Metaplanet Opens Subsidiary in Miami to Expand Bitcoin Derivatives

- Metaplanet creates US subsidiary focused on bitcoin

- The company has already accumulated more than 20.136 BTC in treasury.

- New unit will have initial capital of US$ 15 million

Tokyo-listed Metaplanet (MTPLF), known for its aggressive bitcoin treasury strategy, has announced the creation of Metaplanet Income Corp. , a Miami-based subsidiary. The new entity will focus on derivatives and revenue-generating operations with Bitcoin, expanding the company's presence in the United States.

According to the company's board, the unit will have initial capital of US$15 million and will be wholly owned by Metaplanet Holdings, Inc. It will operate independently of the main treasury assets to ensure greater balance in risk management.

The announcement formalizes a business launched in 2024 that, according to the company, has already been delivering "consistent and growing revenue and net income." CEO Simon Gerovich celebrated the milestone in a post on X, stating: "This business has become our growth engine."

Metaplanet has established Metaplanet Income Corp. in the US to further expand our Bitcoin Income Generation Business. This business has become our engine of growth, generating consistent revenue and net income. We are cash flow positive, producing significant internal cash… https://t.co/WvWkK5ZWzv

— Simon Gerovich (@gerovich) September 17, 2025

The new structure will be led by Gerovich and directors Dylan LeClair and Darren Winia. While Metaplanet does not expect an immediate impact on its 2025 results, it emphasized that it will follow the Tokyo Stock Exchange's requirements to disclose additional information when necessary.

The subsidiary's launch comes after Metaplanet raised $1,4 billion in an international public offering, surpassing its initial target of $880 million. The company stated that the funds will be used to accelerate acquisitions, strengthen its capital policy, and position it among the largest corporate holders of bitcoin, behind only Strategy, led by Michael Saylor.

According to Gerovich, the fundraising attracted mutual, sovereign, and hedge funds, reinforcing institutional confidence in the long-term Bitcoin-based strategy. He described the move as the foundation for the company's "next phase" of global growth.

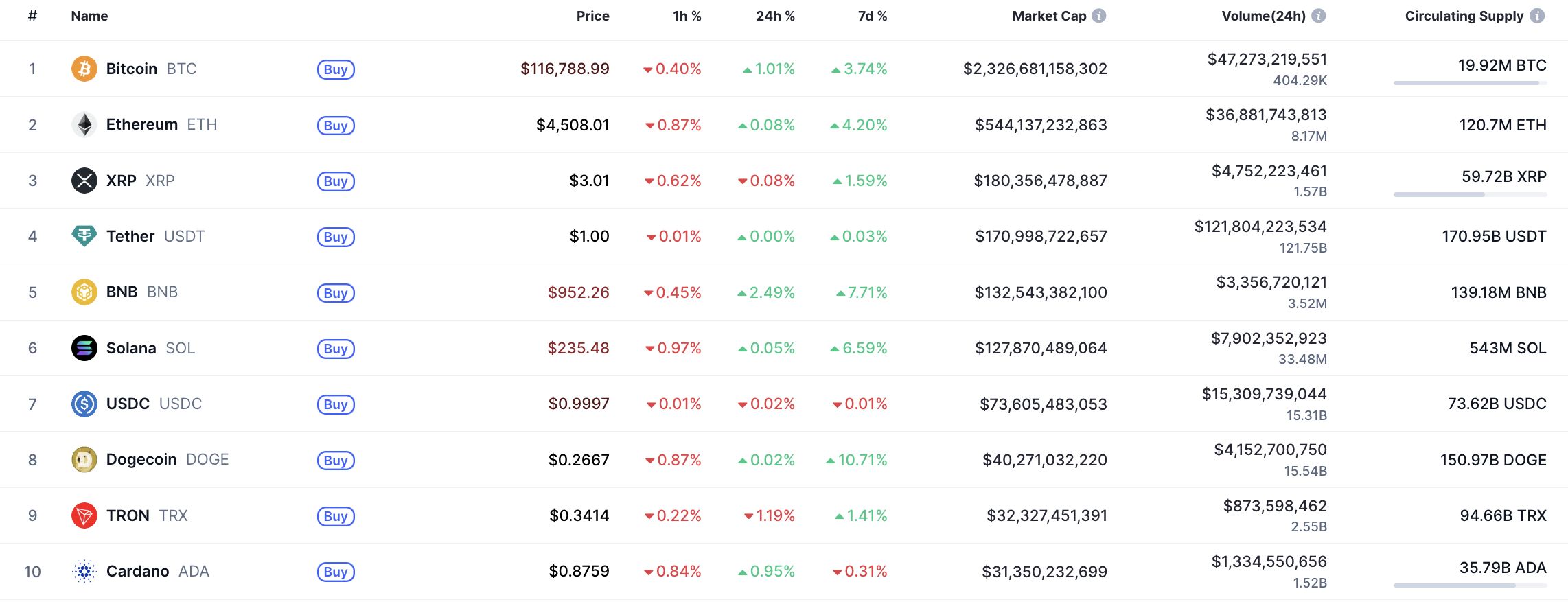

Meanwhile, Metaplanet continued to expand its cryptocurrency holdings. Last week, the company confirmed that it had increased its reserves to 20.136 BTC, an estimated value of over US$2,3 billion. This position reinforces the company's strategy of establishing itself as a global leader in Bitcoin corporate treasury, while also diversifying its revenue-generating operations with financial instruments.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana Could Remain Rangebound Near $230–$240 After False Breakout, Possibly Testing $220–$230

Midweek CoinStats: DOGE May Consolidate Near $0.27, Could Break Toward $0.30–$0.35

SHIB May Remain Sideways Near $0.000013 After False Breakout, Could Test $0.00001290