SignalPlus Macro Analysis Special Edition: One-way Upward Trend

Last week was a remarkable week, with the stock market and fixed income market showing divergent trends — the former continued to climb to record highs throughout the week, while the latter...

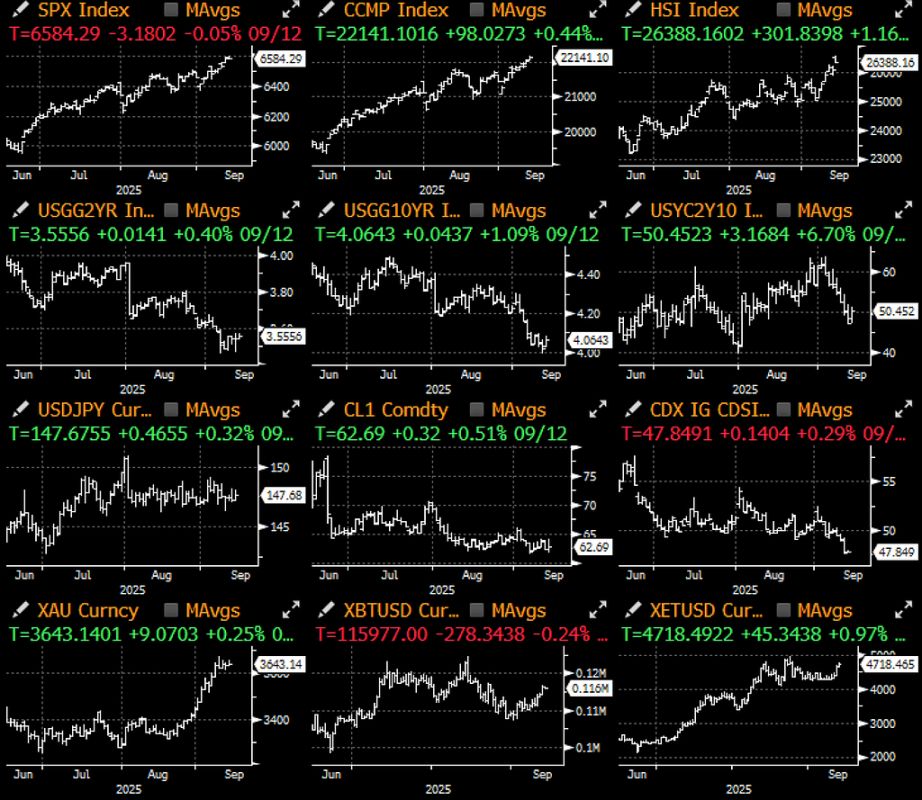

