Solana Price Nears $250, But 6-Month High Selling May Be A Roadblock

Solana is closing in on $250, but long-term holder sell-offs at multi-month highs may block further gains and trigger a correction toward $221.

Solana has extended its uptrend, bringing the altcoin close to the critical $250 mark. This psychological threshold is seen as a key level for SOL.

However, before reaching it, the crypto token appears to be facing skepticism from a significant group of holders.

Solana Crucial Holders Sell

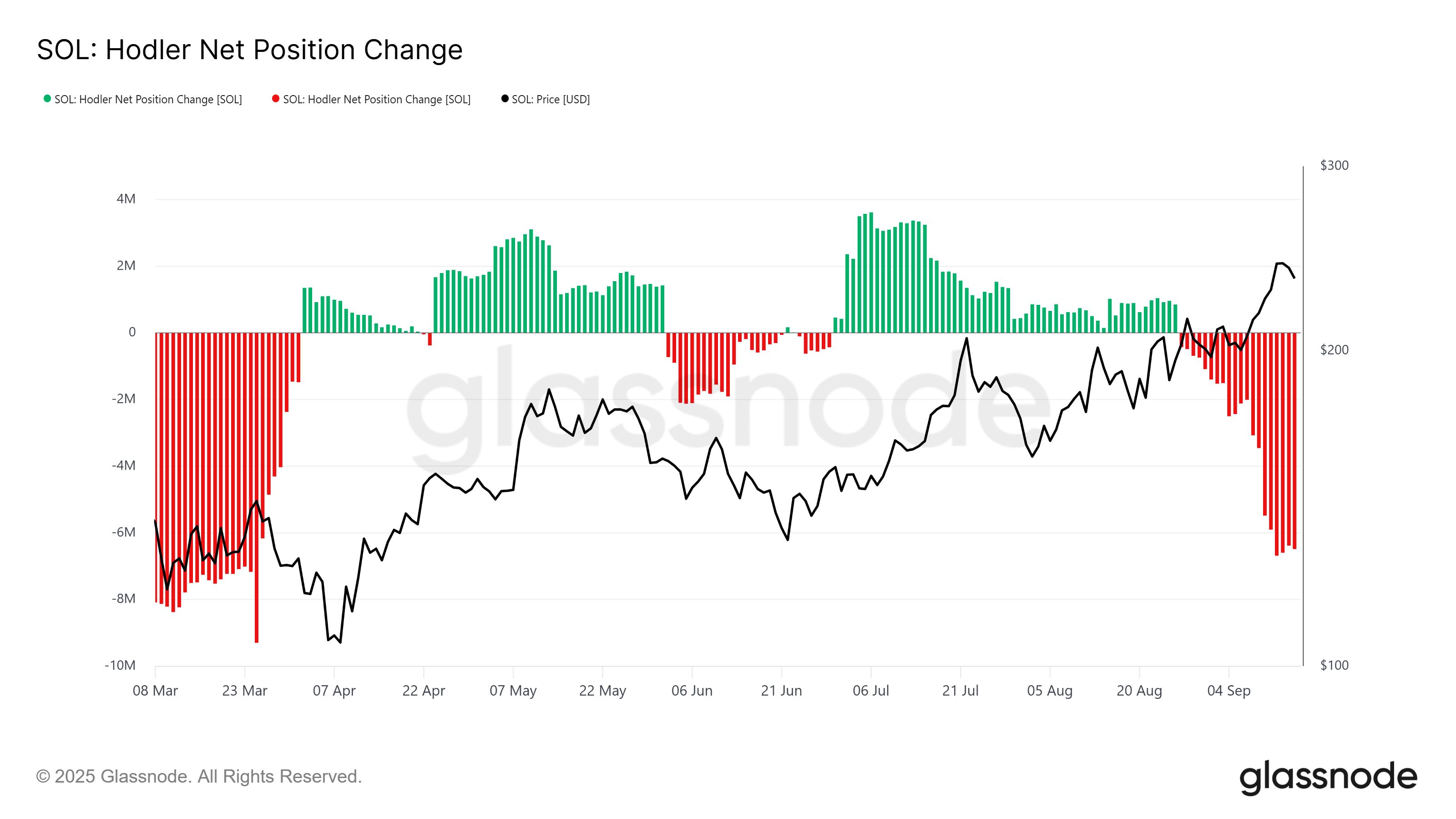

Data from the HODLer net position change shows long-term holders have started selling their assets. These investors play an outsized role in influencing Solana’s trajectory, as their accumulation often supports recovery while their selling can trigger declines.

At present, long-term holder selling is at a six-month high, reflecting waning confidence. This could pressure Solana’s price in the short term. This would prevent it from securing $250 and reducing momentum if the selling trend continues among these influential market participants.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

Solana HODLer Net Position Change. Source;

Glassnode

Solana HODLer Net Position Change. Source;

