Grayscale: Q3 Sees Another Local Altcoin Season, What Should We Watch in Q4?

Cryptocurrency market structure legislation, universal ETP listing standards, and interest rate cuts are the main catalysts for the market in the fourth quarter.

Cryptocurrency market structure legislation, universal ETP listing standards, and interest rate cuts are the main catalysts for the market in Q4.

Written by: Grayscale

Translated by: Luffy, Foresight News

Crypto research institution Grayscale has released its Q3 2025 Crypto Market Insights, noting that all six major crypto sectors posted positive price returns this quarter, though fundamental performance was mixed. Bitcoin underperformed other sectors, showing characteristics of a localized altcoin season. Grayscale also highlighted three core themes: stablecoin legislation and adoption, growth in centralized exchange trading volume, and the rise of digital asset treasuries. The report also looks ahead to potential drivers and risks for Q4. The translated content is as follows:

TL;DR

- In Q3 2025, all six major crypto sectors posted positive price returns, but fundamental performance was mixed.

- This quarter, bitcoin underperformed other crypto market sectors, a pattern that can be seen as an altcoin season, but with significant differences from previous cycles.

- The top 20 tokens this quarter (based on volatility-adjusted price returns) highlighted the importance of stablecoin legislation and adoption, rising centralized exchange trading volume, and digital asset treasuries (DATs).

