Base Faces Controversy Again: From "Is L2 Considered a Trading Platform" to Heated Debate Over Sequencer Centralization

There is ongoing controversy within the industry regarding the centralization of the Base sequencer. Some believe that the centralized sequencer of Base may affect trade execution prices and play a role similar to that of a broker, and therefore should be subject to regulation.

Original Title: "Base Faces Controversy Again: Heated Debate on Whether L2s Count as Exchanges and the Centralization of Sequencers"

Original Author: Eric, Foresight News

Hester Peirce, a commissioner of the U.S. Securities and Exchange Commission (SEC) known as "Crypto Mom," stated on "The Gwart Show" that L2s relying on centralized sequencers may meet the SEC's definition of a trading platform, and therefore operators must register with the SEC and comply with relevant regulations.

Hester Peirce emphasized that the key to making such a determination is not the technology itself, but the actual function. If a single operator controls the matching engine, then it is similar to a trading platform. To some extent, this means that as long as there is a centralized organization with trading control over an L2, that organization needs to be regulated by the SEC.

Initially, this view did not spark widespread discussion, but as it continued to ferment, many began to worry that if even the "crypto-friendly" SEC could reach such a conclusion, the development of L2s might be hindered. Base, which combines elements of both a trading platform and an L2, has become the primary target of criticism.

As FUD grew louder, Coinbase Chief Legal Officer Paul Grewal was the first to speak out. He stated that the SEC defines a trading platform as a market connecting buyers and sellers of securities, but L2s operate as general-purpose blockchains providing infrastructure for on-chain trading platforms, just as AWS provides infrastructure for trading platforms but cannot be called a trading platform itself. Paul Grewal believes that mislabeling sequencers could cause the scalability role of L2s to be overlooked.

Subsequently, Base lead Jesse Pollak also explained sequencers on X, stating that sequencers collect user transactions, sort them on a first-in, first-out basis, and compute resulting state changes, finally batching transactions to L1 for settlement—just like a traffic controller ensuring smooth roads. Jesse Pollak argued that sequencers do not match orders; matching occurs at the smart contract layer, and sequencers simply ensure transactions are processed in a consistent and orderly manner.

Ethereum co-founder Vitalik Buterin joined the discussion after Jesse Pollak, stating that Base is simply an L2 running on Ethereum, providing a stronger user experience through centralized features while still tightly integrated with Ethereum's decentralized base layer to ensure security. Vitalik emphasized that funds on Base are "non-custodial," meaning that assets on L2 are ultimately controlled by L1 and cannot be stolen by L2 operators.

