Standard Chartered’s SC Ventures is launching a $250 million cryptocurrency investment fund in 2026, focusing on global digital-asset opportunities and backed by Middle East investors. The move signals rising institutional interest in altcoins and complements corporate treasury accumulation strategies.

-

SC Ventures to raise $250M for a 2026 digital asset fund.

-

Fund backed by Middle East investors; aims at global crypto opportunities.

-

Complementary $100M Africa fund and possible venture debt vehicle under consideration.

SC Ventures crypto fund: Standard Chartered launches a $250M digital asset fund in 2026, backed by Middle East investors — learn implications and next steps.

SC Ventures is preparing to launch a cryptocurrency fund in 2026, with a focus on global digital asset investment opportunities.

Standard Chartered’s venture arm, SC Ventures, is preparing to launch a $250 million cryptocurrency investment fund in 2026, signaling growing institutional appetite for digital assets. The fund will target a range of global digital-asset opportunities and is reported to be backed by investors in the Middle East.

What is SC Ventures’ $250 million crypto fund?

SC Ventures’ crypto fund is a $250 million investment vehicle planned for 2026 that will target global digital assets and is backed by Middle East investors. The fund forms part of a broader institutional trend toward corporate treasury accumulation and long-term digital‑asset exposure.

How will the fund be structured and who is backing it?

According to Gautam Jain (operating partner, SC Ventures) as reported by Bloomberg, the fund will raise capital primarily from Middle East investors and pursue global opportunities. Details on asset allocation were not disclosed publicly at the time of reporting.

Why does this matter for institutional inflows?

Large corporate funds and treasury strategies can increase market liquidity and broaden institutional adoption. Standard Chartered’s move follows other firms building long-term crypto reserves, suggesting potential incremental inflows into altcoins beyond Bitcoin.

How does this relate to SC Ventures’ other funds?

SC Ventures is separately planning a $100 million Africa-focused investment fund and is considering its first venture debt fund, Jain said. It remains unclear whether those vehicles will include crypto allocations or focus purely on fintech and regional growth equity.

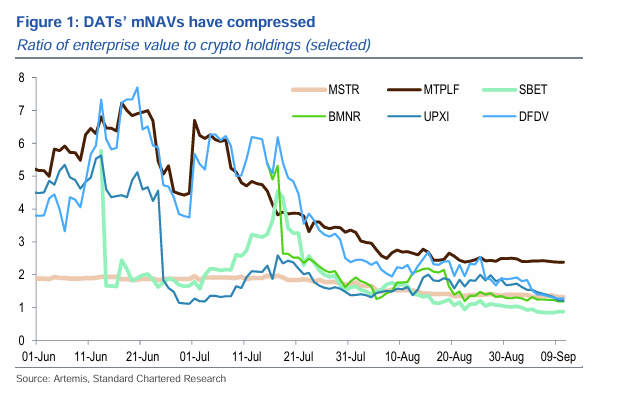

Digital asset treasuries’ mNAVs have been under broad pressure since June. Source: Standard Chartered

Digital asset treasuries’ mNAVs have been under broad pressure since June. Source: Standard Chartered

What is mNAV and why is it relevant?

mNAV (market net asset value) compares a firm’s enterprise value to its cryptocurrency holdings. Standard Chartered warned that some digital asset treasury firms have slipped below a critical one mNAV level, which can limit the ability to issue shares and accumulate crypto holdings.

Frequently Asked Questions

Will SC Ventures’ $250M fund hold Bitcoin only?

SC Ventures has not publicly specified allocations. Reporting indicates the fund targets global digital assets, which suggests allocations may include a mix of large-cap cryptocurrencies and select altcoins.

When will the fund launch and who reported it?

The fund is expected to launch in 2026, and the plan was reported by Bloomberg citing SC Ventures’ Gautam Jain. Requests for comment to SC Ventures were noted in press reporting.

How could this affect smaller treasury firms?

Standard Chartered suggests lower mNAVs may drive market consolidation. Larger, low-cost funders with staking yields could gain an advantage as capital conditions tighten for smaller treasuries.

Key Data Comparison

| SC Ventures digital asset fund | $250 million | Global digital assets (2026 launch) |

| SC Ventures Africa fund | $100 million | Africa investments (sector unspecified) |

| Helius Medical Technologies reserve | $500 million | Corporate treasury reserve with Solana as main asset |

How will institutional flows likely respond?

Institutional inflows tend to follow signals from established financial institutions. A $250M fund from Standard Chartered’s venture arm could encourage other corporate treasuries and institutional allocators to consider diversified digital-asset strategies.

How-to: What should institutional investors consider next?

- Assess treasury objectives and risk tolerance relative to crypto volatility.

- Evaluate custody, compliance, and staking yield opportunities.

- Monitor mNAV and capital-raising dynamics across digital-asset treasuries.

- Engage with regulated custodians and legal advisors before allocation decisions.

Key Takeaways

- Institutional signal: Standard Chartered’s $250M fund highlights growing corporate interest in diversified crypto exposure.

- Market impact: Potential for increased altcoin allocations and higher liquidity if more corporate treasuries follow suit.

- Risk consolidation: Falling mNAVs could trigger consolidation, favoring larger, low-cost funders with staking yields.

Conclusion

Standard Chartered’s SC Ventures planning of a $250 million crypto fund for 2026 underscores a shift in institutional attitudes toward digital assets. As firms weigh treasury strategies, attention will focus on mNAV dynamics, custody solutions, and the potential for broader altcoin adoption. Readers should monitor official SC Ventures statements and industry reporting for allocation details.

By COINOTAG — Published: 2025-09-15 · Updated: 2025-09-15