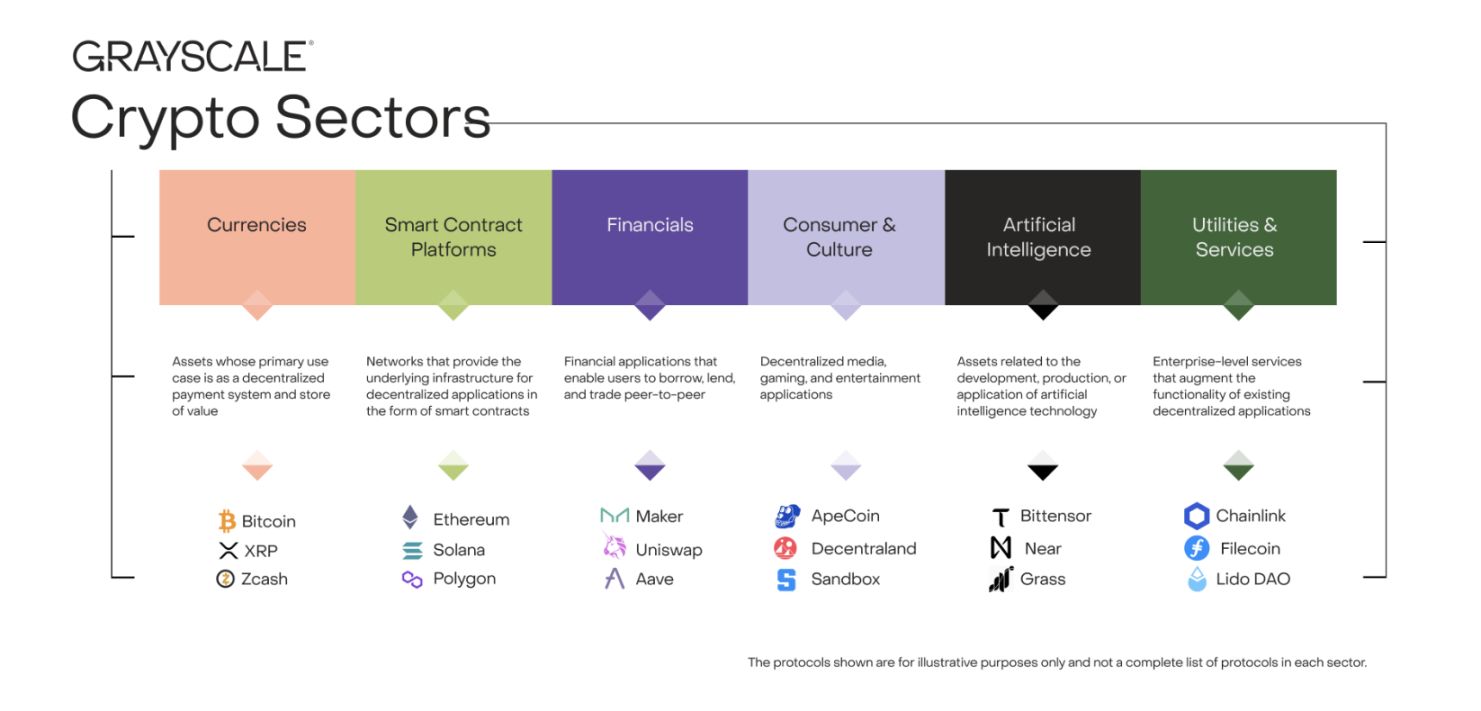

All assets in the crypto space are related to blockchain technology and share the same underlying market structure, but that is where the similarities end. This asset class covers a wide range of software technologies, with application scenarios spanning consumer finance, artificial intelligence (AI), media, entertainment, and more. To organize the market, the Grayscale research team, in collaboration with FTSE Russell, developed a proprietary classification system called "Crypto Sectors." This framework covers six independent market sectors (see Chart 1), including a total of 261 tokens with a combined market cap of $3.5 trillion.

