Nine European Banks to Launch MiCA Euro Stablecoin in 2026

Nine major European lenders, including ING, UniCredit, CaixaBank, KBC, Danske Bank, DekaBank, Banca Sella, SEB, and Raiffeisen Bank International, have announced a consortium to issue a euro-denominated stablecoin. The initiative will operate under the EU’s Markets in Crypto-Assets Regulation (MiCAR). Banks Form Dutch Consortium for Euro Stablecoin The group has formed a Dutch-based company that

Nine major European lenders, including ING, UniCredit, CaixaBank, KBC, Danske Bank, DekaBank, Banca Sella, SEB, and Raiffeisen Bank International, have announced a consortium to issue a euro-denominated stablecoin.

The initiative will operate under the EU’s Markets in Crypto-Assets Regulation (MiCAR).

Banks Form Dutch Consortium for Euro Stablecoin

The group has formed a Dutch-based company that will apply for an e-money license supervised by the Dutch Central Bank. The stablecoin is expected to be issued in the second half of 2026. Subject to regulatory approval, a CEO will be appointed.

The token is designed to provide instant, low-cost transactions, 24/7 cross-border payments, programmable settlement, and applications in digital assets and supply chain management. Banks may also offer wallets and custody services.

Strategic Context, Market Share, and Expert Views

The consortium seeks to create a European alternative to US dollar stablecoins, which dominate over 99% of the global market. The European Central Bank has warned that MiCA may be too lenient, while the European Commission is preparing to loosen rules, raising tension with regulators.

EU officials have also warned that unchecked US tokens could undermine euro stability.

Competition is rising. Société Générale’s Forge has already launched a euro stablecoin on Stellar and recently listed its dollar-pegged USDCV on Bullish Europe.

Source:

CoinGecko

Source:

CoinGecko

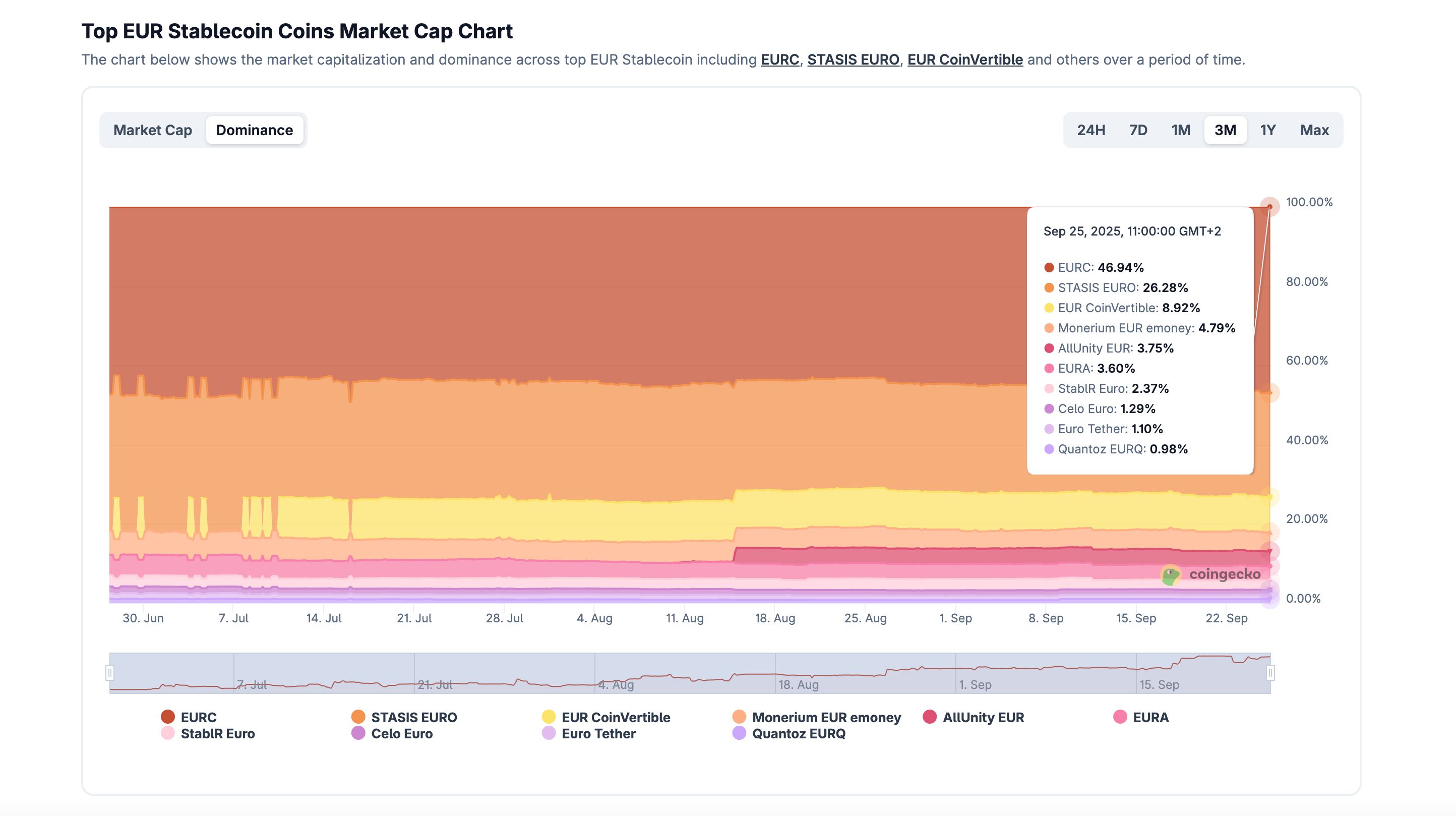

According to CoinGecko data, the euro stablecoin market remains fragmented: EURC controls 47%, STASIS EURO 26%, and CoinVertible 9%. The combined capitalization is still below €350 million, highlighting its small scale relative to dollar-based tokens.

“MiCA is promising, but the framework remains incomplete, especially on cross-border issuance,” an expert told BeInCrypto in February.

Another BeInCrypto analysis found that despite new projects, euro-denominated stablecoins remain marginal. In an ECB blog, senior adviser Jürgen Schaaf wrote that “European monetary sovereignty and financial stability could erode” without a strategic response. He added that the disruption also offers “an opportunity for the euro to emerge stronger.”

ECB President Christine Lagarde has called for stricter oversight of non-EU issuers, tying the debate to Europe’s digital euro push as the US advances its GENIUS Act legislation.

“Digital payments are key for euro-denominated financial infrastructure,” ING’s Floris Lugt said, emphasizing the need for industry-wide standards.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Next-generation Payment Architecture: EIP-7702 Empowers UXLINK FujiPay

FujiPay has integrated Web2 payment channels to support secure and compliant global stablecoin spending, promoting crypto assets as practical payment tools.

Bitcoin tests the bottom again; 2026 may be a good opportunity to enter the market

This article mainly discusses the role of bitcoin and AI in the future economy and their impact on the risk asset market, as well as predicts the market trends for 2026.