XRP price prediction: XRP trades at $2.82 inside a $2.70–$3.20 range and sits above the Bull Market Support Band; historical ascending-channel breakouts produced 350% (2017) and 110% (2021) gains, and analysts project potential targets from $15 to $33 if weekly structure holds.

-

XRP trades at $2.82, holding $2.70–$3.20 with a $169B market cap and steady liquidity.

-

Ascending-channel repeats preceded major rallies; Fibonacci extensions indicate intermediate targets near $5.12 and $6.87.

-

Historical rallies: ~350% in 2017, ~110% in 2021; projections range $15–$33 if long-term structure remains intact.

XRP price prediction: Ascending channel analysis at $2.82, $169B market cap; potential $15–$33 targets. Read concise expert analysis and key levels.

What is the current XRP price outlook?

XRP price outlook shows the token trading at $2.82 within a $2.70–$3.20 consolidation range, supported by the weekly Bull Market Support Band. Short-term volatility persists, but the long-term ascending-channel structure and on-chain liquidity suggest the market could resume a multi-wave rally if the band holds.

How has the ascending channel affected past XRP rallies?

Ascending channels have preceded major XRP rallies in prior cycles. Historical data highlights a ~350% advance in 2017 and ~110% in 2021 after channel-based consolidations. Research cited by analysts at EGRAG Crypto notes ascending channels break down 57% of the time, yet XRP broke higher in two major cycles—indicating the pattern can produce outsized upside in bull phases.

How can traders interpret technical support and market signals?

Monitor the Bull Market Support Band (BMSB) on weekly charts: as long as there are no consecutive weekly closes below the BMSB, the long-term bullish structure remains intact. Use on-chain data—market cap, daily volume, and holder counts—to confirm accumulation strength and institutional interest.

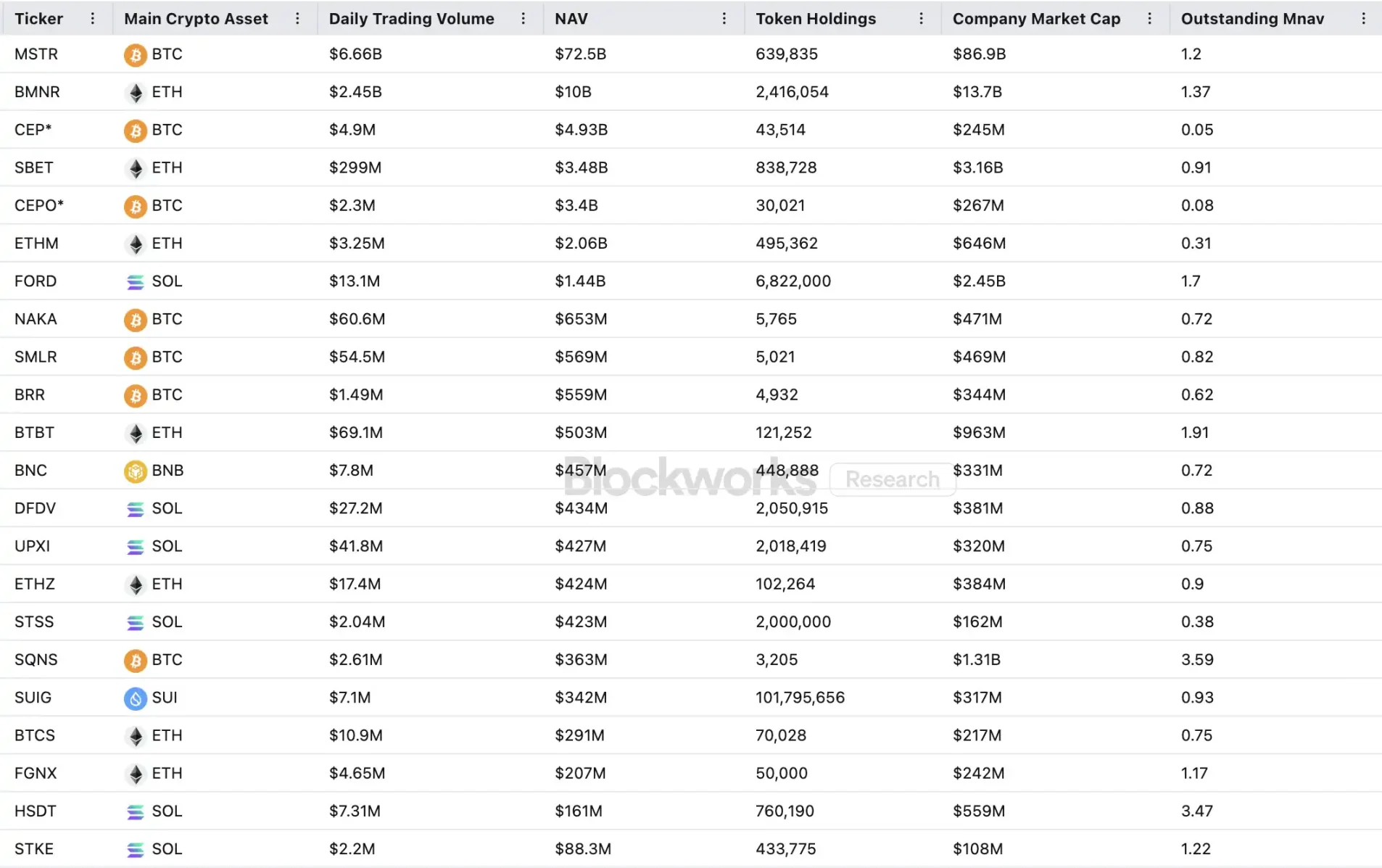

Key comparative table: Past rallies vs. projections

| 2017 | Channel retest | ~350% | Strong breakout after retest |

| 2021 | Channel edge | ~110% | Channel continuation to new highs |

| 2025 (projection) | $2.82 | Potential $15–$33 | Targets depend on long-term channel breakout |

EGRAG Crypto highlights Fibonacci extension levels of 1.272 and 1.618 as intermediate objective zones near $5.12 and $6.87. These levels act as practical take-profit reference points for traders who expect a staged rally rather than a single parabolic move.

