Date: Mon, Sept 22, 2025 | 10:35 AM GMT

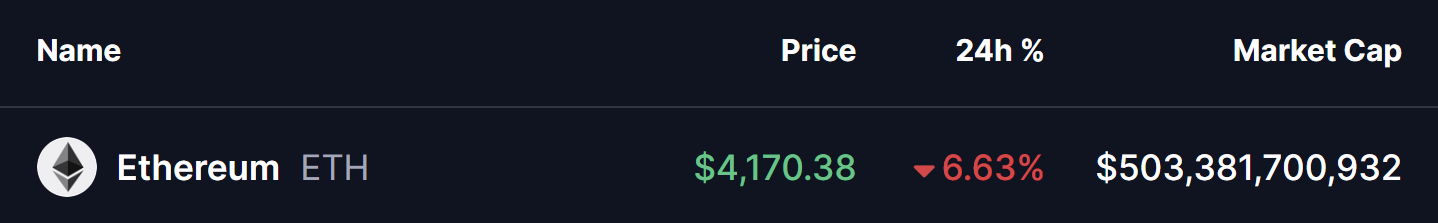

The cryptocurrency market is experiencing heavy selling pressure, with over $1.7 billion in liquidations recorded in the past 24 hours. Ethereum (ETH) has slumped more than 6%, dropping below the $4,175 level, while the total crypto market cap has shed nearly 3.8%. Unsurprisingly, major altcoins are also feeling the brunt of this downturn.

Source: Coinmarketcap

Source: Coinmarketcap

In particular, TOTAL3 — the total crypto market cap excluding Bitcoin and Ethereum — is flashing a key technical signal that could decide the next move for altcoins.

Rising Wedge in Play

On the daily chart, TOTAL3 has been consolidating inside a rising wedge pattern, a structure that often precedes a bearish reversal or continuation.

The rejection from the ascending resistance trendline near $1.17T triggered the latest wave of selling, driving the market down to the wedge’s lower boundary around $1.06T. Notably, this level coincides with the 50-day moving average, making it a critical support zone for altcoins.

TOTAL3 Daily Chart/Coinsprobe (Source: Tradingview)

TOTAL3 Daily Chart/Coinsprobe (Source: Tradingview)

What’s Next for TOTAL3?

At present, TOTAL3 is hovering around $1.08T, where bulls are attempting to defend the wedge’s support trendline. If this level holds, a rebound could push TOTAL3 back toward its upper resistance line near $1.16T, potentially sparking a broad-based recovery across altcoins.

On the flip side, a decisive breakdown below $1.06T would confirm a bearish breakdown of the wedge. Such a move could open the door to deeper losses in altcoins, extending the ongoing market pain.