PENGU price target: Pudgy Penguins (PENGU) confirmed a bullish flag and is targeting $0.076, supported by rising open interest, ETF filing momentum, Asia expansion, strong toy sales and Pudgy Party downloads that together strengthen adoption and upside potential.

-

PENGU confirmed bullish flag breakout with targets up to $0.076

-

Open interest rose 23.39% and short liquidations outpaced longs, reinforcing bullish structure

-

Pudgy Penguins benefit from ETF filing, Asia expansion, millions of toy sales and Pudgy Party downloads

PENGU price target: Bullish flag targets $0.076; ETF filing and ecosystem growth boost momentum — read the latest analysis and trade implications.

What is PENGU’s price target after the recent breakout?

PENGU price target is set at $0.076 following a confirmed bullish-flag breakout. Analysts list intermediate targets at $0.046, $0.055 and $0.065, with support near $0.035 based on Fibonacci retracement and 12-hour chart structure.

How did technicals signal the breakout?

On the 12-hour chart, a falling channel breakout near $0.036 completed a bullish flag pattern, projecting stepped targets through $0.076. The token is holding above the 0.5 Fibonacci retracement at $0.035, signaling a favorable risk-to-reward for continuation trades.

$PENGU broke out of a bullish flag, targeting $0.076! With ETF filings under review, Asia expansion, millions of toy sales, and Pudgy Party on major app stores, the project shows heightened adoption and potential upside. pic.twitter.com/ZPlJNIfJH7

— Ali (@ali_charts) September 13, 2025

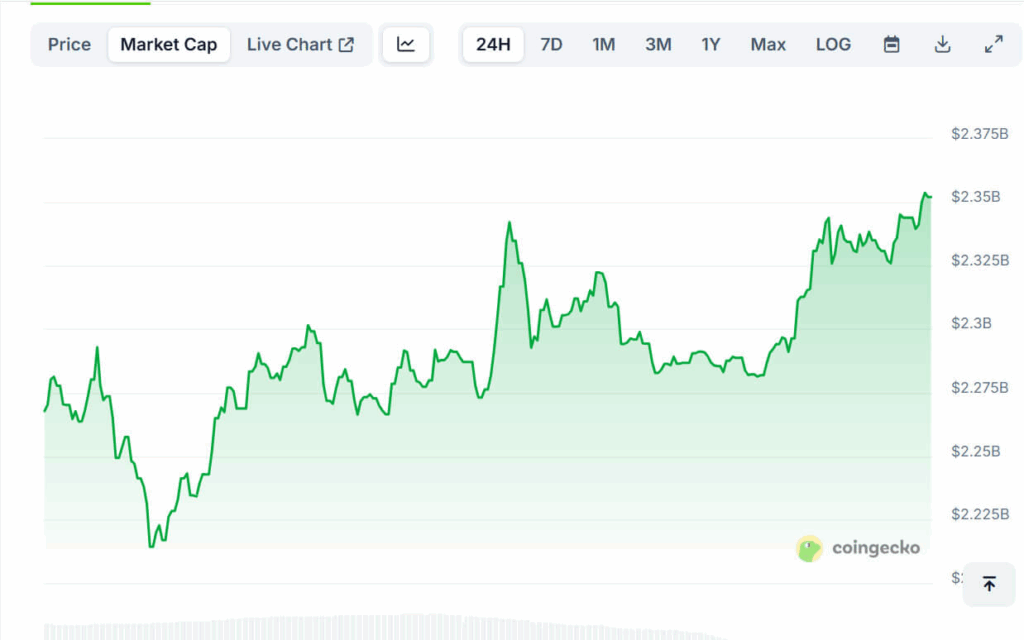

At press time, PENGU traded at $0.03741, recording a 3.6% daily gain according to Coingecko. Market capitalization is reported at $2.35 billion with 24-hour trading volume near $466.7 million. Circulating supply stands at approximately 62.86 billion tokens, providing market liquidity for active flows.

Source: Coingecko

Source: Coingecko

Why does derivatives flow support the bullish case?

CoinGlass data shows open interest rose by 23.39% to $461.98 million. Short liquidations totaled $583.86K versus $120.53K from longs, indicating sellers are being squeezed and buyers are strengthening positions. This imbalance commonly precedes accelerated upside in similar breakouts.

What ecosystem catalysts are supporting PENGU’s outlook?

Pudgy Penguins are seeing multiple adoption signals: an ETF filing scheduled for early October, expansion into Asian markets, millions of retail toy units sold, and the Pudgy Party mobile game surpassing half a million downloads on Android and iOS. These real-economy touchpoints add utility and brand recognition beyond speculative trading.

Frequently Asked Questions

How reliable is a bullish-flag breakout for setting targets?

Technical patterns are probability tools: when combined with volume, open interest increases, and confirmed support levels, a bullish-flag breakout can reliably project staged targets. Risk management remains essential.

Will the ETF listing guarantee a price surge?

An ETF listing typically increases market access and institutional participation, which can create upward pressure. However, listing alone does not guarantee direction; trading dynamics and macro conditions matter.

Key Takeaways

- Technical setup: A confirmed bullish flag projects targets up to $0.076 with support at $0.035.

- Derivatives flow: Open interest up 23.39% and larger short liquidations suggest buyers are dominant.

- Ecosystem growth: ETF filing, Asia expansion, toy sales and Pudgy Party downloads provide fundamental adoption tailwinds.

Conclusion

Front-loaded signals—technical breakout, rising open interest, and tangible ecosystem catalysts—combine to set a staged upside path toward a $0.076 PENGU target. Traders should use clear risk management and monitor ETF confirmation, on-chain flows and app/store metrics for next steps. COINOTAG will update coverage as new data emerges.