Crypto Inflows Reach $3.3 Billion Amid Bitcoin, Ethereum Sentiment Recovery

Crypto inflows reached $3.3 billion last week as weaker US economic data boosted Bitcoin and Ethereum demand. Investors see digital assets as portfolio hedges.

Crypto inflows benefited from a weaker-than-expected US macroeconomic data last week, pushing investments to $3.3 billion.

It came as US economic data elevated Bitcoin (BTC) and crypto’s role as an alternative asset class.

US Economic Data Drives Crypto Inflows to $3.3 Billion Last Week

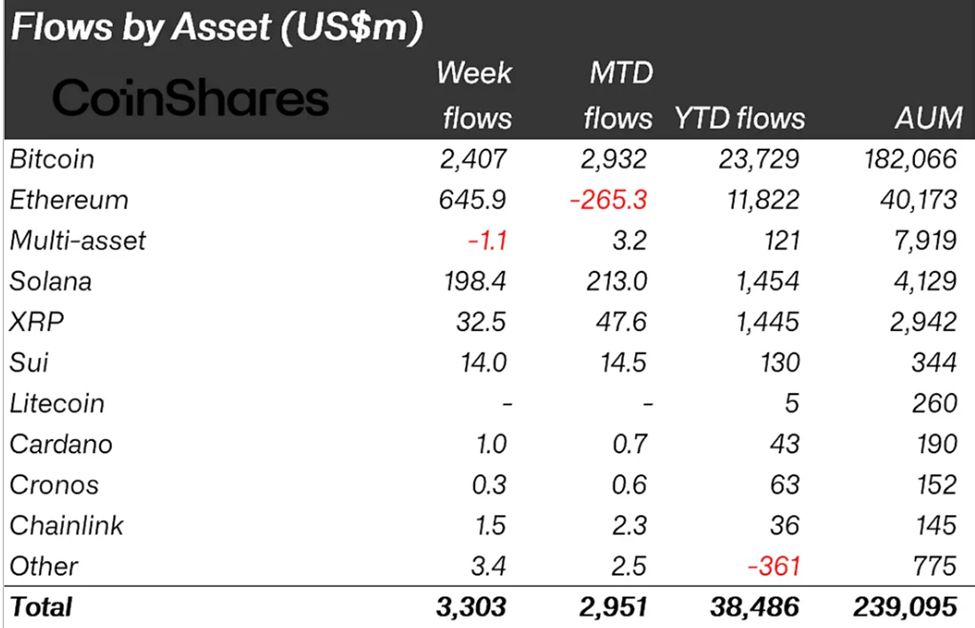

The latest CoinShares report shows crypto inflows rose to $3.3 billion last week, a significant recovery after the $352 million outflows for the week ending September 6.

The correction followed price gains across individual crypto tokens, pushing total assets under management (AuM) to $239 billion. Notably, this was the highest level since the early August all-time high of $244 billion.

CoinShares’ head of research, James Butterfill, ascribes the trend reversal to weaker-than-expected US economic data last week.

Among them was the CPI (Consumer Price Index), which, at 2.9% YoY, aligned with market expectations.

“Digital asset investment products returned to inflows last week, totaling $3.3 billion, following weaker-than-expected US macroeconomic data,” read an excerpt in the latest report.

For regions such as Germany, Friday saw the second-largest daily crypto inflows on record.

Meanwhile, Bitcoin stole the show, attracting $2.4 billion in inflows. This was the largest weekly crypto inflows since July.

Nevertheless, short-bitcoin products recorded modest outflows, bringing their AuM down to just $86 million.

Ethereum Breaks 8 Days of Consecutive Outflows

However, the key highlight in last week’s inflows was Ethereum, which broke a successive streak of negative outflows.

It bucked the trend against the 8-day pattern to record four straight days of inflows last week. This brought their inflows to $646 million.

Crypto Inflows Last Week. Source:

CoinShares Report

Crypto Inflows Last Week. Source:

CoinShares Report

In hindsight, Ethereum had been the main cause of the weekly net outflows ending on September 6.

Therefore, the change seen in crypto inflows and outflows over the past several weeks suggests capital flight into riskier assets during economic uncertainty.

It points to an abounding role of crypto and digital assets as portfolio diversifiers and hedges against economic uncertainty.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin set for ‘promising new year’ as it faces worst November in 7 years

From "whoever pays gets it" to "only the right people get it": The next generation of Launchpads needs a reshuffle

The next-generation Launchpad may help address the issue of community activation in the cryptocurrency sector, a problem that airdrops have consistently failed to solve.

After bitcoin returns to $90,000, is Christmas or a Christmas crash coming next?

This Thanksgiving, we are grateful for bitcoin returning to $90,000.