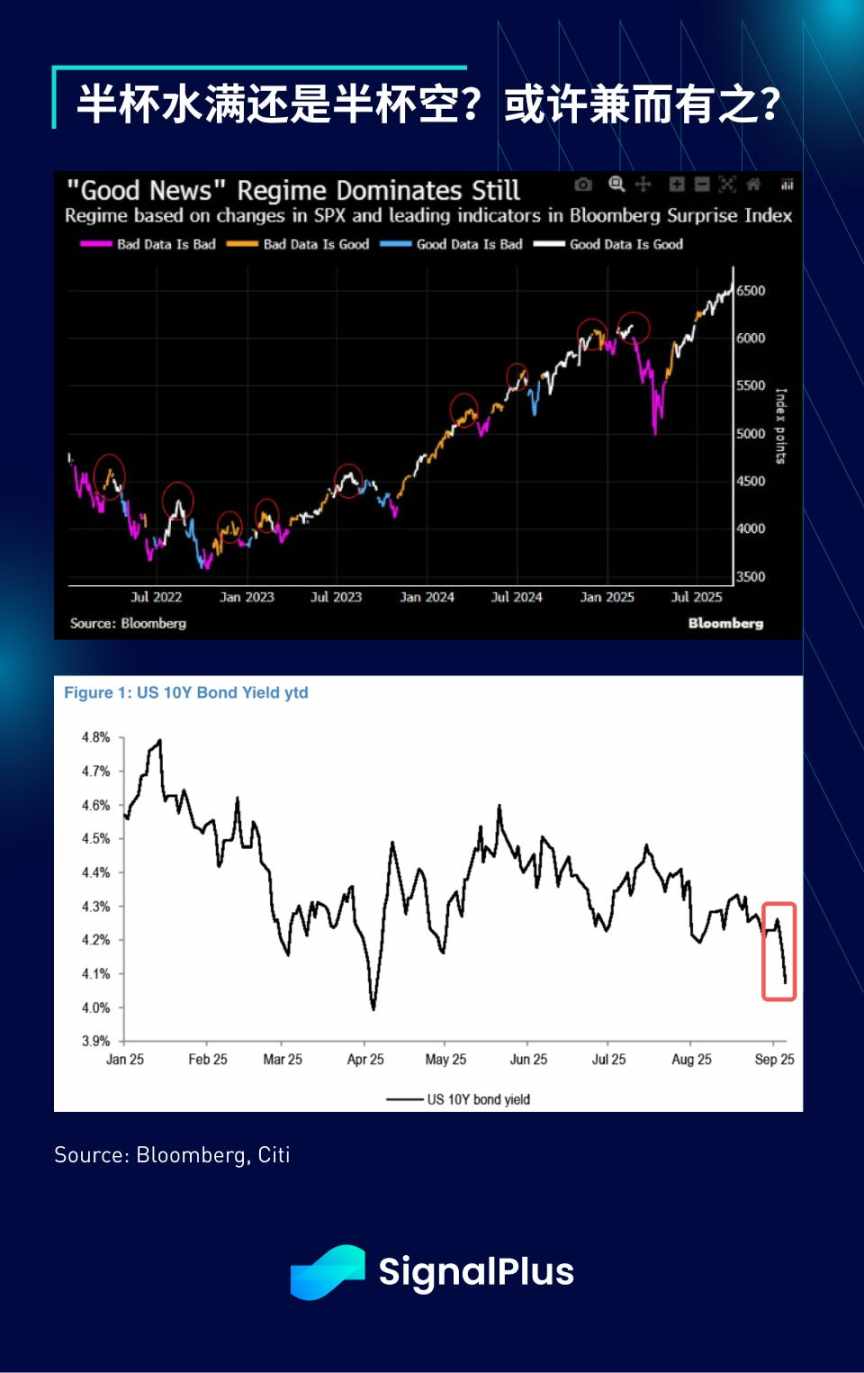

Last week was a remarkable one, with the stock market and fixed income markets showing divergent trends—the former continued to climb to record highs throughout the week, while the latter saw yields drop to near cycle lows due to weak economic data.

