Cardano (ADA) Battles $0.926 Wall as Bear Pressure Mounts

Cardano’s battle with the $0.926 resistance is intensifying, with bearish indicators hinting at deeper losses unless bulls reclaim momentum.

Despite repeated breakout attempts, popular altcoin Cardano (ADA) has struggled to breach the $0.926 resistance level since mid-August.

Each rally toward the mark has been met with heavy selling pressure, keeping the token in a decline. The latest rejection came on September 14, when ADA tested the barrier again but failed to hold momentum. That setback triggered a new downward move, with the token falling by 5% since then.

ADA’s Bullish Structure Breaks Down

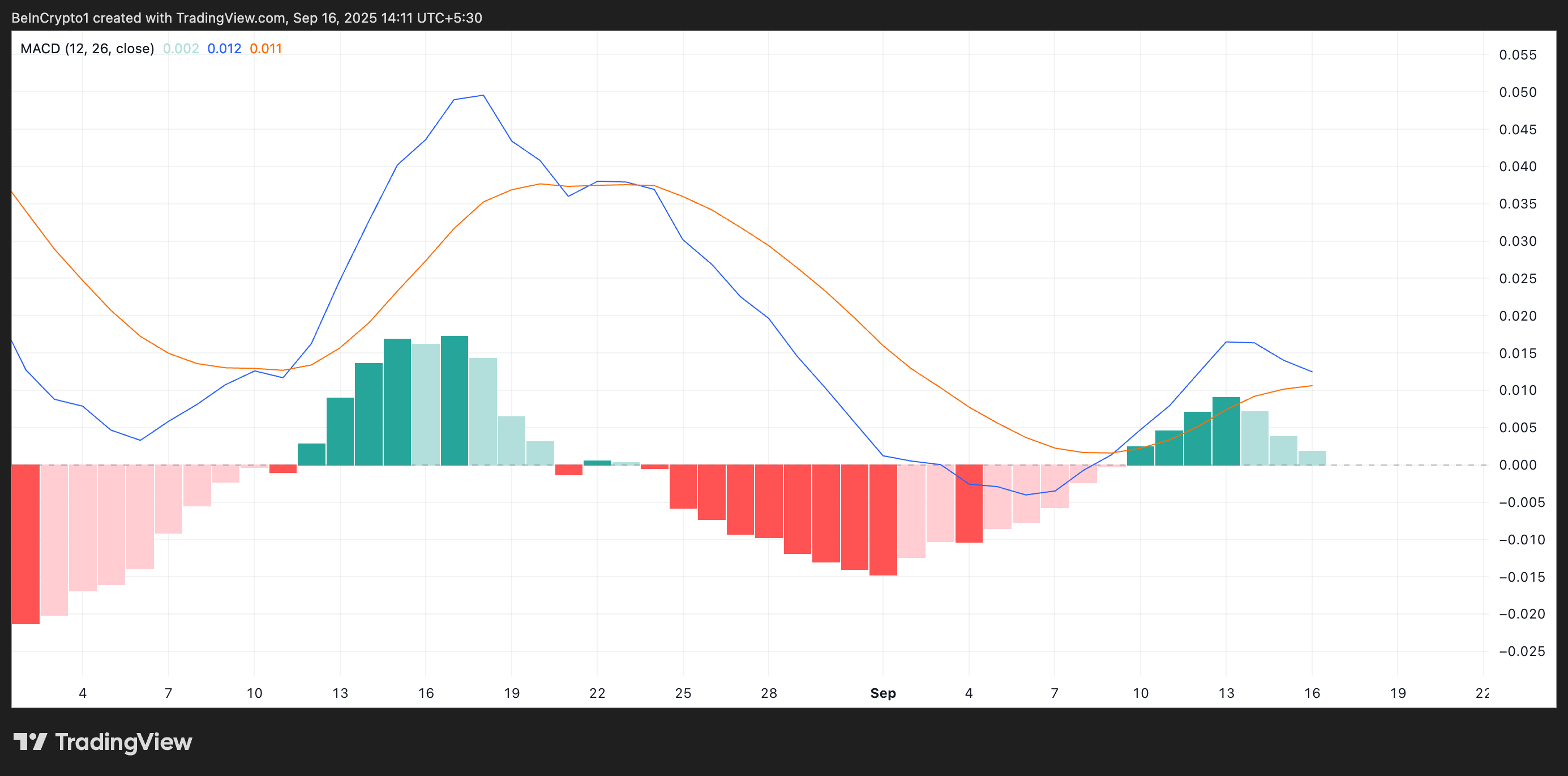

Readings from technical indicators observed on a one-day chart hint at the likelihood of an extended ADA price decline. For example, the coin’s Moving Average Convergence Divergence (MACD) is forming a bearish crossover, hinting at deeper losses in the near term.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Cardano MACD. Source:

TradingView

Cardano MACD. Source:

TradingView

The MACD indicator identifies trends and momentum in an asset’s price movement, helping traders spot potential buy or sell signals through crossovers between the MACD and signal lines. It forms a bearish crossover when an asset’s MACD line (blue) falls below its signal line (orange), indicating a breakdown in the market’s bullish structure.

ADA’s looming bearish crossover on the MACD suggests that bullish momentum is steadily weakening, leaving the coin vulnerable to sharper declines if sellers maintain control.

