In 2021, Solana (SOL) was one of the few altcoins that truly made history. Early believers who recognized the potential of Solana (SOL) in its early stages and invested before the crowd had seen their modest investments explode into multi-million-dollar fortunes within months. Today, market experts are watching three trending altcoins— Paydax (PDP) , BlockchainFX (BFX), and Bitcoin Hyper (HYPER)—suggesting that investing in these tokens now is like buying Solana (SOL) below $1 before its legendary price rally.

Paydax (PDP) Emerges As Hottest Altcoin Set To Mirror The Solana (SOL) Rally

It's a given in crypto that the largest gains go to those who move in first and stake the most. Many Investors missed the explosive Solana (SOL) rally that took it from under $1 to above $260 in 2021 due to their inability to lock in early.

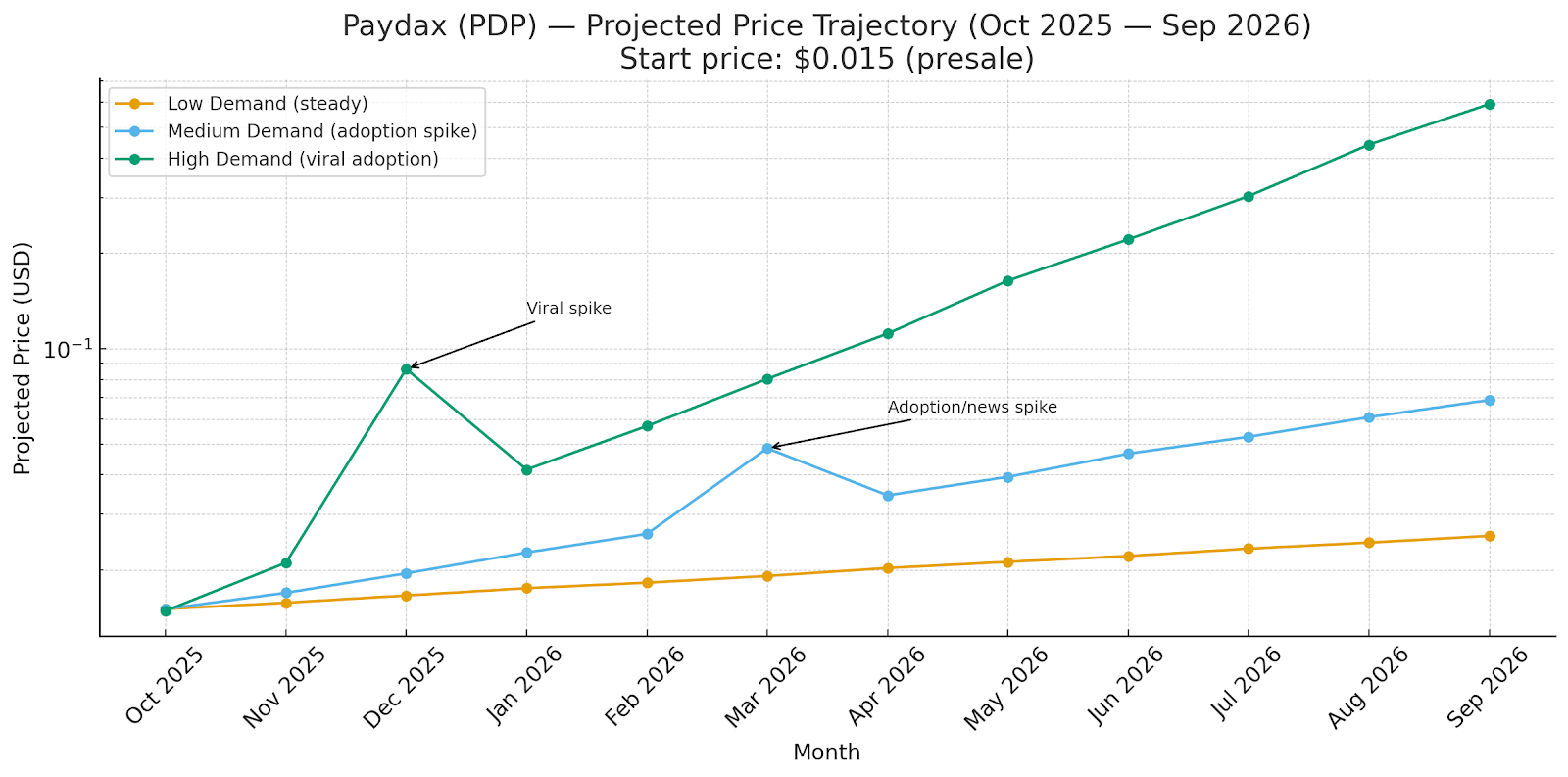

In the current altcoin market, Paydax is emerging as the next must-watch project, poised to replicate Solana’s (SOL) legendary growth and outshine even BlockchainFX (BFX) and Bitcoin Hyper (HYPER). The project’s native token, PDP, is priced at just $0.015 and has already surpassed half a million dollars in investments in under a week.

Robust Utility Driving Explosive Growth Potential

Unlike the BlockchainFX (BFX) and Bitcoin Hyper (HYPER) altcoins, Paydax is not relying solely on hype but on real-world use cases that address the challenges of traditional finance. As a crypto and RWA borrowing platform, Paydax enables users to borrow against crypto and tokenized assets with ease, offering flexible LTV ratios that range from 50% to 97%.

The DeFi platform features a Peer-to-Peer (P2P) lending system, enabling borrowers and lenders to enter mutually beneficial arrangements that offer returns of up to 15.2% APY. To safeguard lenders, Paydax offers a Redemption Pool, which acts as insurance with a 20% APY in the event of borrower default.

With security a top priority within the ecosystem, Paydax employs advanced protocols. Here are a few:

-

Gnosis Safe multisig wallets

-

An emergency shutdown mechanism to prevent system threats.

-

Overcollateralization to protect loans.

Additionally, the crypto platform has undergone a rigorous audit by Assure DeFi, which verified the integrity of its smart contract and highlighted the Paydax leadership and development team’s commitment to transparency.