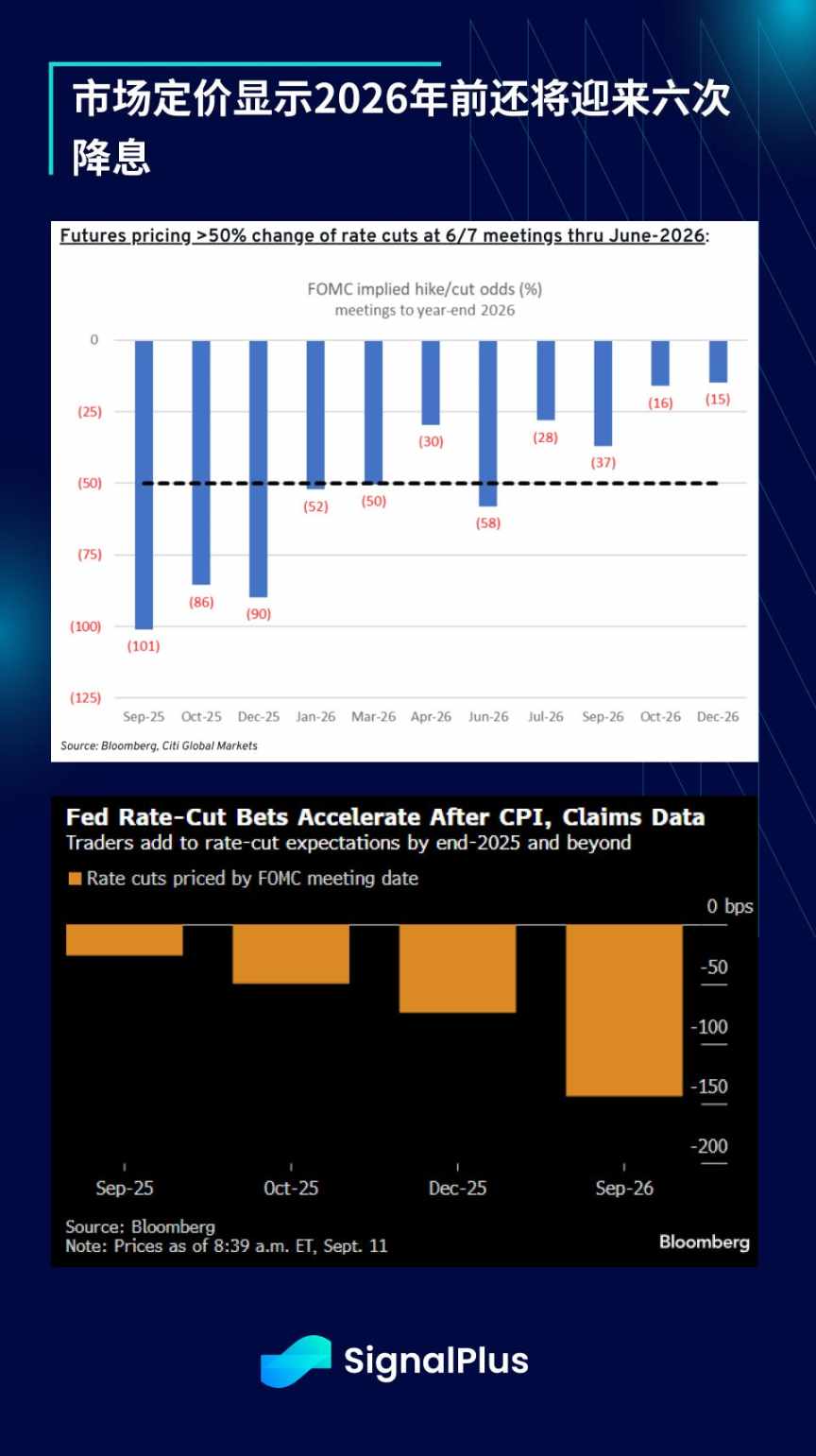

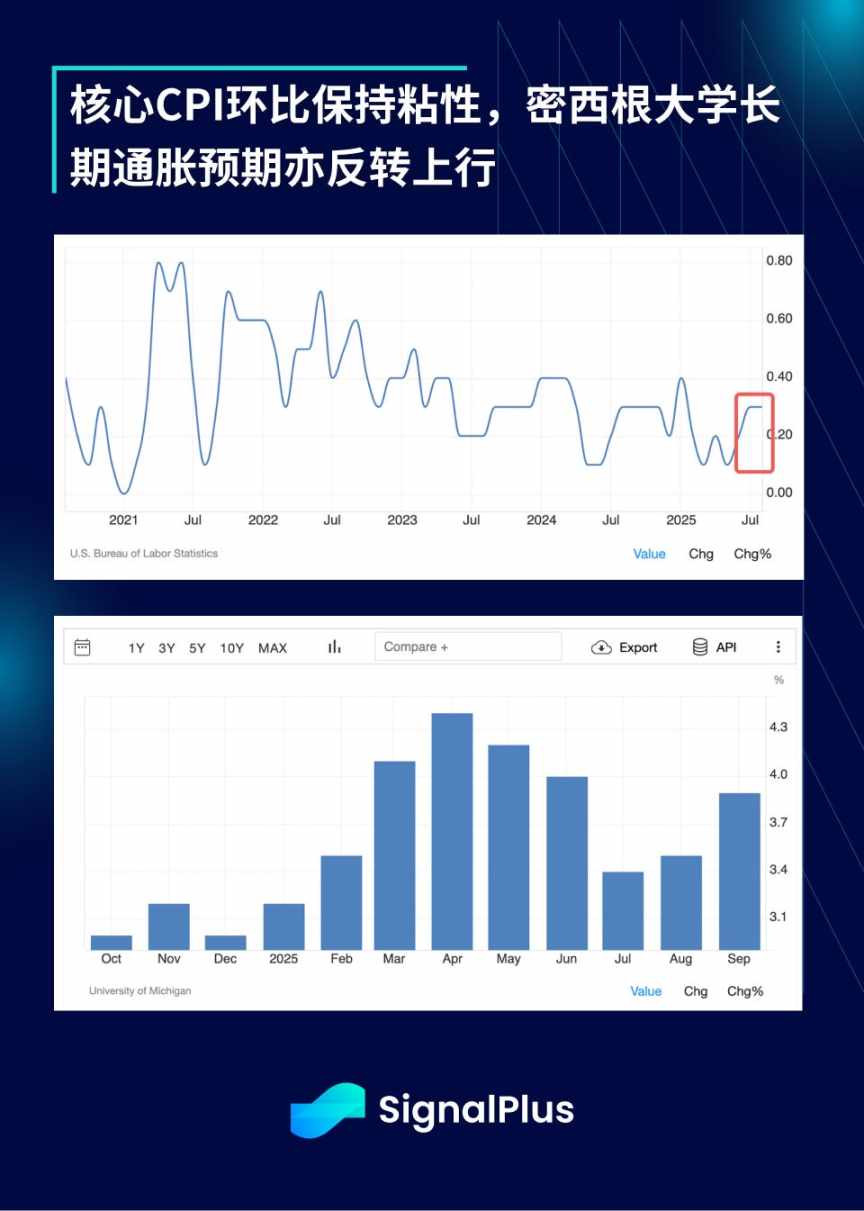

Following disappointing non-farm payroll data, the University of Michigan Consumer Sentiment Index became the latest disappointing soft data, paving the way for the bond market to price in a total of six rate cuts this year and next. The 10-year yield fell below 4% for the first time since April, and the 5-year yield approached its yearly low as initial jobless claims hit a nearly four-year high. This week’s Treasury auctions were met with strong demand across the board, as investors have fully returned to the easing cycle trade.

Despite the core CPI month-on-month increase reaching 0.346%, the highest since January, and tariff-related pressures beginning to seep in and potentially push up core inflation, the market still generally expects the FOMC to restart the rate-cutting cycle.

