Bitcoin Price Soars Past $117,000 Following Fed’s 25 bps Rate Cut

Bitcoin crossed $117,000 after the Fed’s 25 bps rate cut, diverging from volatile equities as ETF inflows provided strong support. BTC now eyes $120,000 but risks correction if profit-taking builds.

Bitcoin crossed $117,000 in the past 24 hours, posting gains even as global equity markets swung sharply following the Federal Reserve’s latest rate cute.

While stocks struggled to find direction, BTC managed to hold steady, supported by renewed inflows into crypto investment products.

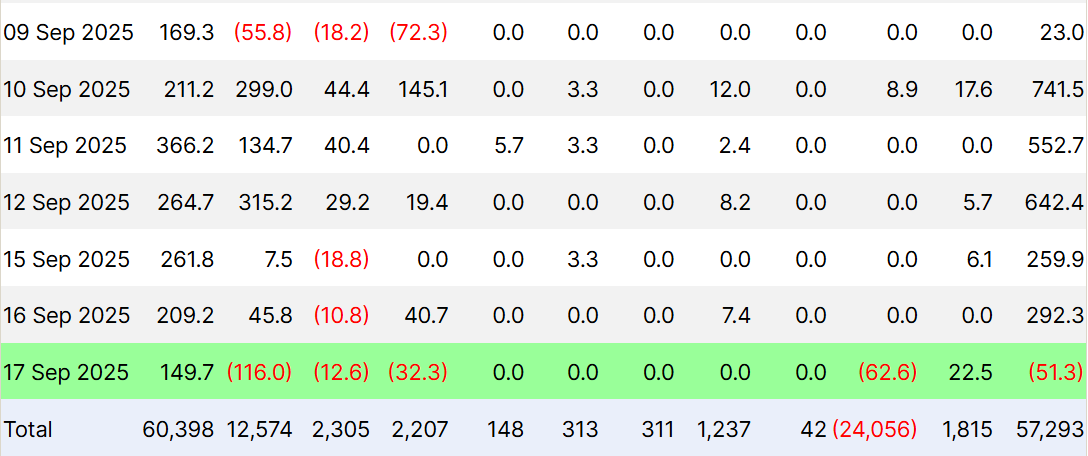

Bitcoin ETF Inflows Rise

The Federal Open Market Committee announced a 25 bps rate cut, which, on paper, is positive for digital assets. However, traditional markets saw the move as a signal of weakening economic conditions, with indexes spiking and then falling in volatile sessions.

Bitcoin, however, maintained momentum, thanks largely to institutional support. ETF inflows were strong throughout the week, except on September 17 when the FOMC decision had yet to be released. Investors appeared unfazed by macro turbulence, betting that Bitcoin’s trajectory would remain positive despite broader financial market concerns.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

Bitcoin ETF Netflows. Source:

Bitcoin ETF Netflows. Source:

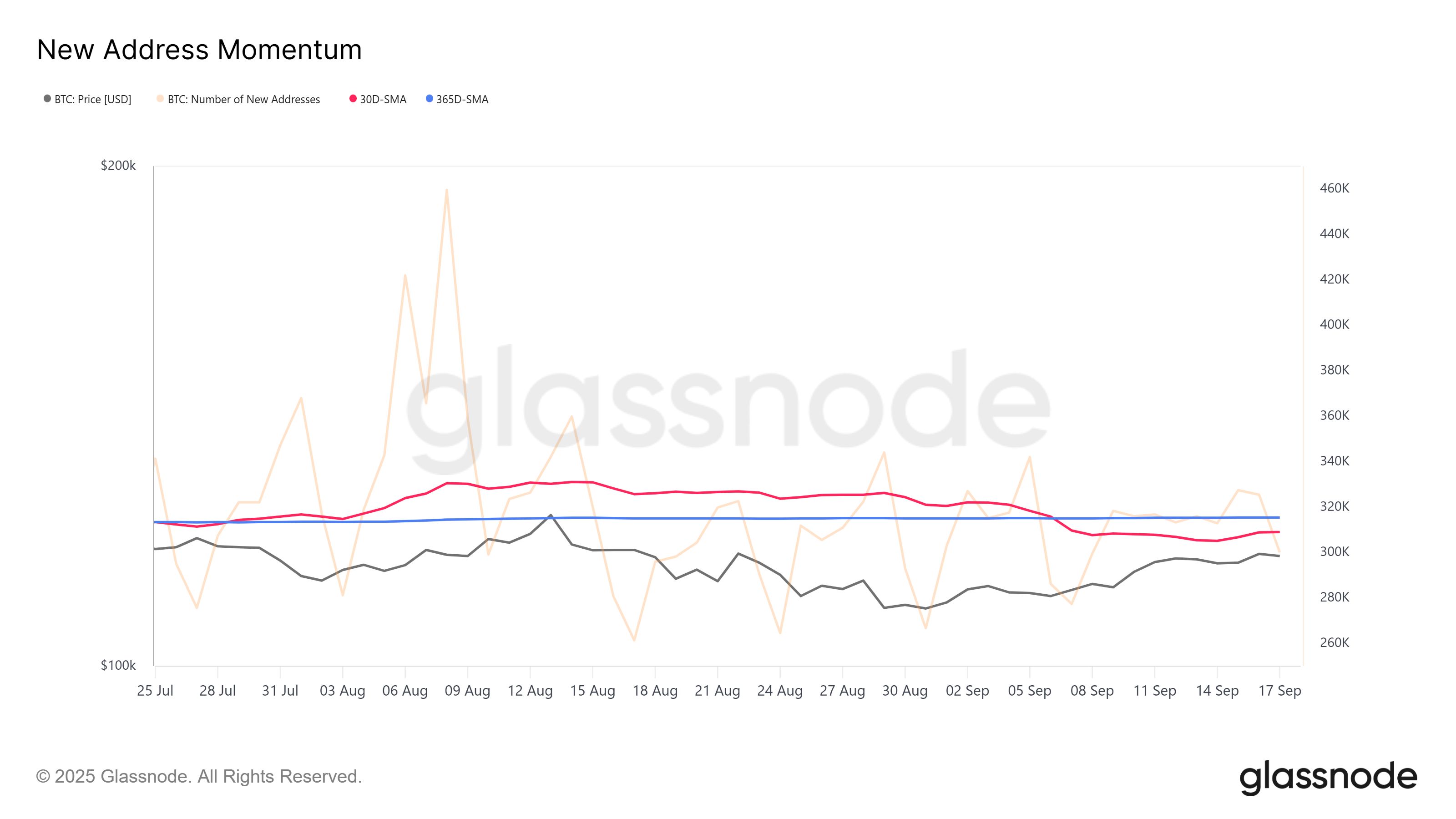

On-chain signals suggest that not every participant shares the same optimism. New Address Momentum has contracted in recent days, reflecting hesitation from retail investors. Fewer fresh entries into the market highlight concerns about potential saturation or an impending reversal.

That said, long-term participants and institutional investors remain consistent in their activity, helping BTC hold its price strength. While retail hesitation can limit growth speed, Bitcoin’s resilience is underscored by its ability to diverge from stock markets when volatility spikes.

Bitcoin New Address Momentum. Source:

Bitcoin New Address Momentum. Source:

BTC Price May Continue Its Rally

Bitcoin is currently trading at $117,182, continuing its uptrend since the beginning of the month. The immediate challenge lies in flipping $117,261 into support, which would give the cryptocurrency the base it needs for further upside.

If successful, Bitcoin could target $120,000 as its next milestone. A breach and consolidation above that level could set the stage for further gains. This is likely, particularly if ETF inflows continue reinforcing investor confidence.

Bitcoin Price Analysis. Source:

Bitcoin Price Analysis. Source:

However, risks remain. Should selling pressure increase, Bitcoin may struggle to hold above key levels. A drop below $115,000 could open the door to a correction toward $112,500, invalidating the bullish thesis and cooling near-term momentum.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Top VC a16z Discusses the Truth About Crypto Hiring: Crypto Veterans vs. Cross-Industry Experts, Who Is the Real Winner?

The article discusses the challenges faced by the crypto industry in recruiting talent, analyzes the advantages of crypto-native talent versus traditional tech talent, and provides recruitment strategies and onboarding advice. Summary generated by Mars AI. This summary is generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative updates.

‘Certainty Assets’ in a Bear Market? Fair3 Uses On-Chain Insurance to Unlock a New Wave of Buying Logic

The article discusses the frequent occurrence of rug pull incidents in the crypto industry and their impact on investors. It introduces the decentralized insurance mechanism of the Fair3 Fairness Foundation, which provides protection through on-chain transparency, position-linked guarantees, and community governance. This mechanism may potentially change the operational logic of tokenomics. Summary generated by Mars AI This summary is generated by the Mars AI model. The accuracy and completeness of its content are still in the iterative updating stage.

Fluence DePIN Day 2025: Building the Cornerstone of Future Web3 Infrastructure

The 12th DePIN Day will be held in Singapore in October, focusing on how decentralized technology is reshaping real-world infrastructure. The event is co-hosted by Fluence and Protocol Labs and will bring together top builders and thinkers from around the world. Summary generated by Mars AI. This summary is generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively improved.

FED's Kashkari confident in achieving inflation targets