Additional Yield Opportunities

Notably, Users can also unlock extra yield opportunities with Paydax. This includes yield farming at 5x leverage, targeting a 41.25% APY, and the PDP Protocol Staking, which adds up to a 6% APY.

Bitcoin Hyper (HYPER) Faces Adoption Challenges

The growth potential of Bitcoin Hyper (HYPER), a new layer-2 scaling solution of Bitcoin, is being compared to that of Solana (SOL). The Bitcoin Hyper (HYPER) altcoin became available on March 14 2025, and now sits at $0.012. According to SingularDAO, the Bitcoin Hyper (HYPER) platform launched on an Ethereum-based roll-up, blending ZK Proofs and the Lightning Network.

Impressively, the Bitcoin Hyper (HYPER) project has garnered investments of over $18 million in under a year. However, Bitcoin Hyper (HYPER) still faces challenges with global adoption and rising competition from top altcoins like Paydax.

BlockchainFX (BFX) Growth Accelerates Yet Competitors Offer Better Incentives

The BlockchainFX (BFX) team recently announced a new milestone on X social media. According to them, BlockchainFX (BFX) raised over $8 million. The team also revealed that participants have exceeded 10,750.

While these milestones are noteworthy and could lay the groundwork for repealing the Solana (SOL) rally, BlockchainFX (BFX) still struggles to compete with rising contenders like Paydax in terms of utility and potential. While BlockchainFX (BFX) growth is hype-driven, Paydax attracts investors' attention for its unmatched growth incentives that reward active contributors and stakers within its ecosystem.

PDP Remains The Market’s Top Choice

Paydax is setting up to be one of the most notable altcoins of 2025, boasting an unmatched DeFi crypto and RWA lending utility backed by high-end partnerships from industry big shots, including Sotheby’s, Brinks, Crypto Astronaut, and more. By participating in the PDP altcoin opportunity today, crypto users can acquire the altcoin before mainstream adoption and potential exchange listings drive both demand and price through the roof.

Getting in now means securing tokens at their lowest price of $0.015. Just as early investors in Solana (SOL) reaped massive returns by believing in its potential, early Paydax holders could be positioning themselves for a similar record-breaking rally.