Chart 1: Crypto Sectors Framework

Blockchain Fundamental Metrics

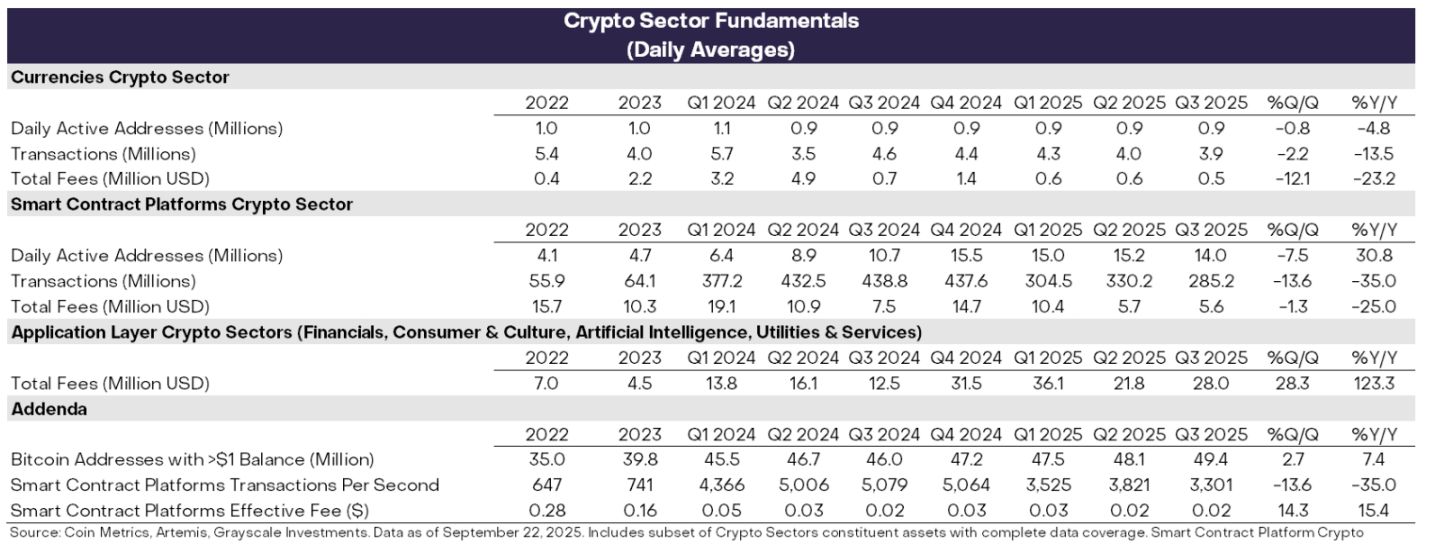

Blockchains are not traditional companies, but we can still use analogous methods to measure their economic activity and financial health. The three core on-chain activity metrics are: user base, transaction volume, and transaction fees. Due to the anonymity of blockchains, analysts typically use active addresses (blockchain addresses that have made at least one transaction) as a proxy for user numbers.