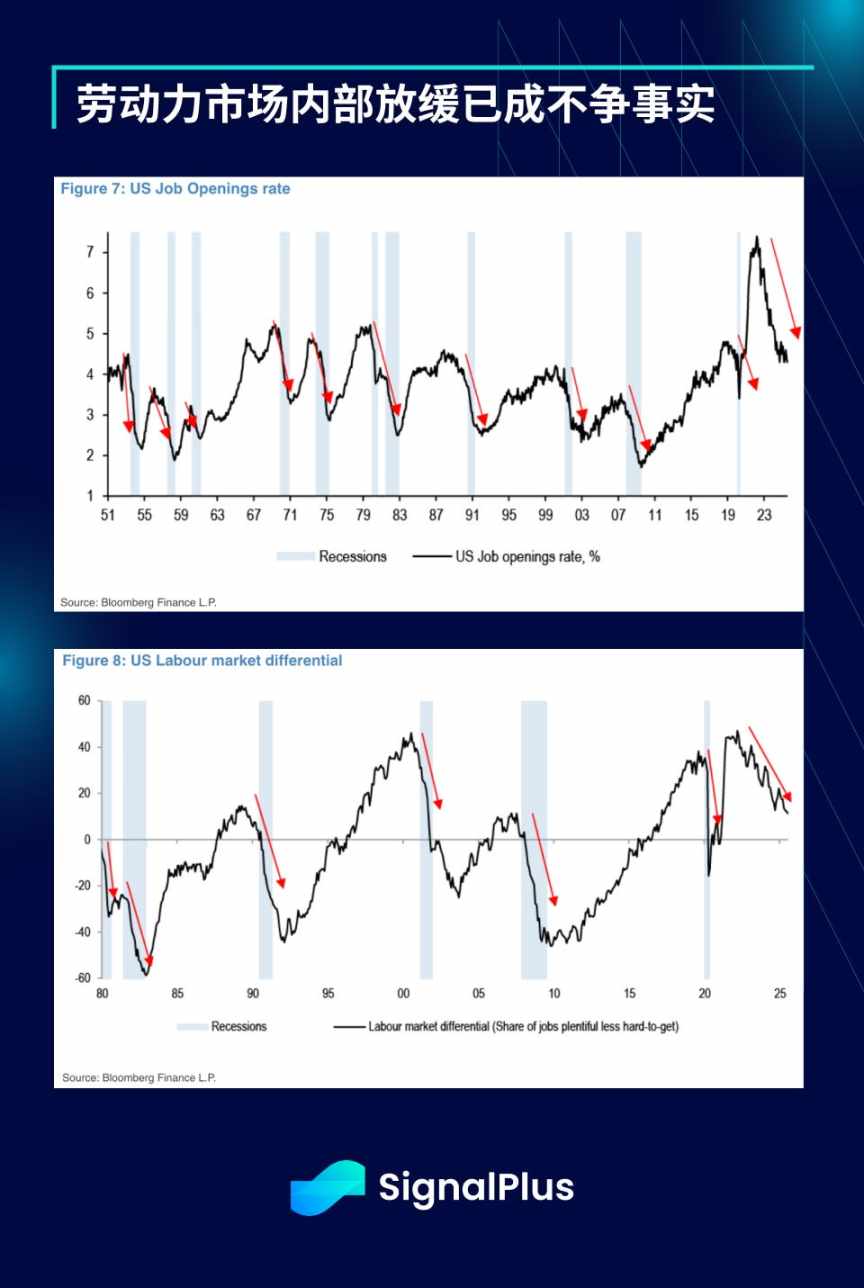

However, the Federal Reserve has chosen to focus on signs of a slowdown within the labor market. Recent benchmark revisions from the Bureau of Labor Statistics showed a downward adjustment far exceeding expectations (-911,000 vs. expected -700,000), further reinforcing this trend.

In stark contrast, the stock market (as usual) painted a completely different picture: the S&P 500 set new closing records three times this week, with more than half of its components trading above their 100-day moving averages. Oracle’s impressive earnings report revived battered AI sentiment, and all sectors posted gains—semiconductors (+6%), banks (+3%), utilities (+3%), and software (+3%) all performed strongly.

Notably, the S&P 500 has rebounded more than 30% from its April low, marking one of the strongest five-month rallies in the past 50 years.