Glassnode

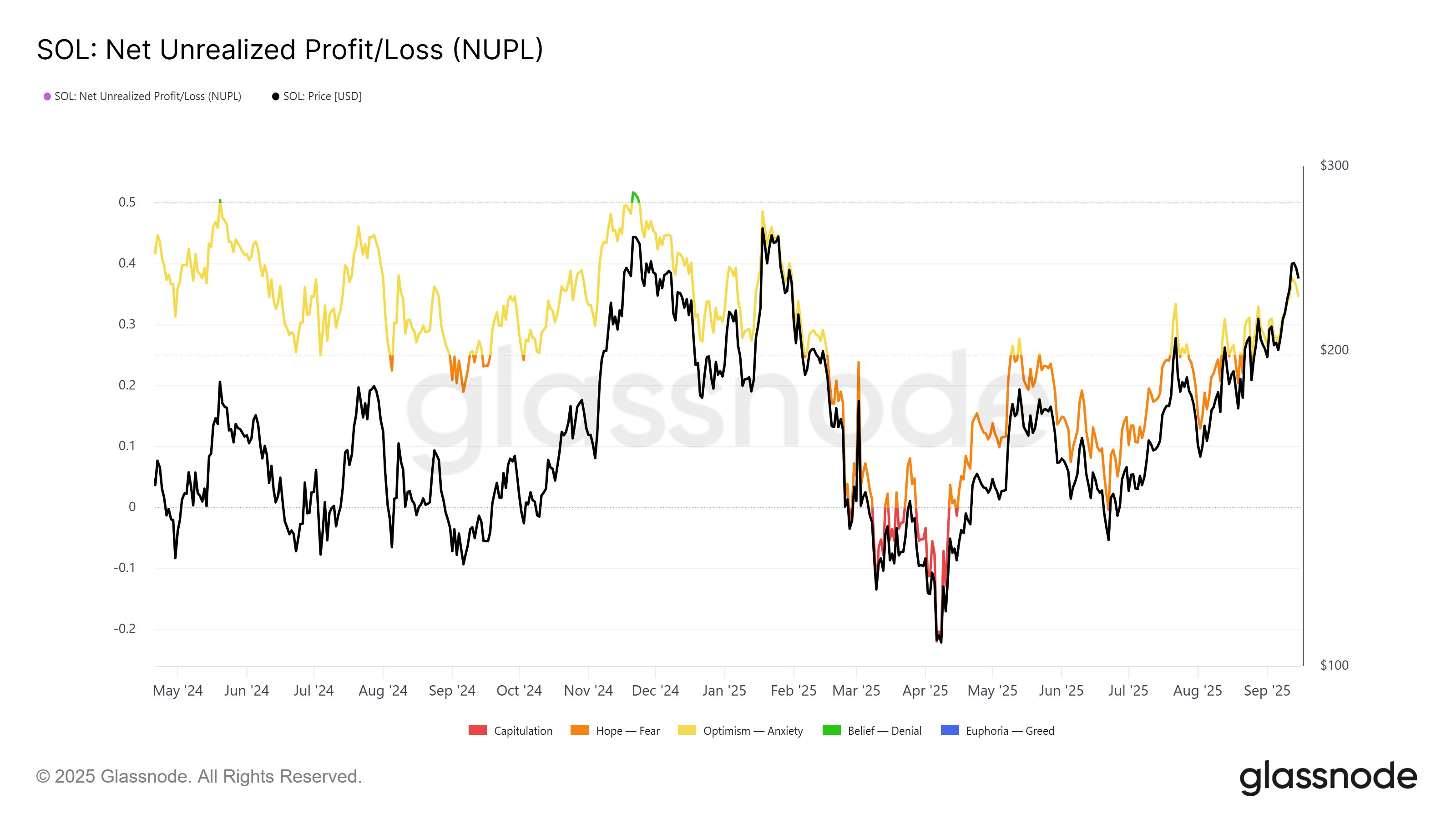

On the broader front, Solana’s NUPL indicator suggests the cryptocurrency has yet to reach a saturation point. Historically, a climb toward the Belief-Denial threshold at 0.5 often marks a reversal, leading to extended corrections in the following weeks.

This leaves Solana with room for additional short-term gains before a major cooling-off period sets in.

Solana NUPL. Source;

Glassnode

Solana NUPL. Source;

Glassnode

SOL Price Nears Critical Level

Currently, Solana trades at $235, sitting just 6% below the $250 milestone. Over the weekend, SOL attempted to reach this target but failed. However, it has managed to hold steady above the $232 support level.

If bullish momentum continues, Solana could rebound from $232 and test resistance at $242. A successful breach, particularly if long-term holders slow their selling. This could push SOL toward reclaiming $250 in the near term.

Solana Price Analysis. Source:

TradingView

Solana Price Analysis. Source:

TradingView

However, if selling pressure from long-term holders accelerates, Solana may struggle to defend $232 as support. This scenario could result in a correction toward $221, undermining bullish momentum and invalidating near-term upward projections.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | SEC Expected to Issue "Innovation Exemptions" for the Crypto Industry in "About a Month"

The SEC is expected to issue an innovation exemption for the crypto industry. The UK "Digital Assets and Other Property Act" has come into effect. BlackRock's CEO revealed that sovereign wealth funds are buying bitcoin. Bank of America recommends clients allocate to crypto assets. Bitcoin selling pressure is nearing its end. Summary generated by Mars AI. The accuracy and completeness of this summary are still being improved as the Mars AI model continues to iterate.

a16z: Inefficient governance and dormant tokens pose a more severe quantum threat to BTC.

Deep Reflection: I Wasted Eight Years in the Crypto Industry

In recent days, an article titled "I Wasted Eight Years in the Crypto Industry" has garnered over a million views and widespread resonance on Twitter, directly addressing the gambling nature and nihilistic tendencies of cryptocurrencies. ChainCatcher now translates this article for further discussion and exchange.