- XRP price today trades near $2.84 after rejection at the $2.94–$2.95 EMA cluster.

- SEC approval of a broader crypto ETF includes XRP, expanding institutional exposure beyond BTC and ETH.

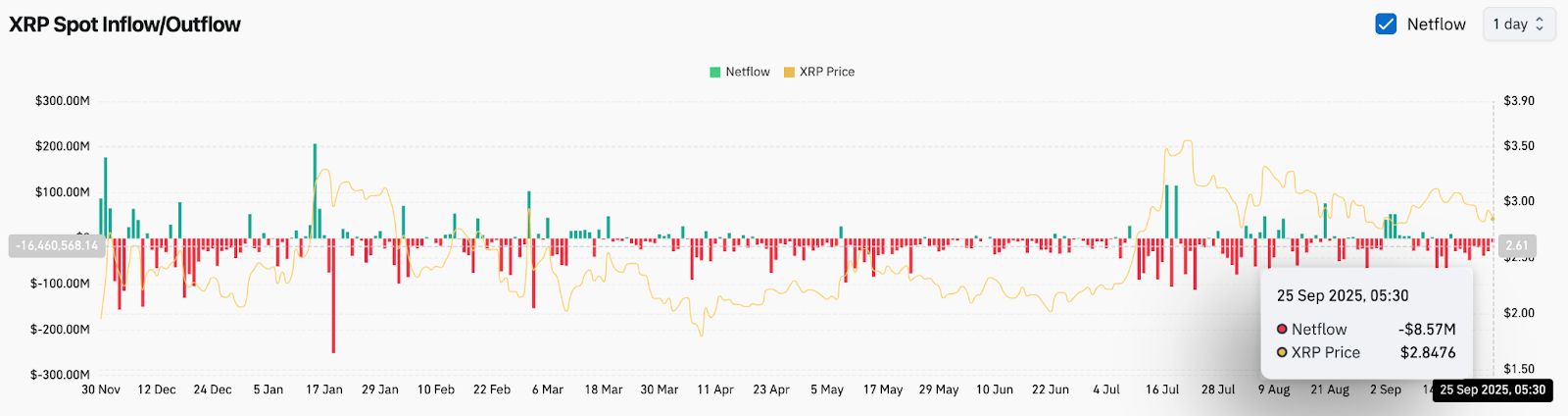

- Net outflows of $8.57M show cautious sentiment, limiting upside attempts toward $3.08 and $3.19.

XRP price today is trading near $2.84, slipping after rejection at the $2.94–$2.95 EMA cluster. Immediate support sits near $2.79–$2.83, while resistance remains at $3.08 and $3.19, aligned with Fibonacci levels. The question now is whether fresh ETF headlines can offset weak flows and revive momentum.

XRP Price Tests Key Support Levels

XRP Key Technical Levels (Source: TradingView)

XRP Key Technical Levels (Source: TradingView)

The daily chart shows XRP trading inside a broad consolidation range between $2.72 and $3.30. Price slipped below the 20- and 50-day EMAs at $2.94, leaving momentum tilted bearish in the short term.

The Bollinger Bands have widened following last week’s drop, with the lower band near $2.79 providing immediate defense. The 100-day EMA at $2.83 has also become a key pivot, with failure here exposing the $2.72 low. On the upside, the $3.08 Fibonacci zone and $3.19 half-retracement level remain the next resistance checkpoints.

SEC Approval Adds Positive Catalyst

Sentiment improved after the U.S. SEC approved the Hashdex Nasdaq Crypto Index US ETF to operate under new generic listing standards. Unlike earlier approvals limited to Bitcoin and Ethereum, the new framework allows the fund to hold additional assets, including XRP, SOL, and XLM.

This move broadens institutional exposure to XRP and signals regulatory recognition beyond the largest tokens. Market participants see it as an important step for mainstream integration, even though the near-term reaction has been muted due to broader market weakness.

On-Chain Data Shows Ongoing Outflows

XRP Netflows (Source: Coinglass)

XRP Netflows (Source: Coinglass)

Exchange flow data highlights continued caution. On September 25, XRP recorded a net outflow of $8.57 million, marking another day of distribution. While persistent outflows often reflect selling pressure, the scale has been lighter compared to August, when outflows exceeded $50 million on multiple days.

Related: Bitcoin Price Prediction: BTC Holds $111K As ETF Demand And Corporate Buying Absorb Supply

Active accumulation remains inconsistent, suggesting investors are still hesitant to commit aggressively despite positive regulatory headlines. Unless flows shift into sustained inflows, upside attempts may remain capped below the $3.08–$3.19 resistance zone.

Technical Outlook For XRP Price

XRP price prediction in the short term remains defined by clear levels:

- Upside levels: $3.08, $3.19, and $3.30.

- Downside levels: $2.83, $2.79, and $2.72.

- Trend pivots: 20/50 EMA cluster at $2.94, 200 EMA deeper near $2.60.

A close above $2.95 would shift momentum back in buyers’ favor, while a breakdown below $2.79 risks accelerating losses toward $2.72.

Outlook: Will XRP Go Up?

The path for XRP depends on whether ETF-driven optimism outweighs cautious flows. As long as XRP holds above $2.79–$2.83, analysts see room for a recovery toward $3.08 and $3.19.

Losing the $2.72 base would weaken the bullish thesis and raise the risk of a deeper retracement toward the $2.60 zone. For now, XRP remains in a holding pattern, with ETF headlines providing a long-term tailwind but flows and technicals signaling near-term hesitation.