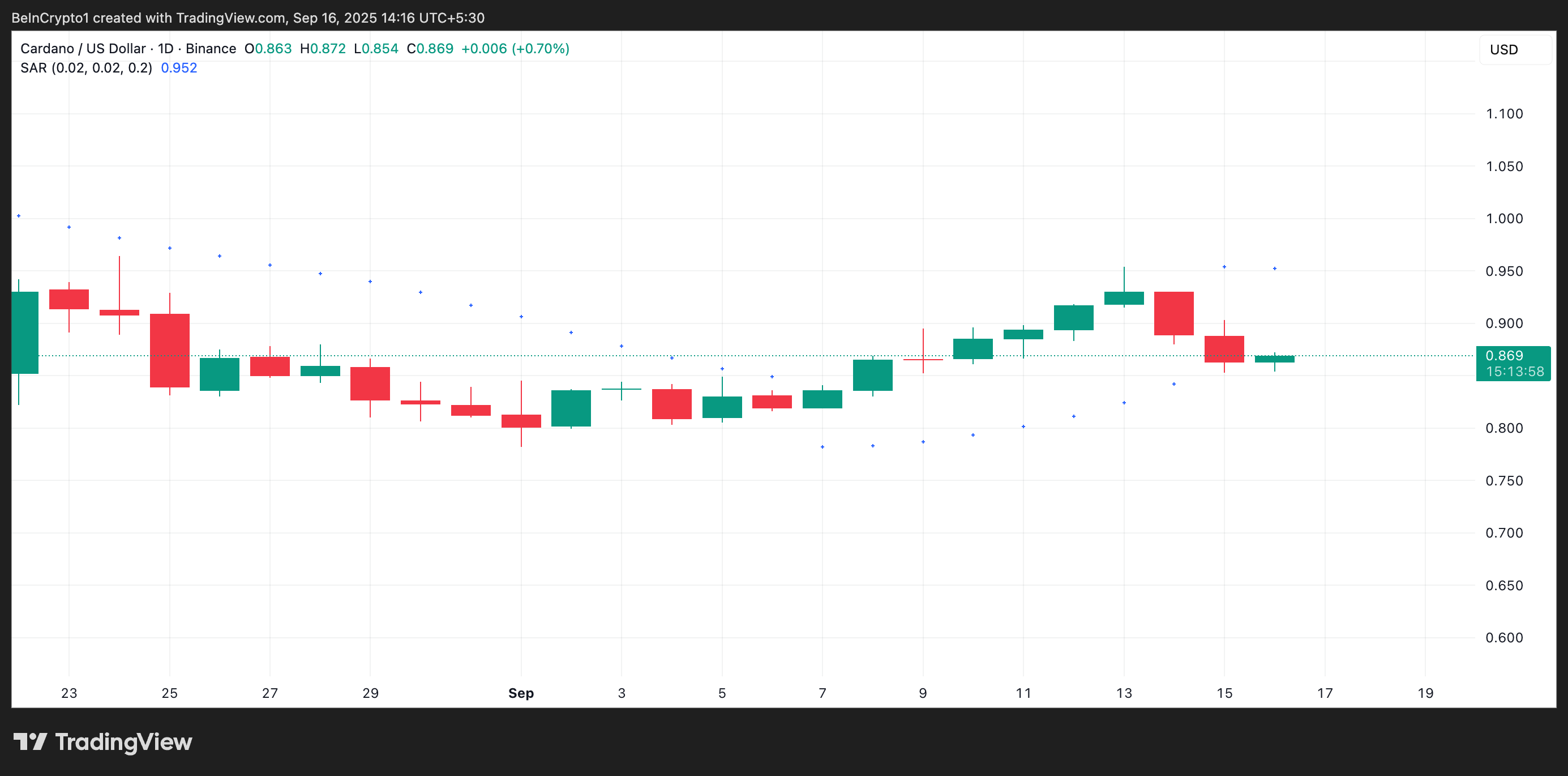

Moreover, ADA’s Parabolic Stop and Reverse (SAR) has flipped position, with its dots now positioned above the price to form dynamic resistance. For context, as of this writing, the SAR is positioned at $0.952, while ADA trades at $0.869.

Cardano Parabolic SAR. Source:

TradingView

Cardano Parabolic SAR. Source:

TradingView

The Parabolic SAR indicator tracks potential trend reversals by placing dots above or below an asset’s price. When the dots remain above price action, it signals that bearish pressure is firmly in control and that any recovery attempts may continue to fail.

This worsens the bearish pressure on ADA and suggests that deeper declines could be on the horizon unless bulls reclaim lost ground quickly.

Will Bears Drag It to $0.677 or Bulls Lift It to $1.079?

With key momentum indicators aligning against the bulls, ADA appears increasingly tilted toward further downside. In this scenario, it could extend its price decline and fall to $0.802. If the bulls fail to defend this support floor, the dip could reach $0.677.

Cardano Price Analysis Source:

TradingView

Cardano Price Analysis Source:

TradingView

Conversely, if bullish momentum regains strength and ADA successfully breaches the $0.926 barrier on a retest, it could pave the way for a rally toward $1.079, a level last seen in March.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Top VC a16z Discusses the Truth About Crypto Hiring: Crypto Veterans vs. Cross-Industry Experts, Who Is the Real Winner?

The article discusses the challenges faced by the crypto industry in recruiting talent, analyzes the advantages of crypto-native talent versus traditional tech talent, and provides recruitment strategies and onboarding advice. Summary generated by Mars AI. This summary is generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative updates.

‘Certainty Assets’ in a Bear Market? Fair3 Uses On-Chain Insurance to Unlock a New Wave of Buying Logic

The article discusses the frequent occurrence of rug pull incidents in the crypto industry and their impact on investors. It introduces the decentralized insurance mechanism of the Fair3 Fairness Foundation, which provides protection through on-chain transparency, position-linked guarantees, and community governance. This mechanism may potentially change the operational logic of tokenomics. Summary generated by Mars AI This summary is generated by the Mars AI model. The accuracy and completeness of its content are still in the iterative updating stage.

Fluence DePIN Day 2025: Building the Cornerstone of Future Web3 Infrastructure

The 12th DePIN Day will be held in Singapore in October, focusing on how decentralized technology is reshaping real-world infrastructure. The event is co-hosted by Fluence and Protocol Labs and will bring together top builders and thinkers from around the world. Summary generated by Mars AI. This summary is generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively improved.

FED's Kashkari confident in achieving inflation targets