Date: Fri, Sept 12, 2025 | 05:10 PM GMT

The cryptocurrency market continues to show strength amid the anticipated potential US Federal Reserve rate cuts, with Ethereum (ETH) reclaiming the $4,600 mark today. Following this, several major memecoins are flashing bullish signals — including Dogecoin (DOGE), which is already in focus ahead of the anticipated launch of the REX Osprey DOGE ETF (ticker: DOJE), expected on September 18.

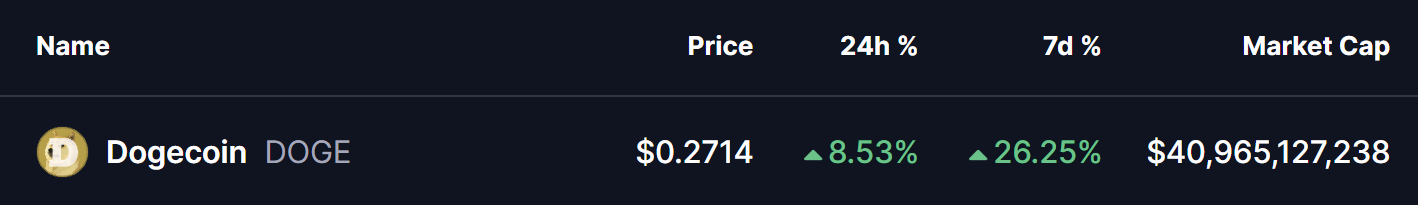

Meanwhile, DOGE jumped by 8% today, extending its weekly rally to over 26%. But more importantly, what’s catching market attention is the striking fractal pattern — a setup that has previously led to explosive moves in the past.

Source: Coinmarketcap

Source: Coinmarketcap

Fractal Suggests Bullish Breakout Ahead

The daily chart of DOGE highlights a potentially powerful bullish reversal forming beneath the surface, driven by a repeating fractal structure. Key technical phases include:

- Accumulation phases (brown lines)

- Descending trendline breakouts (red lines)

- Reclaim of the 100-day moving average (blue line)

- Final breakout above correction range resistance (green line in cirlce)

The first instance occurred in Feb 2024, where DOGE rallied 150% after breaking out. A similar move repeated in Oct 2024, triggering an even bigger 263% rally.

Dogecoin (DOGE) Fractal Chart/Coinsprobe (Source: Tradingview)

Dogecoin (DOGE) Fractal Chart/Coinsprobe (Source: Tradingview)

Now, in September 2025, DOGE appears to be replaying this cycle for the third time. Price action has already completed the first three fractal stages and is now attempting the final step: breaking out above the $0.28746 resistance — a similar green zone that has historically marked the launchpad for massive upside moves.

What’s Next for DOGE?

Currently, DOGE is trading near $0.2714, consolidating just below its green resistance. If bulls manage to trigger a breakout above this level, it would mirror the previous fractal breakouts and could ignite a strong rally.

In such a scenario, upside targets could extend toward to test its long term ascending resistance trendline around $0.82 mark or even higher, depending on market sentiment and trading volume.

In addition, the upcoming potential spot ETF listing could serve as the key catalyst to accelerate this breakout rally.