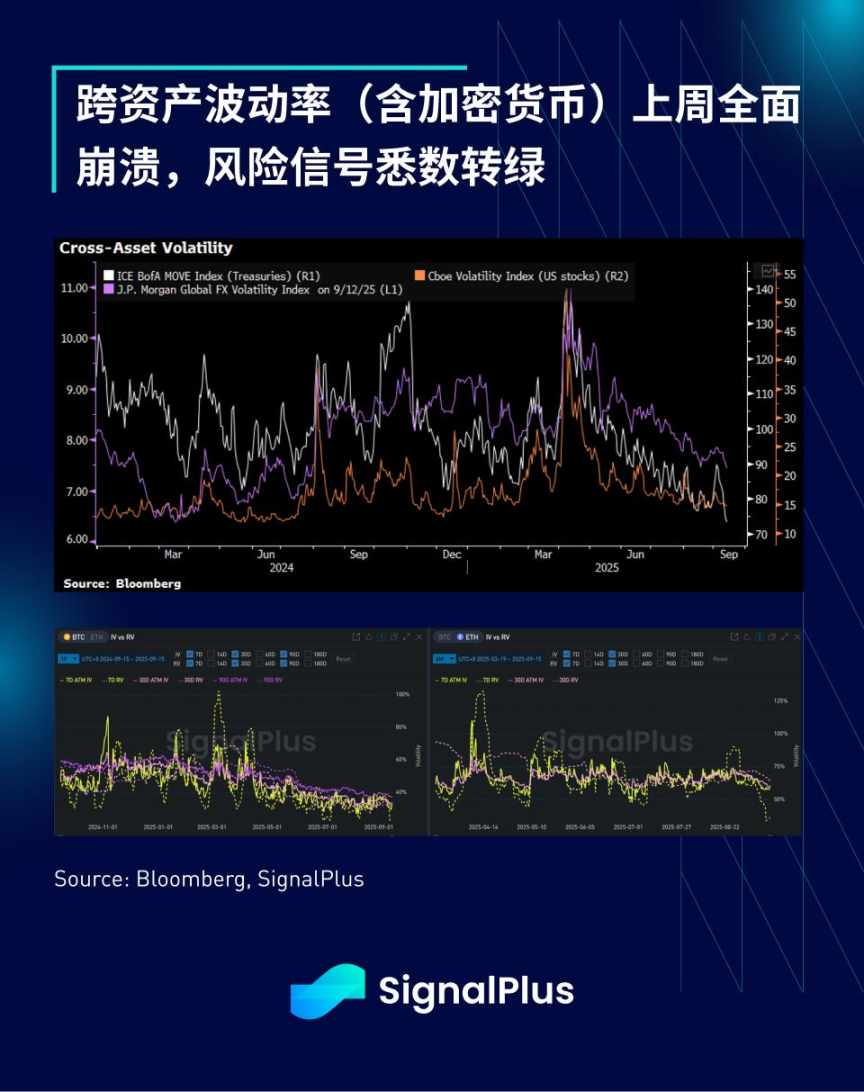

The market’s internal structure is also robust, with implied volatility across all major macro asset classes dropping to new stage lows, led by Treasuries.

S&P 500 options trading volume is more than 20% above the 12-month average, and data from sell-side dealers shows that retail trading accounts for about 12% of the volume.

