BTC Volatility (September 8 - September 15)

SignalPlus2025/09/16 21:31

Show original

By:SignalPlus

Key indicators (Hong Kong time, 16:00 on September 8 to 16:00 on September 15): BTC/USD rose by 3.8% (111,3...

Key Metrics (Hong Kong Time, September 8, 16:00 to September 15, 16:00)

- BTC/USD rose 3.8% (from $111,300 to $115,500), ETH/USD rose 7.2% (from $4,290 to $4,600)

- The BTC spot trend aligns with our gradually evolving view: the upward movement that began in September 2024 has basically completed and is now entering an adjustment phase. It is expected that this phase will mainly be sideways, with the market preparing to test previous highs (or even break historical highs), followed by a larger downward correction. This adjustment may break through the $101,000 support level, causing the price to return to the high-volatility range of $88,000–$92,000, and eventually trigger a three-wave structural adjustment lasting several months (or even the whole year), targeting the $60,000–$75,000 range. The upper resistance is at $118,000 and $120,000; a breakout may challenge the all-time high. So far, the $112,000–$113,000 support below remains relatively solid.

Market Themes

- Last week, the market focused on US economic data and corporate earnings. Against a backdrop of weak non-farm payroll data, expectations for a Federal Reserve rate cut in September are high, and the weak University of Michigan Consumer Sentiment Index and PPI data further reinforced these expectations—even before the CPI was released, the interest rate market had already started pricing in a full cycle of six rate cuts by the end of 2026. Although the core CPI monthly rate of 0.346% was the highest since January this year, the market quickly digested this impact due to recent Fed statements and attention to employment data, allowing US stocks to continue their rally into the weekend.

- Cryptocurrencies benefited from the warming risk appetite: BTC filled the $116,000–$110,000 gap formed after the Jackson Hole meeting. After months of sluggish performance, market confidence is gradually recovering, and ETF inflows have rebounded significantly after the "summer lull." The collapse of the DATs (Bitcoin Trust) NAV premium rate instead boosted overall sentiment, as the coin price and DAT equity price decoupled again. In addition, Galaxy Digital announced a $1.65 billion investment to build a Solana ecosystem treasury, pushing the SOL price close to $250.

BTC Implied Volatility

- Realized volatility fell significantly last week to the 20%-25% range. ETF capital inflows supported spot prices, but each rally was met with heavy selling pressure, limiting upward volatility. As the price gradually approaches the psychological resistance band of $120,000–$124,000, selling liquidity may gradually thin out, so the trend of realized volatility needs to be closely monitored going forward.

- Sluggish realized volatility has dragged down implied volatility (especially for short tenors), but with the FOMC meeting this Wednesday and the price repeatedly testing the upper end of the range, short-term volatility has naturally rebounded. It is possible that we will see bullish spreads re-enter the market, betting that BTC will catch up with the rate-cut rally already seen in other markets, which supports options contracts expiring after September.

