Grayscale ETH staking: Grayscale moved 40,000 ETH in a transfer consistent with staking preparation, suggesting the firm may test SEC clarity on staking inside US spot Ether ETFs and position ETHE ahead of any formal approval.

-

40,000 ETH moved — likely positioning for staking

-

Grayscale’s ETHE holds over 1.06 million ETH, worth about $4.8 billion.

-

SEC delays and guidance plus Arkham Intelligence and CryptoQuant data indicate shifting regulatory and supply dynamics.

Grayscale ETH staking: Grayscale moves 40,000 ETH as it eyes staking for ETFs — read analysis of implications, SEC context, and market impact. Learn what comes next.

What is Grayscale ETH staking and why does the 40,000 ETH transfer matter?

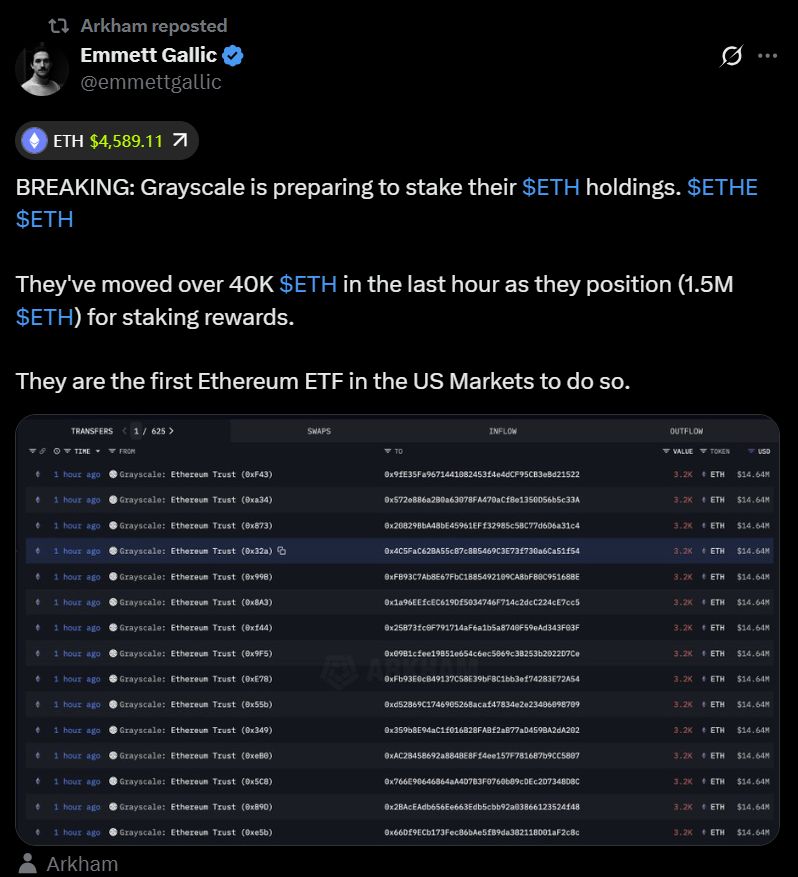

Grayscale ETH staking refers to Grayscale positioning its Ether holdings to earn staking rewards, a move consistent with the transfer of 40,000 ETH tracked onchain. This could mark the first time a major US spot Ether fund sponsor tests staking mechanics ahead of SEC approval. The transfer signals preparatory operational steps and market intent.

How could staking change an ETH spot ETF?

Staking in a spot Ether ETF would allow the fund to generate yield for shareholders rather than purely tracking price exposure. Analysts — including Markus Thielen of 10x Research — have said staking could materially reshape institutional demand. Data from CryptoQuant showing shrinking exchange reserves and Arkham Intelligence tracking Grayscale’s transfer add context to potential supply tightening.

Grayscale’s Ethereum Trust (ETHE) currently holds more than 1.06 million ETH, valued at roughly $4.8 billion. The firm created ETHE in 2017 and introduced a lower-cost Ethereum Mini Trust in 2024 via a partial spin-off. The recent Arkham-tracked move of 40,000 ETH is consistent with internal positioning to enable staking operations, though the SEC has not yet approved staking within Grayscale’s filings.

Source: Emmett Gallic

When did regulators provide clarity on staking and what does that imply?

The US Securities and Exchange Commission delayed rulings earlier this year on staking permissions but has since offered guidance suggesting certain liquid staking arrangements may lie outside its direct jurisdiction. That regulatory nuance opens a path for funds to consider staking structures, subject to final approvals and custodial/compliance safeguards.

What signals are analysts and onchain data showing?

Spot ETF inflows and falling exchange reserves point to institutional accumulation of ETH. Arkham Intelligence’s onchain tracking flagged Grayscale’s 40,000 ETH transfer. CryptoQuant data show Ether exchange reserves at multi-year lows, supporting the thesis that available sell-side liquidity has tightened. Experts note that approved staking could create incremental demand as funds seek yield plus exposure.

Related: Ethereum unstaking queue goes ‘parabolic’: What does it mean for price?

Ether exchange reserves across all crypto exchanges. Source: CryptoQuant

Could Grayscale be first to stake for a US Ether ETF?

Evidence from the transfer suggests Grayscale may be preparing to stake, potentially making it the first US sponsor to operationalize staking for a spot Ether vehicle if approvals follow. No spot Ether ETFs currently advertise staking, and the SEC’s formal sign-off remains the gating item.

How might funds implement staking while meeting compliance?

Funds would need clear custodial frameworks, segregation of staked vs. liquid assets, audited node operators or validated liquid staking protocols, and transparent disclosure to investors. Regulatory filings that Grayscale has submitted aim to address these points, though final SEC rulings are pending.

Frequently Asked Questions

Will staking increase returns for ETF investors?

Staking could add yield on top of price exposure, but net returns depend on validator costs, slashing risk, staking fees, and the fund’s fee structure. Any yield would be disclosed in fund documentation if approved.

How much ETH does Grayscale hold?

Grayscale’s Ethereum Trust (ETHE) manages more than 1.06 million ETH, roughly valued at $4.8 billion at recent prices, making it one of the largest institutional Ether holders.

Is the SEC likely to approve staking for spot Ether ETFs?

The SEC has signalled limited guidance indicating some liquid staking may be outside its purview, but explicit approval for ETF staking features has not yet been granted. Firms are preparing operationally while the agency continues review.

Key Takeaways

- Significant transfer: Grayscale moved ~40,000 ETH in a transfer consistent with staking preparation.

- Large institutional holdings: ETHE holds over 1.06 million ETH, which gives Grayscale scale to materially impact staking flows if implemented.

- Regulatory hinge: SEC guidance and filings will determine whether staking can be integrated into US spot Ether ETFs; firms are positioning ahead of rulings.

Conclusion

Grayscale’s 40,000 ETH transfer is an actionable signal that the firm is preparing operationally for potential ETH staking within regulated products. Continued onchain monitoring and regulatory updates from the SEC will determine timing and scope. For investors and market participants, the prospect of staking-enabled ETFs could change flows and yield dynamics; watch filings, Arkham Intelligence and CryptoQuant data for updates.

Published by COINOTAG • Updated: 2025-09-18 • Sources: Arkham Intelligence, SEC public statements, CryptoQuant, 10x Research (Markus Thielen)