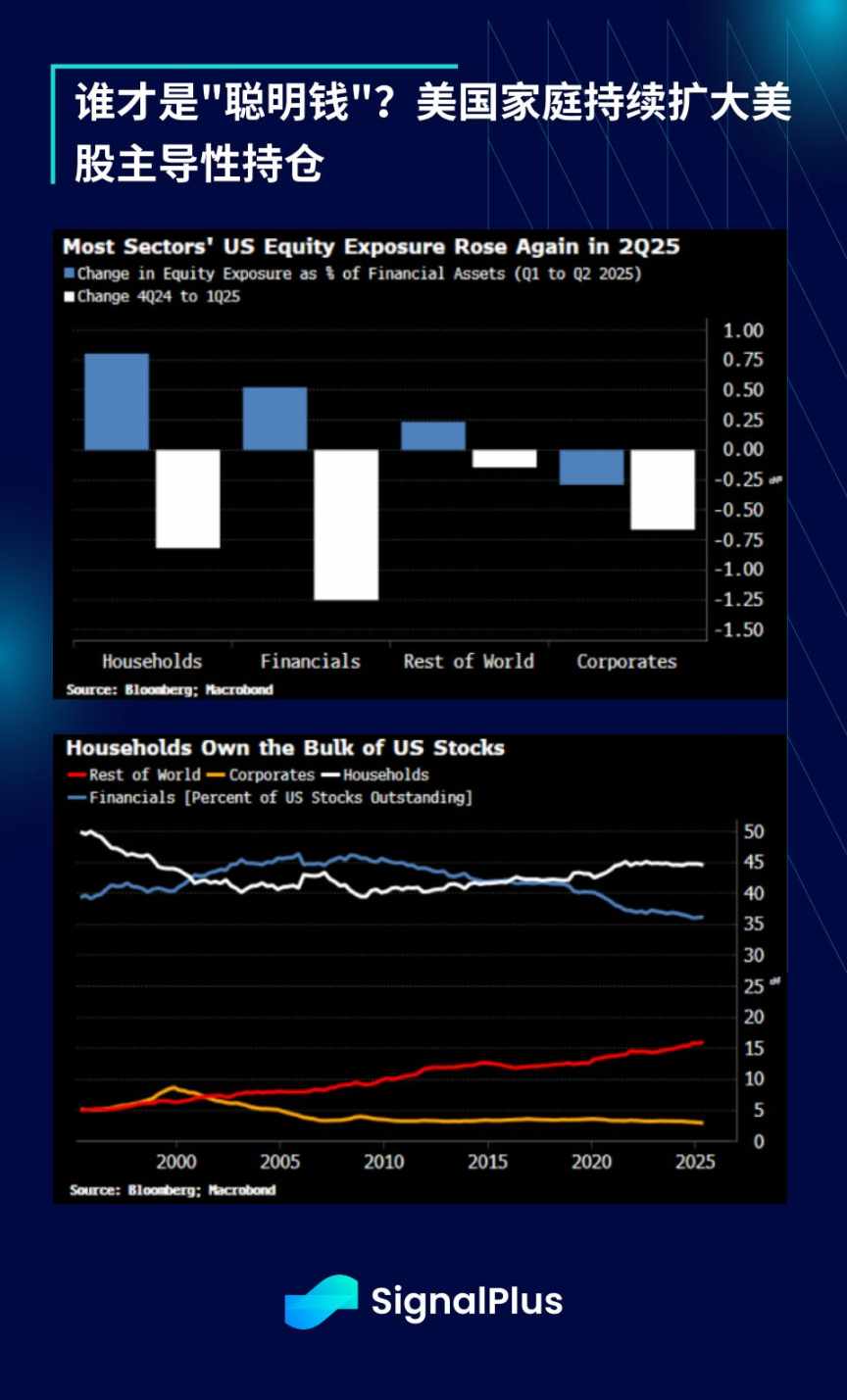

Equity holdings have increased across the board, with U.S. households now the main holders of U.S. stocks, profiting handsomely from this round of gains.

Global market sentiment is also heating up, with the Hang Seng Index climbing to a four-year high and the Taiwan Weighted Index hitting record highs for several consecutive weeks. Gold has become the best-performing asset so far this month, closely followed by macro hedge funds. From any perspective, all risk assets are indeed showing broad-based gains.

Amidst this frenzy, corporate buybacks are advancing at a staggering pace: buybacks in the first eight months have reached $1.4 trillion, setting a new historical record. This represents a 38% increase over the same period in 2024 (which itself was a record year), making the rally even more intense.

Looking ahead, the focus will shift to the FOMC meeting. However, since the market generally expects the Federal Reserve to continue supporting risk sentiment after the Jackson Hole meeting, traders anticipate little surprise from the meeting. Data from Citi shows that the implied volatility for equity options on the meeting day is about 72 basis points, below the historical average of 84 basis points. The market may need to look elsewhere for hawkish surprises.

Cryptocurrencies rebounded over the past week, with bitcoin filling the $110,000–$116,000 price gap, but profit-taking continues to cap the upside, and overall buying momentum has slowed. BTC ETF inflows surged last week (about $2.3 billion) after 1.5 months of sluggish inflows, while ETH inflow momentum has slowed significantly since the late-summer FOMO sentiment.