In Q3, the fundamental performance of various crypto sectors was mixed (see Chart 2). On the negative side, the "Currency Sector" and "Smart Contract Platform Sector" both saw declines in user numbers, transaction volume, and fees compared to the previous quarter. Overall, since Q1, speculative activity related to meme coins has continued to cool, directly leading to declines in both transaction volume and activity.

A noteworthy positive signal is that application layer blockchain fees increased by 28% quarter-on-quarter. This growth was mainly driven by a few high-fee applications, including: (1) Solana ecosystem DEX Jupiter; (2) leading crypto lending protocol Aave; (3) top perpetual contract exchange Hyperliquid. On an annualized basis, current application layer fee revenue has exceeded $10 billion. Blockchains are both digital transaction networks and application development platforms; therefore, growth in application layer fees can be seen as an important signal of increased blockchain technology adoption.

Chart 2: Mixed Fundamental Performance Across Crypto Sectors in Q3 2025

Price Performance Tracking

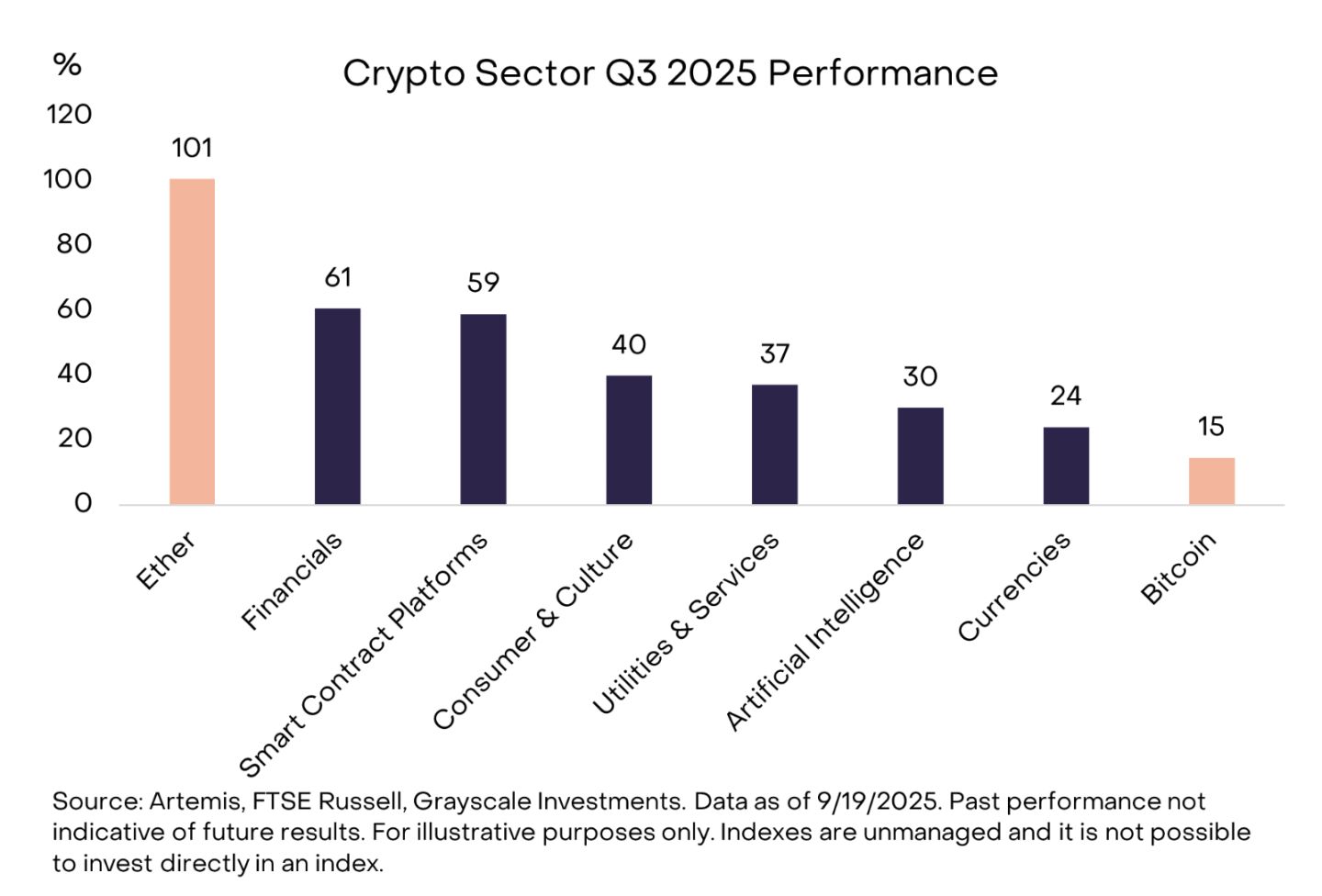

In Q2, all six major crypto sectors posted positive price returns (see Chart 3). This quarter, bitcoin underperformed other market sectors, a return pattern that can be seen as an "altcoin season," but with significant differences from previous cycles of declining bitcoin dominance.

The "Financial Sector" led the way, mainly benefiting from increased centralized exchange (CEX) trading volume; the rise of the "Smart Contract Platform Sector" may be related to progress in stablecoin legislation and adoption. Although all sectors achieved positive returns, the "AI Sector" lagged behind others, a trend consistent with the weak returns of AI stocks during the same period; the "Currency Sector" also underperformed, reflecting the relatively modest price increase of bitcoin.