Why do analysts project $15–$33 for XRP?

Analysts base the $15–$33 projection on percentage-based analogues to previous cycle rallies, combined with ascending-channel geometry and macro liquidity assumptions. If the asset repeats multi-cycle percentage moves from a similar consolidation base, these targets become mathematically feasible—contingent on market breadth and sustained weekly strength.

What are the on-chain fundamentals and market metrics?

Market data from CoinMarketCap shows XRP trading at $2.82, market cap $169.04 billion, daily volume $7.66 billion, and ~474.82K holders. These metrics indicate sustained liquidity and steady adoption metrics, which support thesis scenarios where accumulation precedes larger breakouts.

Frequently Asked Questions

How reliable is the ascending channel as a predictor for XRP?

The ascending channel is a useful structural guideline: it has preceded major rallies in past XRP cycles, but channels can fail. Statistical analysis shows a higher probability of breakdowns, so traders should combine channel signals with volume, on-chain flows, and weekly closes for confirmation.

When should traders expect a confirmed breakout?

A confirmed breakout is typically signaled by a decisive weekly close above the channel with expanding volume and follow-through on daily timeframes. Risk management should include defined stops beneath recent structure and staged profit-taking at Fibonacci targets.

Key Takeaways

- Range-bound strength: XRP sits at $2.82 inside a $2.70–$3.20 range with substantial liquidity and network holders.

- Historical precedents: Prior cycles produced ~350% (2017) and ~110% (2021) rallies after channel consolidations.

- Actionable levels: Fibonacci extensions near $5.12 and $6.87 offer intermediate targets; $15–$33 are higher-cycle projections contingent on weekly structure.

Conclusion

In summary, the XRP price outlook combines technical structure—an ascending channel and the Bull Market Support Band—with solid on-chain metrics and historical analogues. Traders should prioritize weekly confirmation, liquidity signals, and staged objectives while monitoring downside weekly closes. COINOTAG will update this analysis as market conditions evolve.

XRP trades at $2.82 within the $2.70–$3.20 range as analysts track patterns projecting potential rallies toward $15–$33.

- XRP trades at $2.82, holding $2.70–$3.20 range with $169B market cap and steady liquidity.

- Historical rallies show 350% in 2017 and 110% in 2021, with projections aiming for $15–$33.

- Analysts note the Bull Market Support Band holds as long-term structure remains intact above support.

XRP has remained a subject of wide analysis as traders continue to track repeating chart patterns across different cycles. Analysts note that XRP often forms an ascending channel during the last phase of each cycle. This behavior reflects price consolidation or ranging, which is seen as accumulation before a strong upward move.

Ascending Channel and Historical Movements

According to analysis prepared by EGRAG Crypto, research shows that ascending channels statistically break down 57% of the time, while upward breakouts occur only 43% of the time. However, XRP has challenged these probabilities, breaking higher in both 2017 and 2021. Each cycle produced strong rallies that exceeded early expectations.

#XRP – Patterns Repeat, But You Keep Ignoring It! Target: $15-$33 🎯:

▫️The last phase of the #XRP bull run always leaves significant clues, and I’m not overlooking them! 🧐 While many in the #XRP community are panicking, I see a different picture. Some are selling off their… pic.twitter.com/j2D5iY5m5L

— EGRAG CRYPTO (@egragcrypto) September 25, 2025

Historical performance shows clear surges after periods of consolidation. In 2017, XRP advanced by approximately 350% after a retest from the top of the channel. In 2021, it gained about 110% after moving from the channel’s edge. According to EGRAG, this pattern often repeats in the last phase before new all-time highs.

He stated, “Will the third time be the charm? I believe it will.” Looking ahead, if similar percentage moves apply, XRP could reach between $15 and $33 starting from November 27, 2025. Fibonacci extension targets at 1.272 and 1.618 also indicate possible levels near $5.12 and $6.87.

Technical Support and Market Conditions

The Bull Market Support Band (BMSB) acts as a major support on weekly charts. According to an observation by EGRAG Crypto, exceptions like December 2020 during the SEC lawsuit forced XRP temporarily below the band. Yet the asset returned to the ascending channel soon after, preserving its long-term structure.

Source: CoinMarketCap

EGRAG explained that as long as there are no multiple weekly closes beneath the BMSB, strength remains intact. This safeguard continues to provide a reference point for traders monitoring accumulation phases.

Market data from CoinMarketCap shows XRP trading at $2.82, with a $169.04 billion market cap and $7.66 billion daily volume. Holder numbers are recorded at 474.82K, reflecting steady network adoption. Analysts believe that continued liquidity and resilience within the $2.70–$3.20 range supports XRP’s broader cycle outlook.