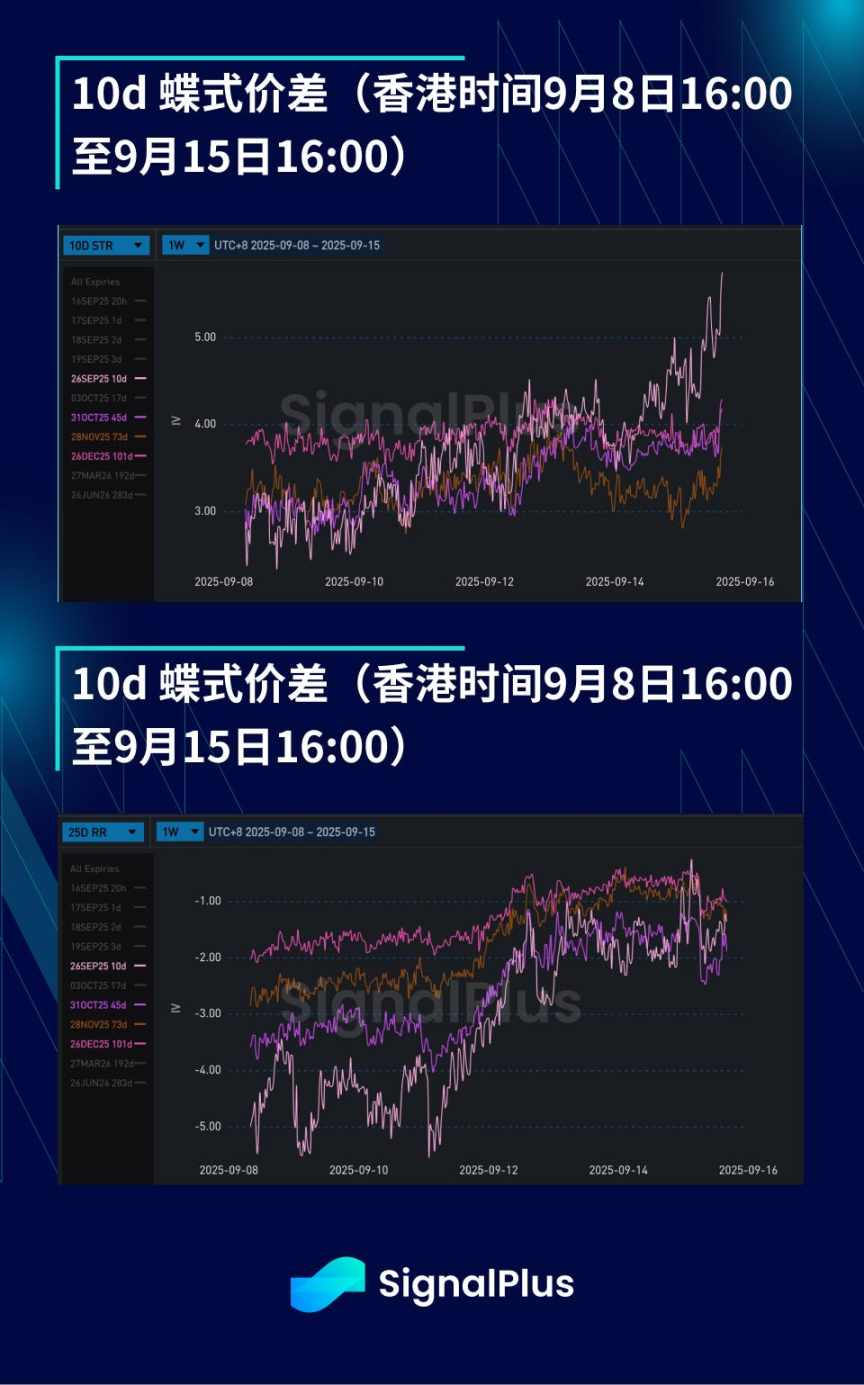

BTC USD Skew / Kurtosis

- The skew indicator shows that put option premiums continue to narrow: ETF inflows have suppressed downside realized volatility, and the risk-on environment has helped spot prices break through the initial resistance of $113,000–$114,000. However, compared to previous cycles, structural bullish demand is still insufficient. Given the low volatility, long-term cash investors are still buying downside protection during the rally.

- Kurtosis rose before the weekend: Historically, BTC's seasonal performance in September has been weak, and (other) markets have already fully priced in the Fed's data-driven risk appetite, so investors continue to seek tail protection. Previously, demand was mainly concentrated on the put side (skew remained to the downside), but the recent price rebound has brought call options above the previous all-time high into focus, pushing kurtosis higher (while put skew narrows)—indicating that the market is strongly avoiding holding too few option positions when breaking through previous highs.

Wishing you a successful trading week!

0

1

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

ETH price fluctuates sharply: Event review and in-depth outlook

AICoin•2025/12/07 20:29

I spent eight years of my youth sinking into the crypto "casino"

Bitpush•2025/12/07 20:24

Bitcoin price dips below 88K as analysis blames FOMC nerves

Cointelegraph•2025/12/07 18:45

Crypto: How Europe Wants to Enforce Its Version of the SEC

Cointribune•2025/12/07 15:03

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$91,436.25

+2.10%

Ethereum

ETH

$3,139.76

+3.28%

Tether USDt

USDT

$1

-0.02%

XRP

XRP

$2.09

+2.72%

BNB

BNB

$904.02

+1.03%

USDC

USDC

$1.0000

+0.01%

Solana

SOL

$135.92

+2.60%

TRON

TRX

$0.2873

+0.03%

Dogecoin

DOGE

$0.1420

+1.59%

Cardano

ADA

$0.4317

+4.10%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now