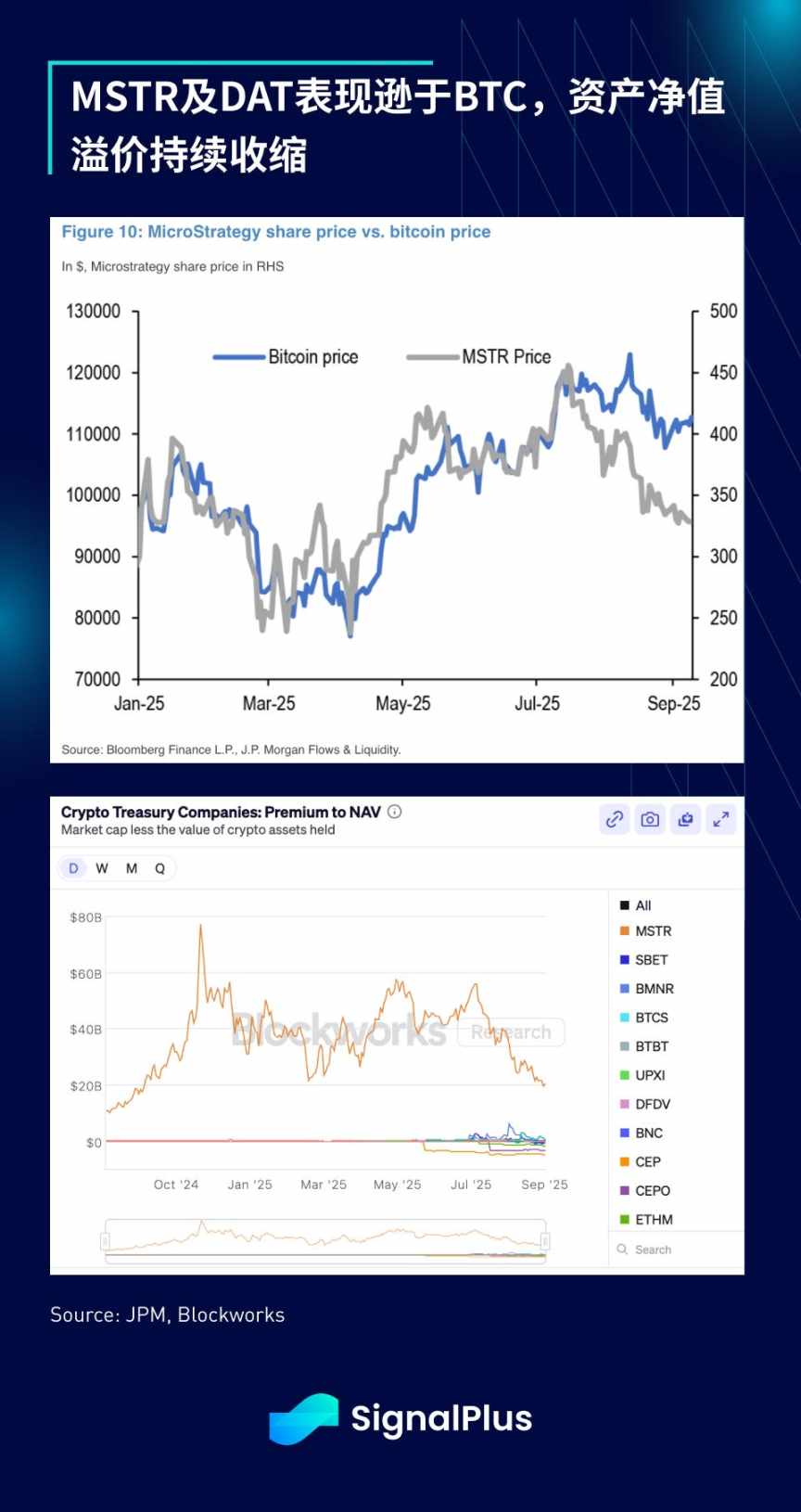

Disappointingly, the S&P 500 last week refused to include MicroStrategy as a component, despite it technically meeting all entry criteria. This shows that the selection committee does indeed have discretionary power and has refused to include Digital Asset Trusts (DAT) in the index.

This is undoubtedly a blow to short-term Treasury momentum—the sustainability of its business model is being questioned, and both MSTR and the entire DAT sector have underperformed BTC, with net asset value premiums continuing to shrink (in most cases, discounts have widened). This trend is expected to continue in the short term, with investors refocusing on crypto companies or miners with actual operating businesses, hoping that weak momentum does not trigger downside convexity risk.

The current strong macro sentiment should continue to support crypto prices, but short-term performance is expected to lag behind overall equities and risk assets. Wishing you successful trading during the FOMC meeting!

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Brazil Explores Bitcoin Reserve with Parliamentary Hearing

Brazil Considers National Bitcoin Reserve Proposal

Bitcoin price drop to $113K might be the last big discount before new highs: Here’s why

Trump Predicts a "Significant Rate Cut" by the Federal Reserve!