Chart 3: Bitcoin Underperforms Other Crypto Market Sectors

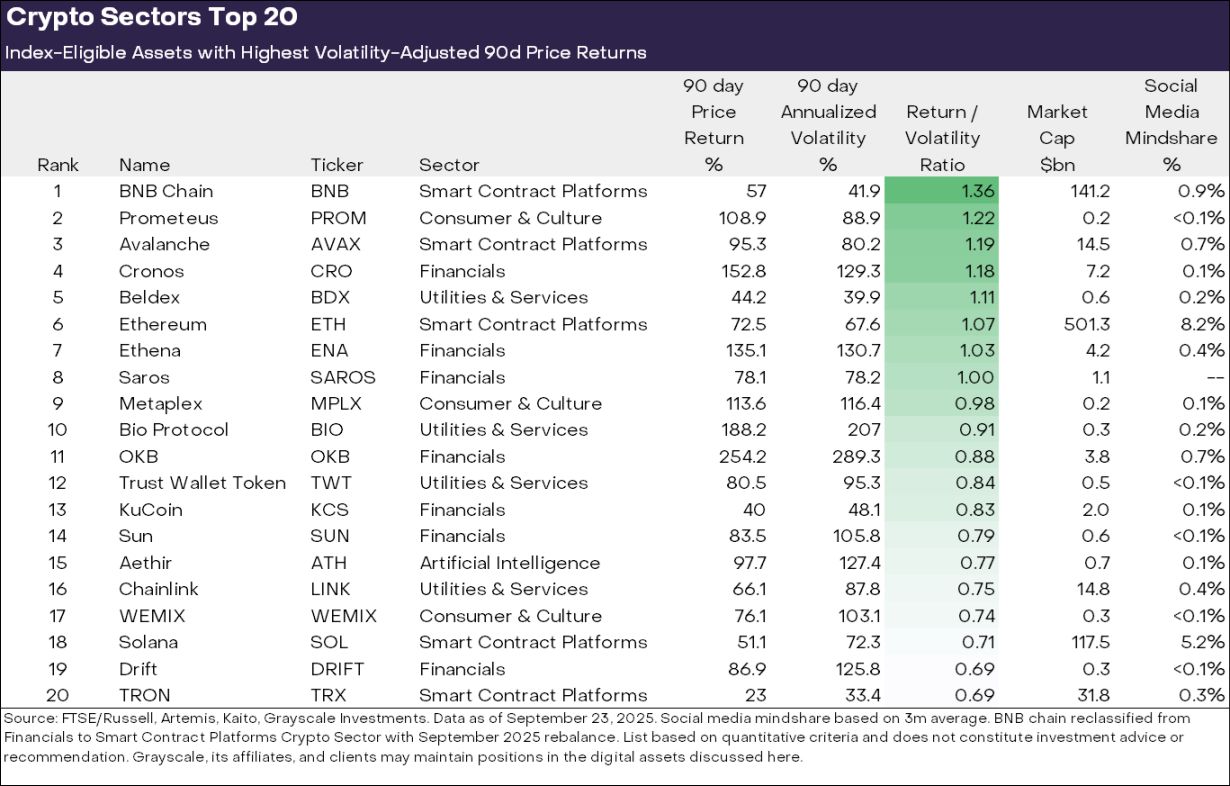

The diversity of the crypto asset class means that dominant market themes and leading sectors often change. Chart 4 shows the top 20 tokens in the Q3 crypto sector index by volatility-adjusted price returns. The list includes both large-cap tokens with market caps over $10 billion (such as ETH, BNB, SOL, LINK, AVAX) and some mid- and small-cap tokens with market caps below $500 million. In terms of sector distribution, the "Financial Sector" (7 assets) and "Smart Contract Platform Sector" (5 assets) were the main contributors to this quarter's top 20 list.

Chart 4: Top Risk-Adjusted Return Assets in Crypto Sectors

We believe there are three major themes behind the standout market performance this period:

(1) The rise of Digital Asset Treasuries (DATs): Last quarter saw a significant increase in the number of digital asset treasuries (DATs)—public companies that add crypto assets to their balance sheets, providing stock investors with crypto exposure. Several tokens in this quarter's top 20 list (including ETH, SOL, BNB, ENA, CRO) may have benefited from the launch of new DATs.

