3 Altcoins Showing Strong Exchange Accumulation — But Still Waiting to Break Out

PEPE, JASMY, and SAND are seeing strong accumulation on exchanges even as their prices remain subdued. Technical setups and on-chain data hint at breakout potential.

Spotting early accumulation activity before a price rally is a challenge for crypto traders. The risk is that even whales that accumulate early cannot always predict the next move.

However, as market sentiment around altcoins improves, several tokens show exchange reserves hitting new lows. This trend could be a positive sign in the current market context.

1. Pepe (PEPE)

PEPE benefits from being an Ethereum-based meme coin at a time when ETH is delivering the strongest market performance.

Despite this, PEPE’s price has not pumped as strongly as expected. Technical analysts observe that its price action has been narrowing within a large symmetrical triangle pattern stretching from the start of the year until now.

PEPE needs a strong catalyst to break above this resistance and rally. Santiment data suggests potential momentum for such a breakout.

PEPE Supply on Exchanges. Source:

Santiment

PEPE Supply on Exchanges. Source:

Santiment

In September, PEPE’s exchange supply dropped to a yearly low of 93.8 trillion. Charts indicate that exchange reserves have steadily declined since the start of 2025.

Additionally, PEPE’s exchange trading volume exceeded $6 billion last week, more than double the previous week.

Falling reserves combined with rising trading volume indicate a favorable setup for a bullish price scenario.

2. Jasmy (JASMY)

Jasmy gains momentum as the robotics sector receives increasingly positive forecasts.

CoinMarketCap data shows that JASMY holders have grown from 86,000 to over 96,000 since the beginning of 2025.

Santiment data also reveals that JASMY’s exchange reserves hit a one-year low of 10.1 billion in September. Charts highlight a persistent downtrend in reserves that lasted for a year.

JASMY Supply on Exchanges. Source:

Santiment

JASMY Supply on Exchanges. Source:

Santiment

Despite these bullish signals, JASMY’s price remains stuck below $0.02.

CryptoMobese, a market analyst, predicts JASMY could soon exit its narrow trading range, enter a five-wave rally, and potentially reach above $0.30.

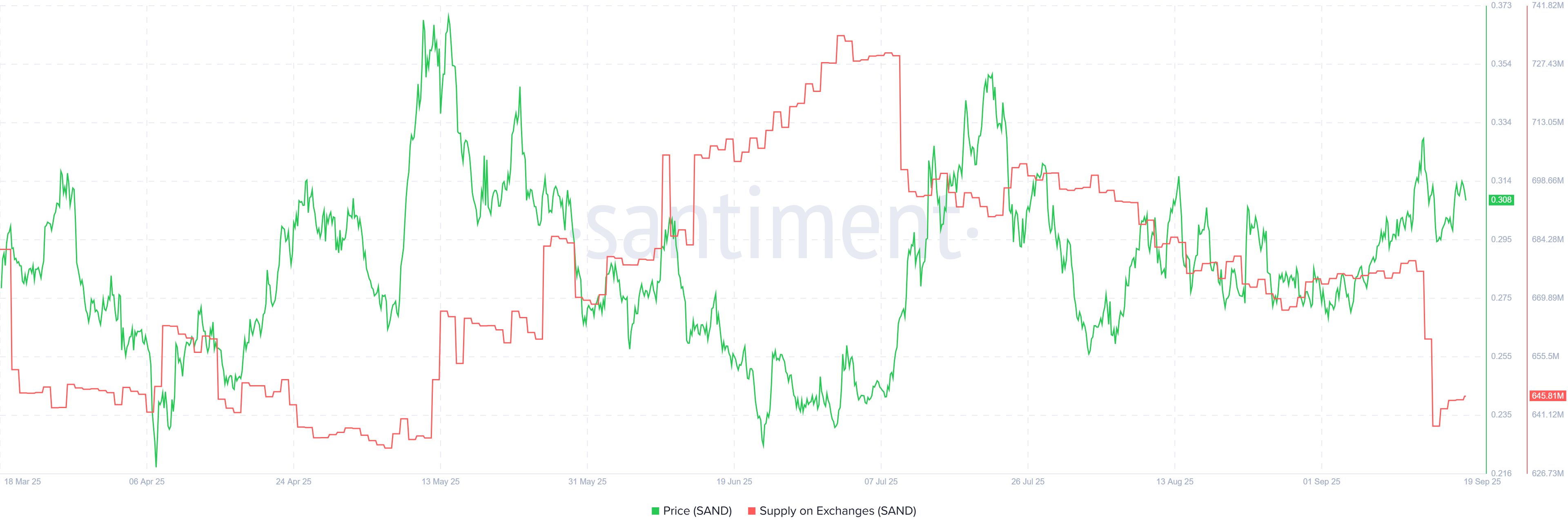

3. The Sandbox (SAND)

SAND’s price has also tightened within a triangle formation, a setup closely watched by technical traders anticipating a breakout.

A bullish sign emerged in September as exchange reserves dropped near yearly lows. In this quarter alone, around 850 million SAND left exchanges.

This trend may reflect growing demand from players to withdraw tokens for use within the metaverse ecosystem.

SAND Supply on Exchanges. Source:

Santiment

SAND Supply on Exchanges. Source:

Santiment

At the same time, Sandbox announced positive news in September by launching Alpha Season 6 with a prize pool of 250,000 SAND. The event could attract more players, energize the ecosystem, and spark a price breakout.

These three altcoins represent another side of altcoin season. Many tokens have yet to showcase their performance, but accumulation patterns suggest that investors may already be preparing for the next move.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Adoption Surges As Finnish MP Sounds Major Alarm

SEC Speeds Up Approval Process for Altcoin ETFs with Strategic Moves

In Brief The SEC withdrew delay notifications for several altcoin ETF applications. This move precedes new cryptocurrency ETF listing standards effective October 1st. Notable price increases were seen in the crypto market following this decision.

Solana Tests 50 Day EMA: Breakout or Breakdown?

Solana retests its 50 day EMA. Will it reclaim key levels or drop to $175? Here’s what traders should watch.Two Key Scenarios for SolanaKey Levels to Watch

Crypto Market Rebounds as $260M Shorts Get Liquidated

Bitcoin and Ethereum lead a recovery after $5B in long liquidations, with $260M in shorts wiped out in the past 24 hours.Bitcoin and Ethereum Regain StrengthNeutral Sentiment Returns Amid Lower Liquidations