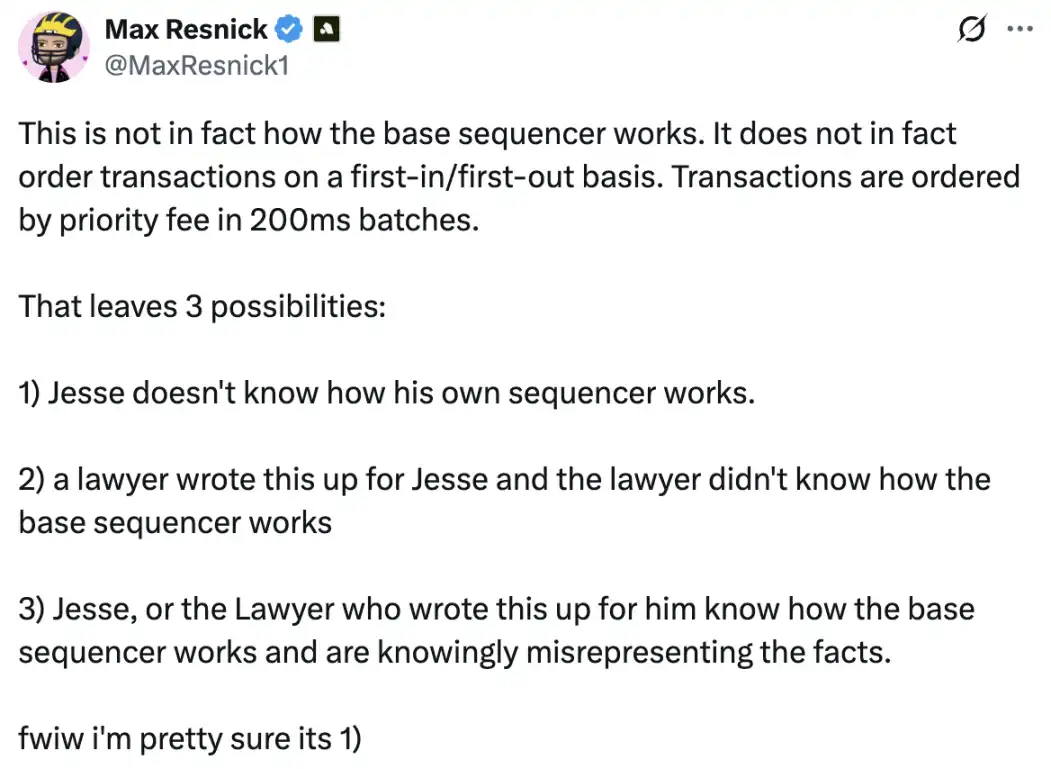

Max Resnick, Chief Economist at Solana-focused development company Anza, questioned Jesse Pollak's statement, saying that Base's sequencer sorts transactions based on priority fees in 200-millisecond intervals, rather than strictly following a first-in, first-out principle. Although Jesse Pollak later explained this, it is clear that Max Resnick's main point is that sequencers can reorder transactions according to certain rules, directly pointing to the issue of sequencer centralization.

There is little disagreement within the industry about whether L2s like Base count as trading platforms; the SEC commissioner's view that "L2s are trading platforms" may stem from a lack of understanding of L2 architecture. Industry discussions are more about regulatory concerns than right or wrong. However, the perspectives of Base stakeholders and Vitalik have sparked another layer of debate: Should the centralization of Base's sequencer be changed?

From Regulatory Issues to the Debate on Sequencer Centralization

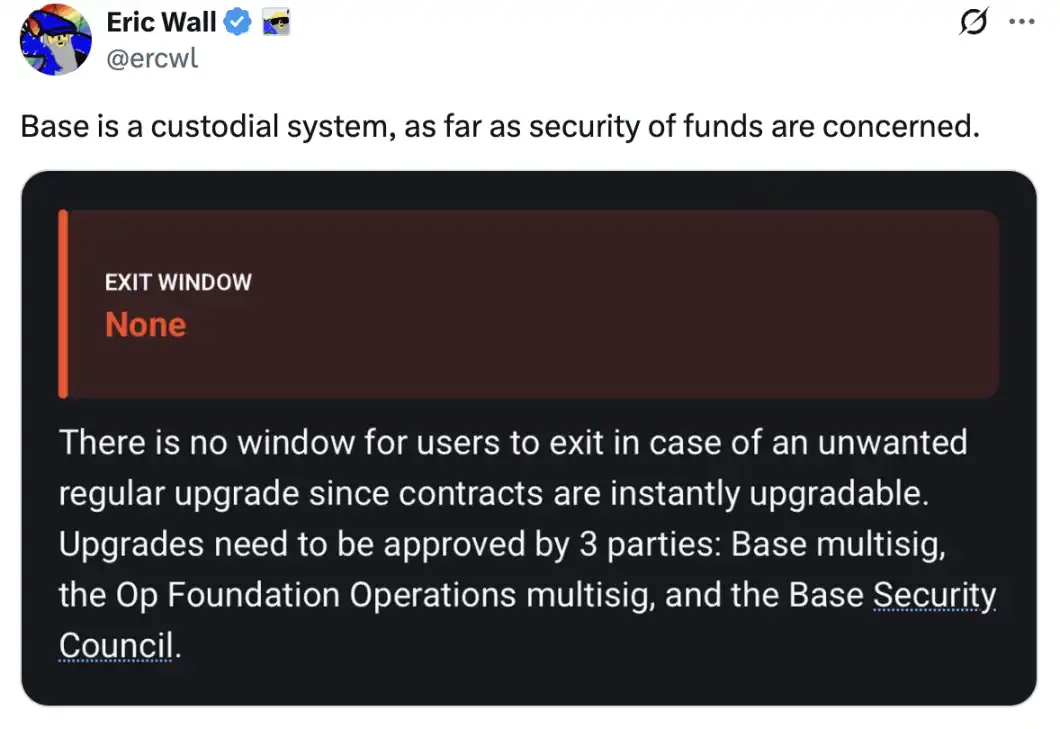

Vitalik's view that Base's centralized sequencer is for scalability and user experience has also sparked much controversy. Taproot Wizards co-founder Eric Wall stated that, in terms of fund security, Base is a custodial system, pointing out that Base's contracts can still be upgraded via governance, meaning operators and related entities (through the security council) retain considerable discretionary power. In his view, this makes Base functionally closer to a custodial system rather than a fully trust-minimized Ethereum extension. Eric Wall also commented that the wording of Vitalik's statement could lead readers to believe that even if keys are leaked, funds would not be lost, which he considers highly irresponsible.

Former Ethereum core developer Lane Rettig stated that while Coinbase itself would not maliciously steal user funds, this does not mean Coinbase would not act against users' interests under government pressure.

Alex Thorn, Head of Research at Galaxy, believes that Vitalik's view misses the point. He said the focus of the discussion should be on securities on L2s, not the security of L2s. Although Alex Thorn did not state it explicitly, his view points to a critical issue: L2s themselves are not trading platforms, but if trading platforms on L2s are built on a highly centralized chain, can these platforms still be called DEXs, and should they be regulated?