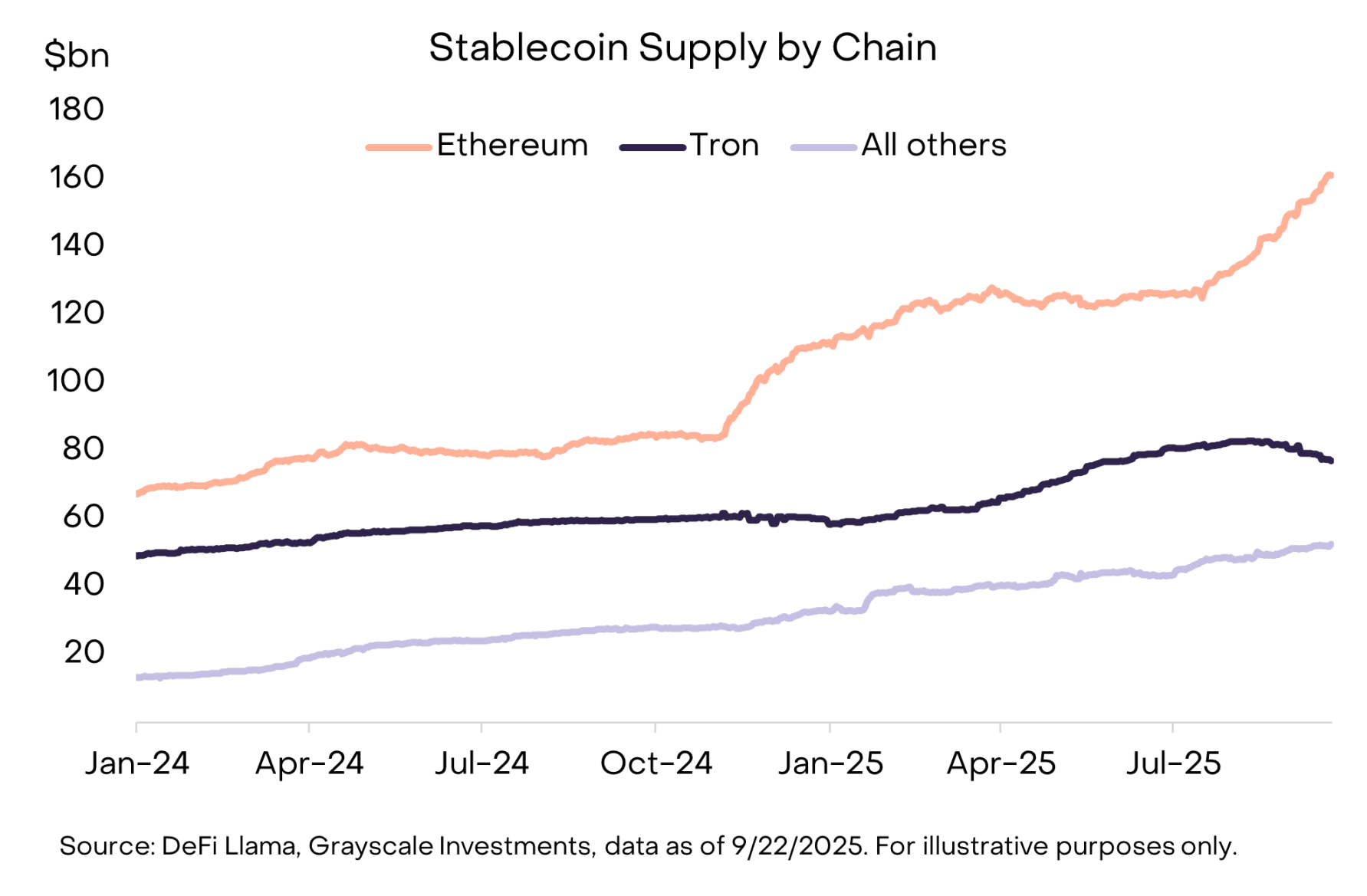

(2) Accelerated stablecoin adoption: Stablecoin-related legislation and adoption was another key theme last quarter. On July 18, President Trump signed the GENIUS Act, establishing a comprehensive regulatory framework for the US stablecoin market. After the act passed, stablecoin adoption accelerated significantly, with circulating supply growing 16% to surpass $290 billion (see Chart 5). The direct beneficiaries are smart contract platforms hosting stablecoin transactions, including ETH, TRX, and AVAX, with AVAX seeing a notable increase in stablecoin trading volume. Stablecoin issuer Ethena also achieved strong price returns, even though its USDe stablecoin does not meet the requirements of the GENIUS Act.

Chart 5: Stablecoin Supply Growth This Quarter, with Significant Contribution from the Ethereum Ecosystem

