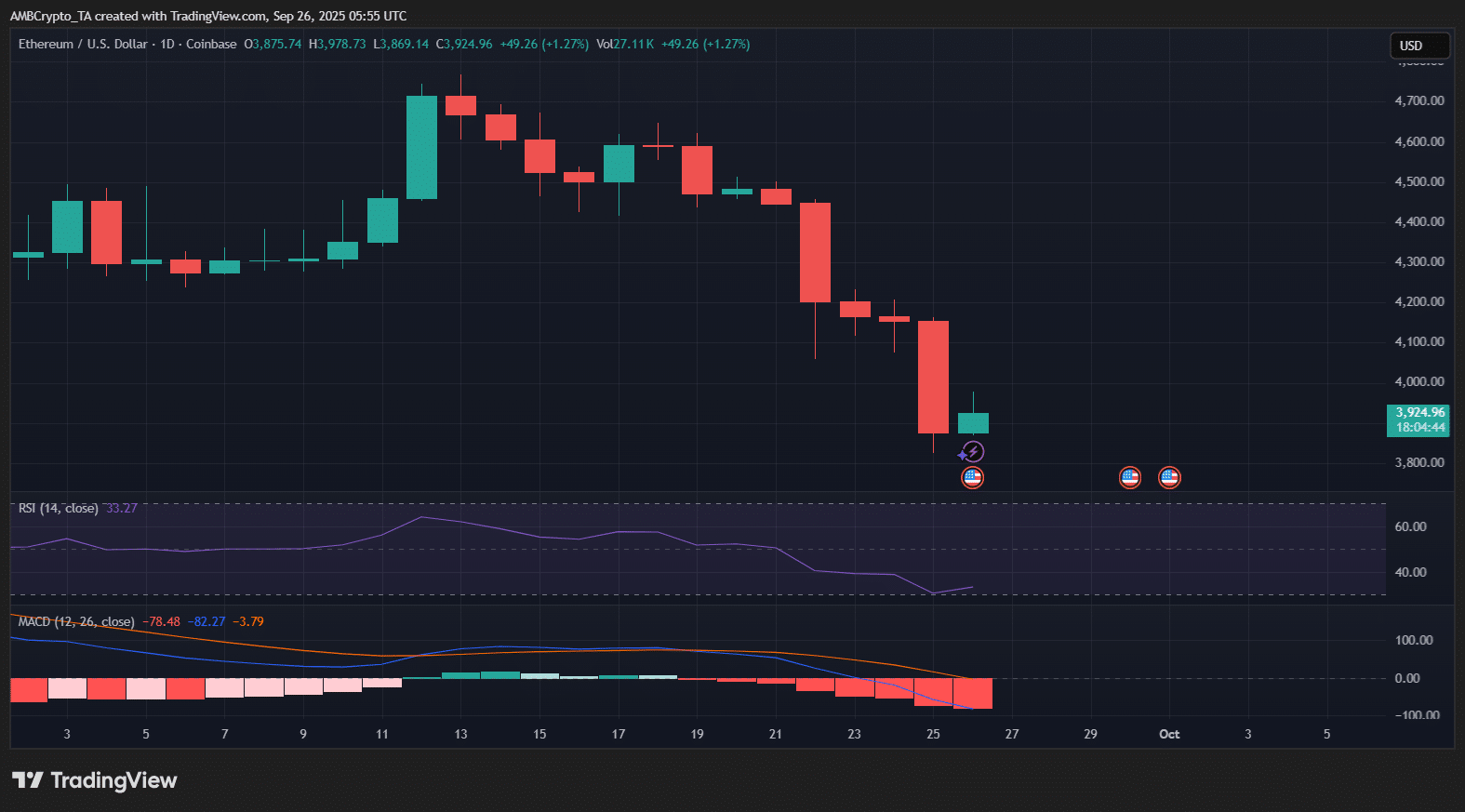

With leverage flushed out, downside cascade risk falls and price moves may become more driven by on-chain flows and spot demand. Technical indicators (RSI ~33, MACD flattening) point to oversold conditions that could allow a measured rebound if buying pressure continues.

What’s next for ETH?

With long-term holders accumulating and derivatives deleveraging, ETH sits at a pivotal juncture. After sliding below $4,000, price recently showed a green candle and traded near $3,925 at press time.

Watch these short-term signals:

- On-chain inflows/outflows: continued net accumulation by LTHs supports a bullish base.

- Derivatives positioning: subdued OI reduces liquidation risk and limits violent moves.

- Technical setup: an RSI below 35 signals oversold conditions; a sustained MACD turn positive would confirm momentum shift.

Source: CryptoQuant (plain text)

Source: TradingView (plain text)

Frequently Asked Questions

How much ETH did long-term holders accumulate in September?

Long-term holders and accumulator wallets added roughly 1.6 million ETH across September, with ~1.2M on September 18 and ~400K on September 25, according to on-chain monitoring data.

What does an Open Interest reset mean for ETH price action?

An OI reset removes excessive leverage, lowering forced-liquidation risk and often leading to less volatile, more sustainable price moves — especially if spot demand from accumulators persists.

Key Takeaways

- Large-scale accumulation: Long-term holders added ~1.6M ETH, signaling conviction.

- Leverage flushed: Roughly $5B+ of Open Interest was wiped, reducing tail-risk.

- Cleaner market setup: Lower leverage plus on-chain buying may support a healthier ETH recovery; monitor on-chain flows and technicals.

Conclusion

Ethereum accumulation and the Open Interest reset together create a constructive environment for ETH, provided on-chain demand continues and macro conditions remain stable. COINOTAG will continue to monitor on-chain indicators, derivatives positioning, and price action for evolving signals and practical implications.