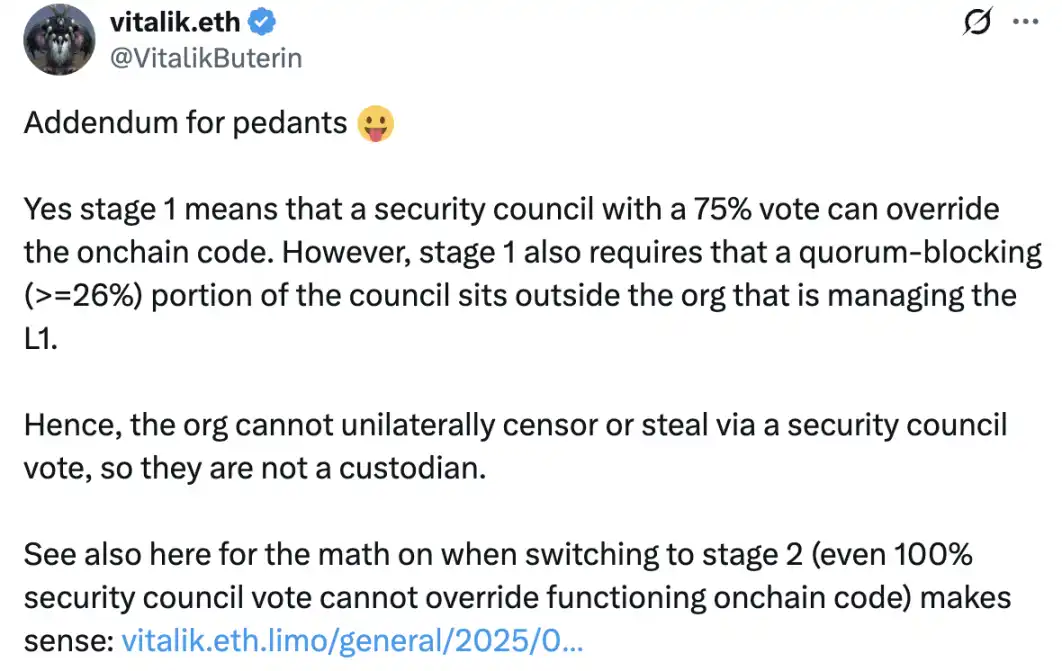

In response to increasing criticism of Base's centralization, Vitalik reiterated that Base is indeed in a centralized stage, where an absolute majority vote of the security council can upgrade contracts. However, he pointed out that quorum rules prevent Coinbase from unilaterally censoring or stealing funds. In addition, a second phase is being planned, where even a 100% security council vote cannot change the running on-chain code.

The founder of Anastasia Labs, which is developing Cardano L2 Midgard, sharply "interpreted" Vitalik's supplementary comments: interpreting "security council" as "multi-signature"; "75% vote" as "7 private keys"; and "requiring that individuals with more than 26% voting power to veto proposals be independent of the organization managing the L2" as "requiring the organization to use shell companies, friends' companies, obfuscated subsidiaries, or partner companies to hold the 3 private keys needed for the multi-signature."

Many users in the comments supported the Anastasia Labs founder's view, believing that although the rules are set this way, circumventing the rules to achieve complete control over Base is very simple, and the lack of transparency in governance makes these transparent rules seem highly untrustworthy.

The Regulatory Dilemma of Web3 Infrastructure

Base's excessive centralization as an L2 has sparked discussion many times. This time, the SEC commissioner's view may seem somewhat "absurd," but it also points directly to the core issue: if transaction ordering on an L2 can be arbitrarily manipulated, then that L2 should be regulated. Of course, regulating L2s as trading platforms seems unfounded on the surface, but if L2 operators use control over sequencers to pocket MEV profits or affect transaction execution prices, then L2s do, to some extent, play a role similar to brokers.

For regulators, determining the "decentralization" of infrastructure is a challenge. Even if sequencers are decentralized, it is difficult to quickly clarify whether the entities maintaining the sequencer network have related interests. The SEC, worried about a repeat of the FTX tragedy due to lack of regulation, has somewhat relaxed oversight under the new U.S. presidential term, but remains concerned about major risks arising from regulatory relaxation. Recently, U.S. regulators have introduced some exemptions for DeFi, but how to define and review infrastructure remains an issue that needs further study.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Why Eastern Europe Is Becoming the Next Crypto Hub

[Long English Thread] In-Depth Analysis: How Can Plasma Change the Landscape of On-Chain Payments?

Retail Traders Chase the Next Big Crypto to Hit $1 as BTC Consolidates Under Heavy ETF-Driven Resistance

Australia Plans 10% Revenue Fines for Crypto Firms