Author: Taiki Maeda

Translation: TechFlow

As the market enters what many call the "late-cycle stage," I believe there are some rising risks that cannot be ignored. At this stage, it is especially important to think comprehensively about your portfolio and build an "all-weather portfolio" that can withstand various market conditions. Such a portfolio not only protects you from market downturns but also allows you to capture returns from asymmetric opportunities.

As a humble airdrop hunter, I have developed an investment framework that combines the two best strategies and iterates according to readers' preferences.

This is the "Humble Farmer Portfolio" framework (including allocation ratios for each asset class):

-

Stablecoin yield farming (30%-60%)

-

Holding high-quality crypto spot assets (30%-60%)

-

Airdrop farming on new perpetual contract decentralized exchanges (Perp DEX) (1%-10%)

Stablecoin Yield Farming (30%-60%)

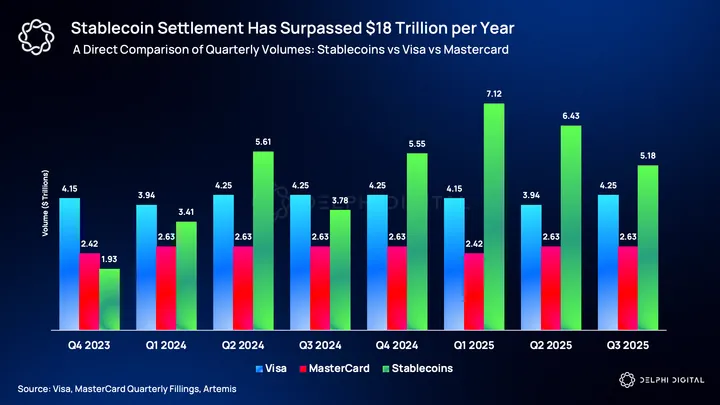

Stablecoin yields are usually compressed during bear markets but perform extremely well in bull markets. A smart airdrop hunter once told me: "If you are farming in DeFi, you are actually indirectly bullish on altcoins, because good yields require altcoins to be in a bull market." As a stablecoin yield farmer, the possibility of loss is very low (as long as the project doesn't rug), because you are selling tokens to those blindly buying coins.

By holding a healthy proportion of stablecoins, you can earn over 15% returns in a bull market while improving your "sleep-adjusted returns" (i.e., reducing anxiety caused by market volatility). The main advantage of holding stablecoins is that if the market enters a bear phase, we can buy crypto at lower prices.

Holding High-Quality Crypto Spot Assets (30%-60%)

Many people have proposed the "end of cycle theory," believing that strong assets like bitcoin can continue to rise like the stock market. The crypto space has also seen truly compound growth assets, such as BNB, which are more suitable for long-term holding rather than frequent trading. However, we must also accept the fact that if "this time is not different," all these coins may drop by at least 50% in a bear market.

Therefore, as humble airdrop hunters, we must set aside our egos and choose assets that we believe can outperform the market in the long run, while accepting possible drawdowns. This requires proper due diligence and research, and forming an investment thesis with conviction—which is exactly what you are good at.

Airdrop Farming on New Perpetual Contract Decentralized Exchanges (Perp DEX) (1%-10%)

Finding an edge in liquidity markets becomes increasingly difficult over time. In the past few years, I realized that our advantage as retail users lies in trying new things and earning rewards through airdrops. Compared to those fighting each other in altcoins, how many people have achieved financial freedom through farming the Hyperliquid airdrop?

I once thought Hyperliquid was the last large-scale Perp DEX airdrop. But now, I think Lighter will also perform well. After Lighter, people may say it is the last big airdrop in the perpetual contract field, and that new projects are not worth farming.

I challenge this view, because even now, we still have many other Layer 1 and Layer 2 blockchain projects with high valuations but no users. If perpetual contracts are the killer app in crypto, why can't there be multiple valuable Perp DEX tokens? Is it possible to have 1-2 large-scale airdrops every year? This possibility may be higher than you think.

So the question is, how should we farm? Where should we farm?

Airdrop Farming Strategies

"You just need to be a profitable perpetual contract trader." Yes, but unfortunately, most people lose money trading perpetual contracts. Therefore, it is best to minimize risk exposure and develop a comprehensive strategy that benefits the entire portfolio.

I started trying a strategy and achieved varying degrees of success, which is to take very small short positions on high market cap tokens while earning positive funding.

The goal of this strategy is not to mimic "The Big Short" and make huge profits by shorting tokens, but to accumulate airdrop points while supplementing other parts of the portfolio. Perp DEXs usually reward open interest rather than trading volume:

If we already have long exposure through spot holdings, the entire portfolio may benefit from opening some short positions, especially since most perpetual contract tokens have positive funding (i.e., you earn by shorting). Personally, I open small short positions on tokens I don't mind betting against for a few months. If these tokens rise 50%, I can further increase my contrarian positions.

If the market rises, the money you make from spot holdings will outweigh the losses from shorting. If the market continues to rise, the airdrops you farm may be worth a lot in the future. If the market enters a bear phase, at least you get paid for shorting falling assets (though the airdrop may be worth less).

People often joke that there are "air projects" worth tens of billions of dollars in crypto... so why not make money by shorting them? In my experience, I have had some success shorting high market cap tokens and increasing my positions when prices rise. For example, if you have a $100,000 portfolio, you can start with a $500 short at 1x leverage and gradually increase as prices go up.

This may not be the most exciting operation... until the airdrop tokens hit your wallet. For example, in April 2023, I did a few small trades on Hyperliquid's closed beta, deposited HLP, and received over $100,000 in airdrop rewards. I also did a few bad trades on Lighter between March and April 2025, but accumulated a lot of points (and luckily referred some big traders).

Every time I farm a new Perp DEX, I regret not farming earlier. Acting early really pays off, and there may be some kind of signal hidden in this.

Summary and Risks

The obvious risks include shorting a token that eventually goes up 100x, and farming a Perp DEX airdrop but the project never launches (TGE). But you can mitigate these risks by adjusting position size and choosing the right tokens/platforms. I'm not saying never go long on tokens, but I think the "small-scale shorting" strategy is a default option worth adopting.