Nansen AI is an AI agent for onchain crypto trading that uses natural conversation to deliver portfolio-connected market insights for Ethereum and EVM networks. Built on 500M+ labeled addresses, it prioritizes research and decision support now, with guarded execution flows planned later in 2025.

-

Nansen AI delivers conversational onchain insights without traditional charts.

-

Supports embedded self-custodial wallets across 25 EVM networks at launch.

-

Built on a dataset of 500+ million labeled addresses for faster, portfolio-aware signals.

Nansen AI: conversational onchain insights for Ethereum and EVM chains—read the rollout timeline and key takeaways. Learn how to use the AI agent. (Nansen AI launch details)

What is Nansen AI?

Nansen AI is an AI agent built to simplify onchain crypto trading by replacing charts with natural conversation. The platform uses a labeled dataset of more than 500 million addresses to provide portfolio-aware research and insights for Ethereum and EVM blockchains.

How does the Nansen AI agent work?

Nansen AI analyzes onchain signals in real time and responds via conversational prompts. It connects to embedded, self-custodial wallets to attribute performance drivers and highlight portfolio changes. Execution is planned but gated: the agent prepares orders and requires user confirmation before any transaction is submitted.

Nansen unveiled an AI agent to simplify onchain crypto trading with natural conversation, aiming to bring more value to Ethereum and EVM networks.

Crypto intelligence platform Nansen is rolling out an artificial intelligence agent designed to make onchain cryptocurrency trading more intuitive, in a move it says could shift more value back to public blockchains such as Ethereum.

The company announced Thursday that it is launching Nansen AI, a mobile agent that uses natural conversation instead of trading charts to deliver market insights.

The new trading interface seeks to eliminate traditional trading charts and offer an AI agent as the main interface for onchain trading, delivering insights through what Nansen calls “natural conversation” instead of technical charts.

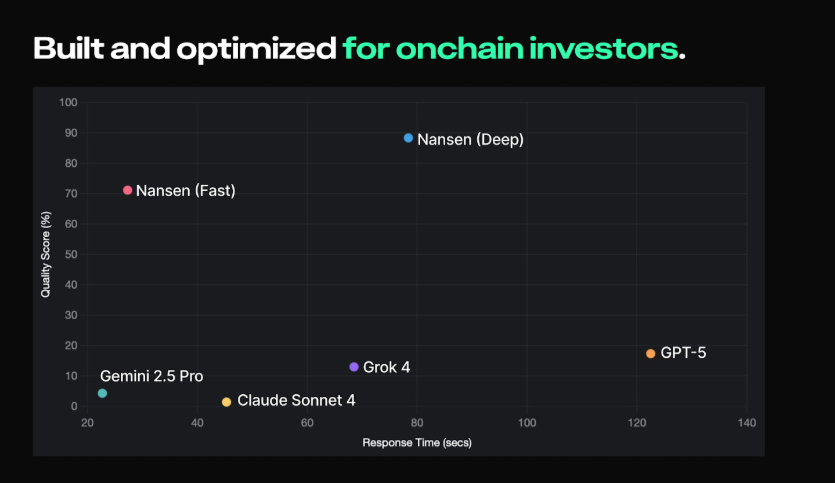

Built on Nansen’s data set of more than 500 million labeled addresses, the platform aims to provide investors with faster and more accurate information than general-purpose tools such as ChatGPT or Claude (as compared by Nansen).

Nansen AI platform. Source: Nansen

“We’re starting with research and insights first, helping users discover and decide faster,” Logan Brinkley, head of product UX and design at Nansen, said in an industry interview. “Execution is on the roadmap, but we want to validate the core loop, improve the agent, and build trust before introducing trading flows.”

At launch, Nansen said the platform will support embedded, self-custodial wallets with Ethereum and other major Ethereum Virtual Machine (EVM) blockchains. Initial support covers 25 high-demand networks with plans to expand.

When will AI-powered trading go live?

Nansen expects to introduce AI-powered agentic trading by the end of Q4 2025. The company emphasized a phased rollout: research and insights first, followed by execution flows after validation and user trust are established.

Why does Nansen AI matter for onchain trading?

Nansen AI matters because it embeds portfolio context and onchain labeling directly into conversational queries, reducing dependence on generic LLMs for chain-specific signals. It may strengthen investor decision-making and support responsible blockchain adoption, according to industry commentary.

Justin Sun, founder of Tron Network, commented that AI agents can transform how market participants access and interpret information, potentially accelerating responsible adoption of blockchain technology.

LUNA virtual protocol, X post. Source: Luna

How does Nansen AI compare with general-purpose LLMs?

| Data source | 500M+ labeled onchain addresses | Broad internet-trained models |

| Portfolio context | Native wallet connection and attribution | Requires user-provided context |

| Execution | Planned, user-confirmed | Not native to onchain trading |

Frequently Asked Questions

Is Nansen AI safe for live trading now?

No. At launch the platform focuses on research and insights; order execution is on the roadmap and will require explicit user confirmation when it is introduced. Nansen emphasizes validation and trust-building before full trading flows.

Which blockchains does Nansen AI support?

Initially, Nansen AI supports Ethereum and 24 other major Ethereum Virtual Machine (EVM) networks, with plans to expand network coverage over time.

Key Takeaways

- Conversational interface: Nansen AI replaces charts with natural language to surface onchain insights quickly.

- Data depth: The product leverages a dataset of 500M+ labeled addresses to provide portfolio-aware analysis.

- Phased rollout: Research and insights are live first; execution is expected by Q4 2025 with mandatory user confirmation.

Conclusion

Nansen AI represents a shift toward conversational, portfolio-connected onchain analysis for Ethereum and EVM networks. By prioritizing research and trust before enabling execution, Nansen aims to deliver faster, context-rich signals while minimizing operational risk. Watch for the planned Q4 2025 execution rollout and evaluate the agent as a research co-pilot for onchain decision-making.