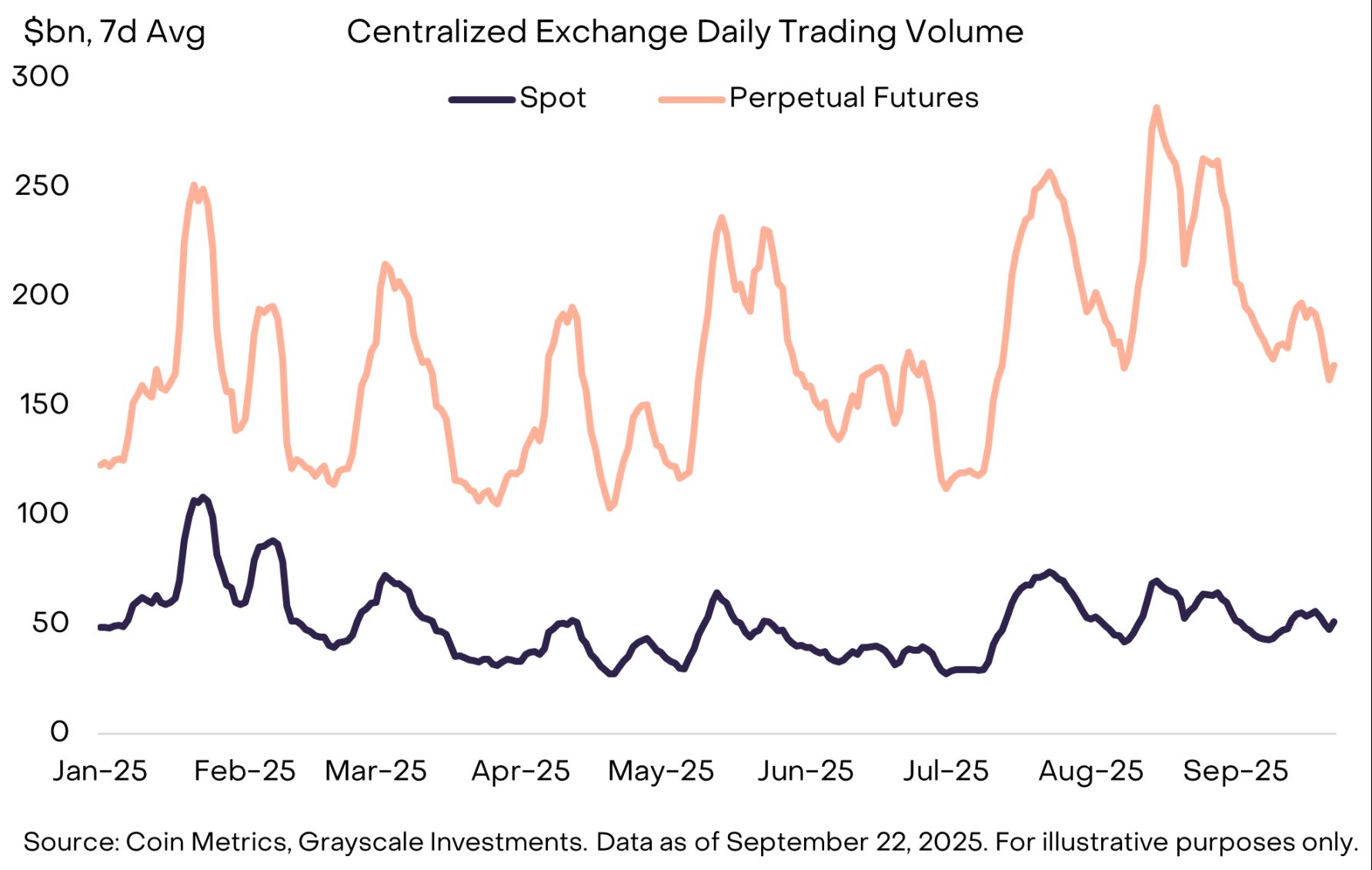

(3) Recovery in exchange trading volume: The active exchange sector was the third major theme. In August, centralized exchange trading volume hit a monthly high not seen since January (see Chart 6). This trend benefited several assets related to centralized exchanges, including BNB, CRO, OKB, and KCS, all of which made this quarter's top 20 list (some tokens are also related to smart contract platforms).

Meanwhile, the decentralized perpetual contract sector continues to heat up. Leading perpetual contract exchange Hyperliquid saw significant expansion this quarter, with fee revenue ranking among the top three crypto assets; smaller competitor DRIFT entered the crypto sector top 20 list due to a surge in trading volume; another decentralized perpetual protocol, ASTER, launched in mid-September and saw its market cap soar from $145 million to $3.4 billion in just one week.

Chart 6: Centralized Exchange Perpetual Contract Trading Volume Hits New High in August

Q4 Outlook

In Q4, the drivers of returns for crypto sectors may differ from those in Q3, with the main potential catalysts including:

First, relevant committees in the US Senate have begun advancing cryptocurrency market structure legislation, after related bills received bipartisan support and passed in the House in July. The bill will provide a comprehensive financial services regulatory framework for the crypto industry and is expected to promote deeper integration between the crypto market and the traditional financial services industry.

Second, the US Securities and Exchange Commission (SEC) has approved universal listing standards for commodity exchange-traded products (ETPs). This move could open up more crypto assets to US investors via ETP structures, further expanding market access.

Finally, the macroeconomic environment may continue to evolve. Last week, the Federal Reserve announced a 25 basis point interest rate cut and hinted at the possibility of two more cuts this year. Crypto assets are expected to benefit from rate cuts, as lower rates reduce the opportunity cost of holding non-yielding assets and may boost investor risk appetite. Meanwhile, a weak US labor market, high stock market valuations, and geopolitical uncertainty will be the main downside risks facing the crypto market in Q4.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Analyst Sees Ethereum Potential Bottom Near $3,850 Amid Low RSI and Negative Funding

Bitwise Seeks SEC Approval for Innovative HYPE ETF

In Brief Bitwise filed for an ETF based on Hyperliquid's HYPE coin with the SEC. SEC delayed decisions on several other altcoin ETF applications. The cautious SEC approach fosters market uncertainty amid rising ETF applications.

Avalanche Climbs to $34.55 as Support Holds and Resistance Nears